Many growth-dependent stocks have seen significant pullbacks in a recent bout of market volatility. Tech stocks have been volatile across 2021's trading, and concerns about rising Treasury bond yields and valuation levels have caused some investors to move out of riskier plays in the sector. But long-term investors may be able to take advantage of recent market turbulence and use it as an opportunity to build positions in strong businesses with market-crushing potential.

With that in mind, a panel of Motley Fool contributors has weighed in with some of their favorite discounted growth picks. Read on to see why they think PayPal (PYPL 0.64%), Fiverr International (FVRR 1.34%), and Twitter (TWTR) are great buys right now.

Image source: Getty Images.

A slight slowdown in growth doesn't justify the PayPal stock sell-off

Daniel Foelber (PayPal): Crypto, real estate, and stock markets all have one thing in common: When the best names in the business go on sale, it's usually a great time to buy.

In hindsight, the housing crash of 2008, the crypto crash of 2018, and the stock market crash of 2020 were all incredible times to jump in. While today's Nasdaq sell-off isn't as severe, it could be a dip worth taking advantage of.

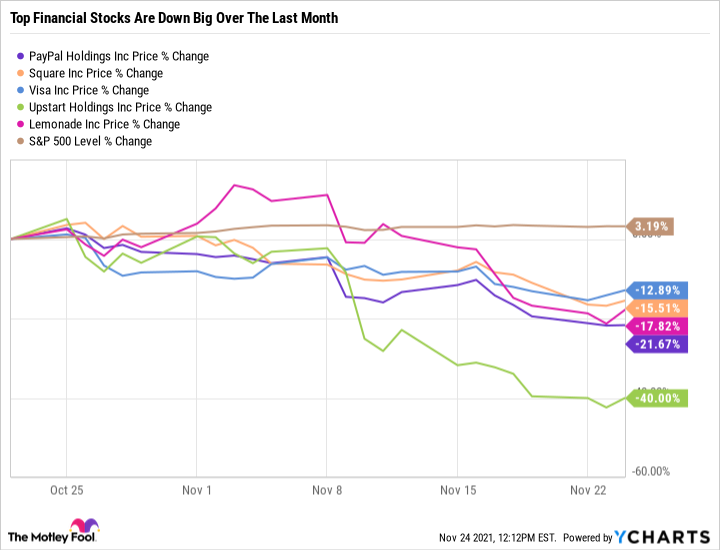

The headline story is that the stock market is hovering around an all-time high. But behind the scenes, many industry leaders are substantially down from their highs. When it comes to fan-favorite financial stocks, consider that PayPal, Square, Visa, Upstart, and Lemonade are all down 13% or more over the last month while the S&P 500 is up 3%.

The big reason PayPal stock is down 40% from its all-time high is slowing growth. PayPal's revenue growth rate has slowed, and that's chased a lot of growth investors out of the stock. However, what hasn't slowed, and in fact has improved a lot, is the company's ability to generate cash. PayPal stands out as the best of them. Its core business is performing well. Its smaller businesses like Venmo have a lot of growth potential -- as evidenced by Venmo's partnership with Amazon.

Over the last few years, PayPal has transformed itself into the ultimate cash cow. Over the last four quarters, it has generated over $24 billion in revenue and $5 billion in free cash flow (FCF) that it can use to reinvest in its business.

So while Wall Street is fixated on slightly lower than expected growth numbers, long-term investors can take advantage of the overreaction to PayPal's earnings. The investment thesis is simple. PayPal benefits from a growing economy that relies less and less on cash. If that's a trend you believe in, then going with an industry titan when there's blood in the streets could be a winning move.

Get a piece of the gig economy at a discount

Keith Noonan (Fiverr International): When it comes to growth stocks, picking the trends you focus on can play a huge role in shaping your performance. The rise of the gig economy is one shift that will likely be hugely influential over the next decade and beyond, and Fiverr International looks like a great way to play the trend.

Gig labor has already been a foundation that's enabled Uber, Lyft, DoorDash, and many other service leaders to rapidly scale large businesses, but that's just the most obvious facet of the gig economy revolution. Businesses of all sizes are increasingly relying on short-term contract labor instead of traditional employee-employer relationships, and Fiverr's marketplace for gig labor has the company positioned to facilitate and benefit from this trend.

The traditional employment structure leaves businesses with employee insurance expenses, pay roll taxes, office costs, and other expenses. Meanwhile, hiring a remote worker can allow companies to reduce those costs and operate on a short-term hiring basis that offers greater flexibility.

Fiverr grew sales 42% year over year in the third quarter, but the company's healthy momentum and massive runway for expansion haven't been enough to please the market lately. The stock is now down roughly 26% year to date -- and roughly 58% from the lifetime high it hit in February.

The business hasn't kept pace with the even more explosive growth rates that it was posting during the height of pandemic-related office disruptions in key markets, but patient investors can benefit from the stock having fallen out of favor. Fiverr has a great platform and some powerful trends on its side, and it's worth taking advantage of the substantial valuation discount.

Missing a key point about Twitter

James Brumley: Twitter (TWTR) shares aren't just down 30% from last month's high and off by more than 40% from February's peak. With this steep sell-off, shares of the microblogging platform are back to where they were shortly after their 2013 IPO, wiping away around eight years' worth of gains. And I sort of get why. The social media space as a whole is running out of room and ways to grow. Its dialogue is also too toxic too often.

What's largely being overlooked about Twitter, however, is that it continues to cultivate healthy ways to engage consumers by creating healthy digital content to gather around. For example, last week it announced a partnership with S&P Dow Jones Indices that will effectively use Twitter to collect sentiment data regarding stocks that make up the S&P 500 Index, and turn that data into a sentiment index of its own. Earlier this month Twitter renewed a deal with ViacomCBS that makes Twitter a delivery platform for a sizable swath of premium video content.

None of these agreements are game-changers in and of themselves. Collectively, though, these deals and a bunch of others like them say Twitter is still refining its product with the goal of growing its engagement. This should in turn keep the ad revenue engine revving. Analysts think so, anyway. They're calling for top-line growth of 21% next year, following this year's projected 37% improvement.

Of course, this makes the recent sell-off a great buying opportunity.