What happened

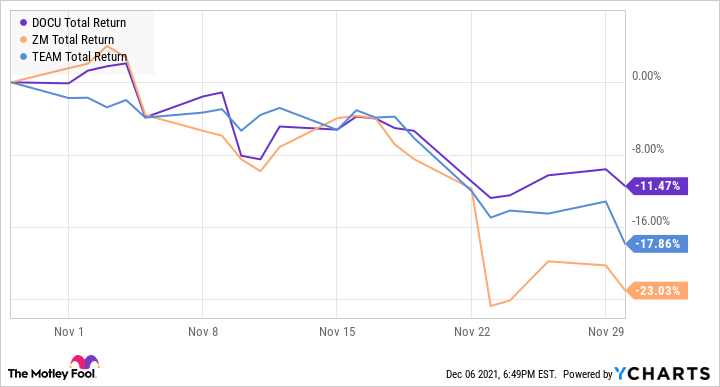

DocuSign (DOCU 0.55%) stock tumbled 11.5% in November as work-from-home stocks took a beating. There wasn't any major company-specific news for DocuSign last month, but it couldn't overcome a broader sell-off.

DOCU Total Return Level data by YCharts

So what

DocuSign's November was one of those rare instances of a stock rising or falling without any major news. The company released a terrible earnings report in the first week of December, which sent the stock another 40% lower. There's always a chance that the market was responding to whispers, and some people were trying to unload shares prior to the damaging report.

I'll stop short of speculating about fraud and insider trading, because there are other plausible reasons for the November slide. Stay-at-home stocks hit unsustainably high valuations, and investors are bailing now. Remote work leaders such as DocuSign, Zoom Communications, and Altassian are prime examples, as are Peloton and Teladoc. The whole space took a beating, and DocuSign's chart looks conspicuously similar to its peers'.

Image source: Getty Images.

The pandemic is by no means over. However, vaccination rates are climbing, nonvaccination treatments are improving, and people are becoming more adjusted to the lifestyle changes associated with public health. Many businesses are bringing employees back to offices next year. Overall, consumer behavior appears to be normalizing, and it's unwinding faster than people had anticipated.

Just as importantly, the game of musical chairs in the capital markets also looks like it's about to end. The Fed seems like it's accelerating its tapering and rate-hike timeline, which should drive capital out of the stock market and toward other asset classes, such as bonds. This puts downward pressure on stock prices, and the high valuation ones are the first to get hit.

DocuSign's price-to-sales ratio was around 27 at the start of November. Fears about work-from-home businesses mixed with a decreasing appetite for risk could only go one way.

Now what

A quarter that was considered disastrous still featured 28% revenue growth and a wider-than-expected operating profit margin. The company forecasts further growth next quarter, and it operates a cash-flow-positive business.

Remote collaboration was a growing trend in the years prior to 2020 -- there just happened to be an unprecedented 18-month distortion that gave it temporary benefits. Many businesses have permanently changed, now that the processes and tech are in place to manage a distributed workforce. This is by no means doomsday for DocuSign.

This was all a healthy readjustment. The stock was way too expensive. Even after it got slammed, it's still more than 60% above its pre-pandemic level, with a forward P/E ratio still above 62. DocuSign is out of insane valuation territory, but it's still not really a value stock. Now it just looks like a reasonable growth stock for investors who wanted a more rational entry point.