What happened

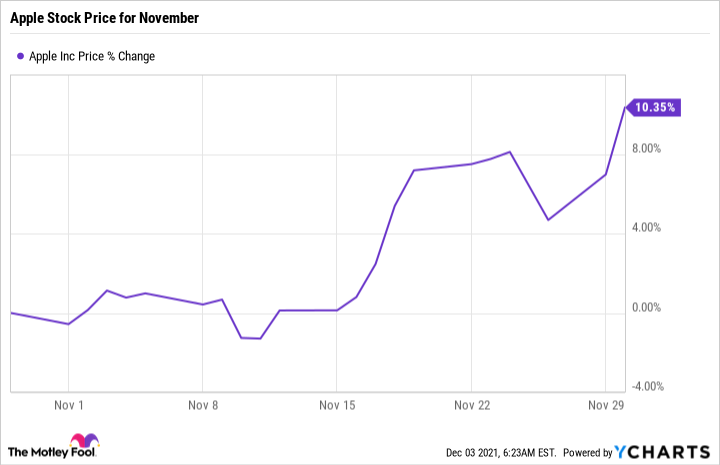

Shares of Apple (AAPL 1.27%) ended the month of November 10.3% higher than where it started, according to data from S&P Global Market Intelligence, as the tech stock bounced back from what some saw as a disappointing earnings report at the end of October.

While supply chain woes continue to dog it, Apple's announcement it was launching a self-service repair program to let consumers make repairs to their own devices helped Apple stock start climbing.

Apple is easing into the project by permitting the most commonly serviced iPhone components such as the display, battery, and camera, to be fixed using genuine Apple parts, tools, and manuals by third parties. The issue has long been a bone of contention among right-to-repair advocates.

Apple also got a push higher following reports there's renewed enthusiasm for an electric, self-driving Apple car that could launch as soon as 2025. Typical of the sleek design aesthetic Apple is known for, there will reportedly be no steering wheel or pedals, making the vehicle fully autonomous.

So what

Still, it wouldn't be a complete month without some sort of concern for persistent Apple worrywarts. The latest is the tech stock has supposedly warned component suppliers iPhone 13 demand is slowing because supply chain problems have made buying one too difficult. Analysts think consumers may choose to forgo the iPhone 13 and wait for the next upgrade.

Even so, Apple is still on track for a record Christmas sales season with sales anticipated to rise 6% to almost $118 billion, so the quarter will be big, just not the blockbuster analysts had anticipated.

The hand-wringing may be overwrought considering Apple is still forecast to produce some 90 million units. Sure, it was 10% less than what it had originally thought, but hardly enough to break out the hair shirts.

Image source: Getty Images.

Now what

The thing about Apple is it is more than any one product. The iPhone is obviously critical to its success, but it has such a broad range of products, all of which still sell strongly, including the iPad, iMac, Apple Watch, AirPods, and even Apple TV+, which is already at 30 million subscribers -- not bad for a product that many observers didn't think had much depth of content to attract subscribers.

Once again the most valuable company with a $2.6 trillion valuation, Apple is still a tech stock with plenty more upside ahead.