With some parts of the broader market trading close to record highs, finding a decent dividend yield can be tough. Investors looking for income still have options, but they need to look a little harder to find them. One place to start is with the real estate investment trust (REIT) sector.

Many of these REIT stocks have some great characteristics when it comes to generating income for their shareholders because they are only able to avoid paying corporate income taxes by distributing at least 90% of their earnings as dividends. The best ones also are in growing industries that allow for stock price appreciation as well.

Here are two REITs along these lines that income investors should find appealing.

Image Source: Getty Images.

1. A housing shortage means good things for Weyerhaeuser

Weyerhaeuser (WY 0.76%) is a timber REIT, which means it owns and manages forests. The company also processes timber into wood products. Weyerhaeuser is highly leveraged to construction, especially residential construction. Lumber prices rose massively in the spring, fell over the summer, and are back rising again this fall. Just over the past month, lumber prices have increased 66%.

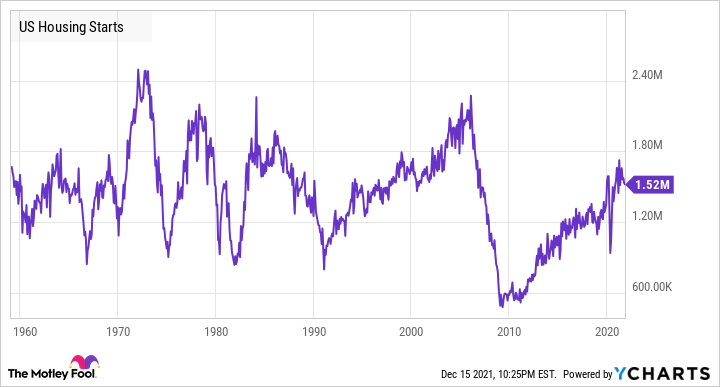

According to the National Association of Realtors, there is an underbuilding gap of 5.5 million to 6.8 million housing units. At the current annualized pace of 1.5 million starts per year, that works out to be roughly 4 years' worth of production just to catch up with demand. Take a look at the chart below, which goes back over 60 years. Housing starts are at the same levels they were during the Eisenhower administration. Yet, the U.S. population is up about 88% since then. Clearly, supply is not keeping up with demand.

US Housing Starts data by YCharts

For Weyerhaeuser, rising lumber prices equal higher profits. The company has an unusual dividend policy, however. It sets its normal quarterly dividend at a conservative enough level to be maintained even in weak lumber or housing markets. When the company is highly profitable (as it is now), it will pay a variable dividend as well. The company just introduced this policy, and the first variable dividend will be paid early next year.

The stock pays a quarterly dividend of $0.17 per share, which works out to be a yield of 1.7%. It paid a $0.50 per share special dividend in October, and we have to see what fourth-quarter earnings look like before we get an idea of what the variable dividend will be. With rising lumber prices and strong demand for housing, Weyerhaeuser is poised to deliver strong earnings for the foreseeable future.

2. Annaly pays a huge dividend yield

Annaly Capital Management (NLY 1.69%) is a mortgage REIT focusing on mortgage-backed securities that are guaranteed by the U.S. government, residential mortgage loans that are not guaranteed by the government, and loans to businesses. The different loan portfolios add diversification and allow the company to perform well across the entire business cycle.

Mortgage REITs are different from the classic REIT business model. The typical REIT will develop actual properties like apartment buildings or shopping malls and lease out the units to individual tenants. It is an easy-to-understand model. Mortgage REITs operate more like banks. They invest in mortgage debt and earn interest instead of rent.

Mortgage REITs have some of the highest dividend yields in the stock market, but the high rates aren't necessarily a sign of trouble. That said, mortgage REITs are highly susceptible to financial shocks, which seem to come around every decade or so. The last shock was during the early days of the COVID-19 pandemic, when liquidity dried up in the mortgage-backed securities market.

Annaly will have a headwind going forward as the Federal Reserve begins to reduce its purchases of mortgage-backed securities. So far, mortgages have taken the Fed's plans in stride, and we haven't seen a repeat of the "taper tantrum" of 2013, which was a rough period for mortgage REIT investors.

At current levels, Annaly is trading at a small discount to book value, which is typical for a mortgage REIT. It also pays a quarterly dividend of $0.22 per share, which gives the stock a yield of 10.9%.