What happened

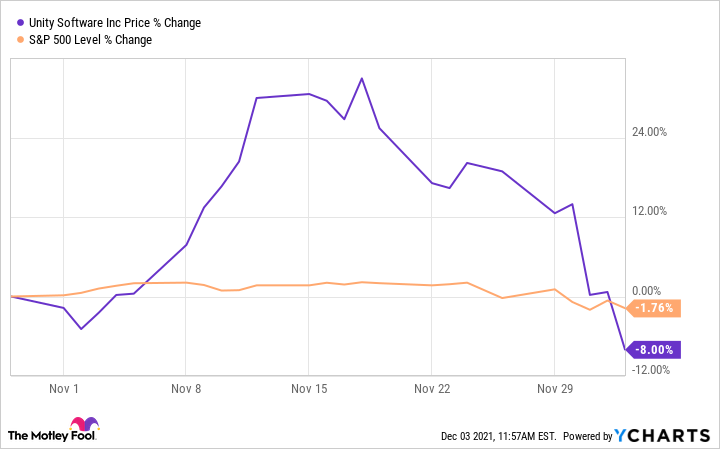

Shares of Unity Software (U -2.31%) popped by 13.9% in November, according to data provided by S&P Global Market Intelligence. The stock was rising ahead of the company's third-quarter financial report, which it delivered on Nov. 9. However, despite beating expectations and raising guidance, the stock gave back some of its gains from early in the month and has continued falling into December.

So what

In Q3, Unity generated revenue of $286 million, up 43% year over year. The company's customers -- many of which are video game developers -- can build games with its software, and revenues from that are counted under its "create solutions" segment, where sales were up 34% from the same quarter last year. However, Unity also helps developers over the lifetime of their games with the offerings in its "operate solutions" segment. That part of the business accounted for 65% of total revenue in Q3 and grew 54% year over year.

Image source: Getty Images.

Unity's create solutions revenue is subscription-based whereas its operate solutions sales are usage-based. And higher usage fueled Unity's revenue growth and helped it beat expectations. Speaking of expectations, management also raised its full-year revenue guidance. Previously, it was forecasting revenue in the $1.045 billion to $1.06 billion range. Now, it's now guiding for revenue in the $1.08 billion to $1.085 billion range.

Several analysts on Wall Street raised their price targets for Unity stock immediately following the release of the Q3 results, but the stock began falling -- and falling fast. This could have had something to do with the company's acquisition of visual effects company Weta Digital for $1.625 billion, which it announced the day of the Q3 report and completed Dec. 1. Unity sold $1.5 billion in convertible notes to fund the transaction, and it seems the market wasn't thrilled by it.

Now what

The decline in Unity's stock price could also have had something to do with its valuation. It hit an all-time high during November and was trading at around 55 times sales -- some investors consider a technology stock to be richly valued at even 10 times sales. So there's no question that Unity stock was pricey. Right now, it appears that the market views stocks of this type as becoming riskier, and investors are looking to take some of that risk off the table.

Maybe you believed Unity stock was fairly valued back in November. Or maybe you feel like the stock is still too richly valued now. Either way, it's fair to say that Unity's business will have to keep serving up robust growth and expanding profit margins for a long time if it's going to be a winning investment. That's going to be hard.

The good news is the business delivered strong results in Q3. And there are certainly still potential growth drivers (including the metaverse) that could help Unity report strong results in the years to come.