One of the most exciting investment opportunities is a business that is entering new markets. Cannabis and sports betting are great examples of that. States have been slowly legalizing both of these sectors, and for businesses operating in those industries, that means their potential for growth is climbing higher. And with 3 million fewer people in the labor force than there were before the pandemic, there's definitely an incentive for legalization to continue, to create job growth.

Two stocks that are well-positioned in cannabis and sports gambling that investors should consider buying heading in 2022 are Ayr Wellness (AYRW.F 0.81%) and DraftKings (DKNG -0.87%).

Image source: Getty Images.

1. Ayr Wellness

Cannabis producer Ayr Wellness is eyeing a big year in 2022. As it ramps up production in multiple states, and with New Jersey's recreational market looking to open up, Ayr expects solid performance next year. For 2022, it projects revenue to top $800 million (up from an earlier estimate of $725 million) and its adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) to come in at $300 million.

That's a solid improvement over its already strong results this year. During the first six months of 2021, Ayr reported revenue of $150 million, putting it at a run rate of about $300 million for the full year. Adjusted EBITDA of $46 million puts it on track for approximately $92 million.

Currently, the company estimates it has a total addressable market of 85.7 million people that's worth $9.4 billion this year. Massachusetts, Arizona, Florida, Nevada, and Illinois are among the most attractive markets that Ayr is in today; through the first nine months of 2021, Arizona has already brought in $1.6 billion in sales, which is more than Colorado.

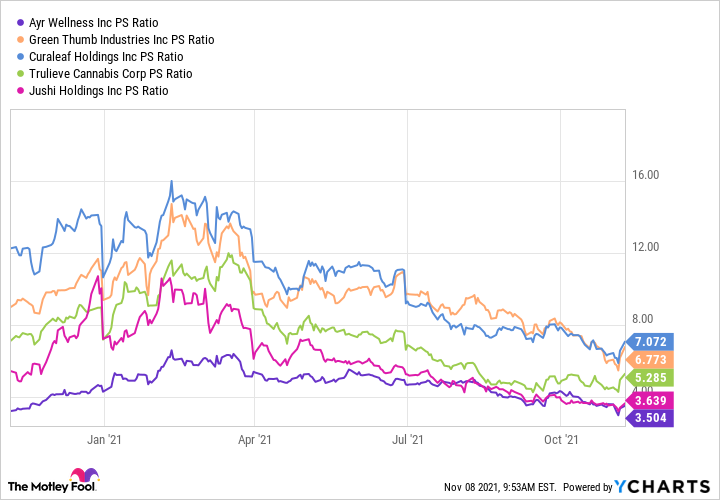

If Ayr comes through on its guidance, it will have a blowout year in 2022, setting it up to be one of the top cannabis companies in the country. And the pot stock is already a deal compared to other multi-state operators, which trade at higher price-to-sales multiples:

AYRWF PS ratio data by YCharts.

2. DraftKings

Sports entertainment and gambling company DraftKings is another business that looks to be solid heading into next year. Thus far in 2021, its shares are down 5% while the S&P 500 has soared 25%.

Despite an otherwise strong performance, the company's mergers and acquisitions and related dilution have been keeping the stock down this year. Most notably, in August, DraftKings announced a mammoth deal to purchase gaming company Golden Nugget Online Gaming for $1.56 billion, funded entirely with shares.

While it's a promising acquisition for DraftKings that will allow it to reach millions more customers, the dilution hasn't helped the stock in the short term. Since August, DraftKings stock is down more than 9% (the S&P 500 has risen 7%). Through the first half of this year, Golden Nugget has brought in more than $58 million in sales.

DraftKings is already a growth beast, recently releasing third-quarter results showing that revenue of $213 million for the period ending Sept. 30 soared 60% year over year. For the full year, the company anticipates that its revenue will come in at approximately $1.26 billion, more than double the $615 million it reported in 2020.

But with DraftKings continuing to expand, next year might be an even stronger one for the business. As of the third quarter, the company said it offered mobile sports betting in 15 states. And with legalization efforts continuing to expand the markets it can serve, DraftKings can reach approximately 39% of the U.S. population today.

Legalization is always a tricky topic as it can be a bit unpredictable. Currently, over two dozen states have legalized sports betting. And with states eager to make up for the economic damage from the pandemic, more markets could open up in the not-too-distant future.

DraftKings stock may be struggling right now, but with so much growth potential, it can make for a fantastic investment for 2022 and beyond.