Pandemic-hit 2020 was a terrible year for mall real estate investment trusts (REITs), with some actually ending up in bankruptcy court. The niche retail sector has rebounded strongly in 2021 as the economy has reopened after the shutdowns that hit mall REIT results last year. Is pent-up demand among consumers the big story here, or is there something more going on?

The obvious and the not-so-obvious

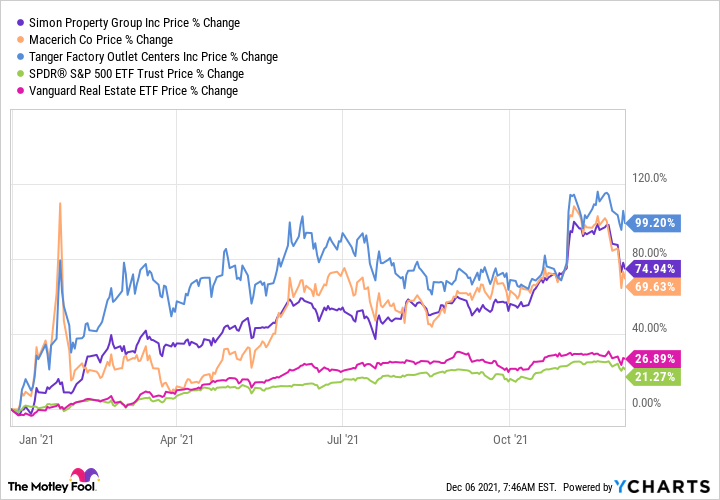

Mall landlords like Simon Property Group (SPG 0.00%), Tanger Factory Outlet Centers (SKT 0.34%), and Macerich (MAC 0.99%) have seen huge gains so far in 2021 after suffering painful declines in the early days of the pandemic. All three of these REITs have at least doubled the return of the S&P 500 Index and the average REIT, using Vanguard Real Estate ETF as a proxy.

On one hand, that makes sense, given that lockdowns in 2020 likely created pent-up demand among consumers eager to get out and shop. And since more people have been able to head out to the mall in 2021 thanks to increasing vaccination rates, spending at malls has increased.

Image source: Getty Images.

But that's a little too simple a storyline for a sector that's been facing material headwinds for years. Here are four additional reasons malls are thriving that may be even more important than you think.

1. People are social animals

The big pitfall in the pent-up demand theory is that nobody had to stop shopping during the lockdowns. There was always the option of buying over the internet, which a lot of people chose to take advantage of. Basically, nobody was stuck at home lamenting the fact that they couldn't buy a shirt (or just about anything else, for that matter), hoping for the day when they could return to the mall. So demand for goods in the mall isn't exactly pent-up. Note that the trend toward online shopping has been going on for years, often overzealously dubbed the retail apocalypse.

What was really pent-up? People who wanted to go do something with their friends and family. And going to the mall is, for better or worse, one of the ways Americans like to spend time doing that. Sure, stores likely benefited from this increase in traffic, but the traffic uptick was not all about buying things.

2. The deadwood has been cleared

The next big issue to consider is that, for mall REITs, part of the problem over the past several years has been store closures. Financially weak names that failed to keep up with consumer trends, including having an online presence, failed or had to scale back operations (this is the real backdrop of the retail apocalypse). That trend picked up during the pandemic, resulting in notable drops in occupancy for malls.

The story at Simon is a good example. Occupancy was at 95.1% at the end of 2019 and fell to 91.3% by the end of 2020. It dipped again in the first quarter of 2021 to 90.8%, but then started moving higher again, hitting 92.8% by the end of the third quarter thanks to strong leasing demand.

That trend is similar across the best-positioned mall REITs. Retailer demand for space is really what will drive long-term results for mall REITs, and it is rebounding. The key is that the weakest names have been forced out, which has opened space up for new concepts. Add in the swift occupancy declines, and malls are probably offering rent deals as well, making it less costly for up-and-coming retailers to try out a new physical location.

Here's a look at price performance for some of these mall giants, compared to the SPDR S&P 500 ETF Trust and the Vanguard Real Estate ETF.

3. Only the best survive

In addition to the retail sector purification that got fast-tracked, lower-quality malls have also been shutting down. There's a reverse-network effect to this, as the remaining malls become more valuable to retailers and customers alike.

This too has been an ongoing trend, but one that got a boost from the pandemic. This is a far cry from "all malls are dying." For example, the sales figures in Macerich's malls in the second and third quarters were 114% higher than they were prior to the pandemic. That could be pent-up demand, but it could also be better malls benefiting from their improving market positions.

4. Adapting, not going away

The last big reason why pent-up demand isn't likely the only reason malls are rebounding was summed up by Macy's CEO Jeff Gennette during his company's third-quarter 2021 earnings conference call: "Our data validates that in markets where we have a physical presence, our online business is stronger." He went on to discuss the important interplay between online and brick-and-mortar stores.

And Macy's is not the only retailer that's figured this out. Simply put, the retail world isn't likely to be online only any more than it is likely to revert to brick-and-mortar only. The solution will be the mix of the two that best works for end customers. And that means that the best-positioned malls still have plenty of life left in them. Note that this rational industry shift is finally starting to take stronger hold, thanks to the effects of the pandemic.

Demand for sure, but more is going on

As you look at the mall REIT sector, there's probably some amount of pent-up demand among consumers that's helping to boost results. But that's not the whole story for an industry that has been working through a difficult transition for a very long time.

In fact, the pandemic may have actually sped up the transition, allowing other factors (such as the reverse-network effect and clearing out troubled retailers) to play a bigger role in the mall REIT recovery. And, assuming that the "pent-up demand" story is only part of what's going on, the upturn for mall REITs from here could be a lot stronger and last longer than you may think.