One of the more fascinating storylines of this year in the investing world has been the rise of so-called meme stocks. These are companies whose shares have skyrocketed due to interest from investors on social media platforms such as Reddit, sometimes despite the lack of strong financial results or solid fundamentals.

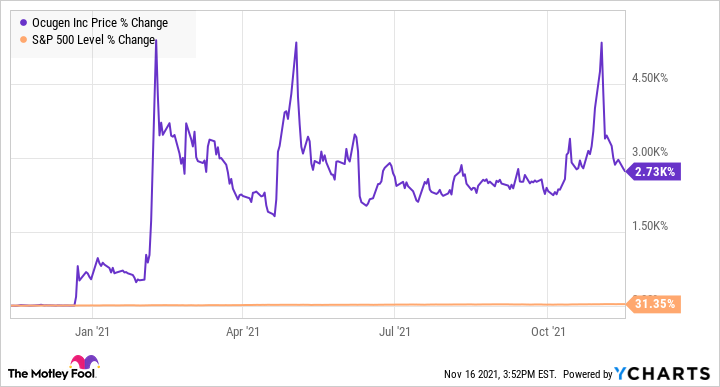

To be fair, not all meme stocks are created equal, and one could make a decent investing case for some of them. But many of these companies are still far too risky for investors focused on the long game to even consider. One that falls squarely in the second category is Ocugen (OCGN 0.63%). Although the stock has risen nearly 3,000% over the trailing-12-month period there isn't a solid basis for the growth. Here's why this biotech isn't worth the trouble long-term.

A look at Ocugen's COVID-19 strategy

Ocugen is hardly a household name, but it may have picked the right market in which to become famous. The company signed an agreement with India-based Bharat Biotech, which developed a coronavirus vaccine called Covaxin. But there's a catch. Ocugen can only make money from Covaxin if it is approved and marketed in North America, and even then, the company will only keep 45% of the profits.

This deal could have been very lucrative if Ocugen had managed to earn regulatory approval for Covaxin quickly. However, the process is taking longer than the company expected, particularly in the U.S. Ocugen had plans to apply for an emergency use authorization (EUA) for Covaxin in the country, but under the advice of regulators, it will submit a Biologics License Application (BLA) instead. The BLA is essentially a license to distribute a biologic across states within the U.S.

The company is also planning to run a phase 3 clinical trial in the U.S. for the vaccine to support its BLA. The entire process could take a year -- or longer (an EUA would take a few weeks), so don't expect to see Covaxin in local pharmacies in the U.S. anytime soon. Unless, of course, Ocugen's recent EUA application for Covaxin for kids from the ages of two to 18 is approved.

Image source: Getty Images.

The U.S. Food and Drug Administration (FDA) was not willing to grant this vaccine an EUA for adults. So the chances that the agency will change its tune and give this nod to Covaxin for kids looks improbable, to say the least. Ocugen's prospects look better north of the border. In July, the company initiated a rolling submission for an EUA for Covaxin in Canada.

A rolling submission allows a company to send part of the data to support its application for review without submitting the entire application all at once; this option helps speed up the review process. In August, Ocugen announced that it had completed the rolling submission for Covaxin in Canada, and it is now awaiting a decision from health industry regulators.

A questionable long-term investment

Covaxin is highly unlikely to hit the U.S. market within the next year and a half. If the vaccine is approved in Canada, that would make Ocugen a more attractive investment. Still, even this hypothetical nod wouldn't be enough for long-term investors to make the company a buy. For one, several biotechs are already fighting for market share.

Even a company such as Novavax, whose vaccine isn't approved in Canada yet, signed an agreement with authorities in the country to deliver tens of millions of doses of its candidate, NVX-CoV2373. And there is no reason to think Covaxin would attract more patients than its competitors. The vaccine's overall efficacy in a phase 3 study conducted in India was 77.8%, and its efficacy against severe cases of the disease was 93.4%.

By comparison, Novavax's vaccine proved roughly 90% effective overall and 100% effective against moderate and severe COVID-19 in a phase 3 study. In my view, Covaxin will only manage to carve out a tiny fraction of the coronavirus vaccine market in Canada -- if it is approved -- and it will have to share the spoils with its partner, Bharat Biotech.

What else does Ocugen have to offer? The company does have a couple of other pipeline candidates, but all are still very early in their development stages. In other words, these programs currently hold negligible weight as far as Ocugen's long-term investment thesis is concerned.

Meanwhile, Ocugen's stock will likely remain highly volatile in the short term due to its standing as a meme stock. However, in the long run, there is at this point very little to suggest that it will perform on par with -- let alone outpace -- the broader market. Especially considering the company isn't reporting revenue and doesn't appear to have a clear pathway to profitability yet. That's why investors should stay away from this biotech stock.