Apple (AAPL -0.57%) is currently the world's most valuable company with a market capitalization of $2.82 trillion. That isn't surprising as the tech titan is a dominant player in the smartphone market and has ancillary products and services to drive growth.

The tech giant generated a whopping $365.8 billion in revenue in fiscal 2021, an increase of 33% over the prior year. The fact that Apple is growing at an eye-popping pace despite being a mega-cap company is impressive, but it's not surprising as its products and services are in great demand. More importantly, Apple isn't resting on its laurels and is looking to push the envelope by seizing emerging tech trends and moving into new markets.

Image source: Getty Images.

As such, Apple is pulling several strings to ensure that it remains the world's most valuable company for a long time to come. However, the likes of Nvidia (NVDA 0.76%), ASML Holding (ASML -2.05%), and Amazon (AMZN -1.14%) could become more valuable than Apple by 2035, thanks to the fast-growing markets they operate in. Let's see why that may be the case.

1. Nvidia

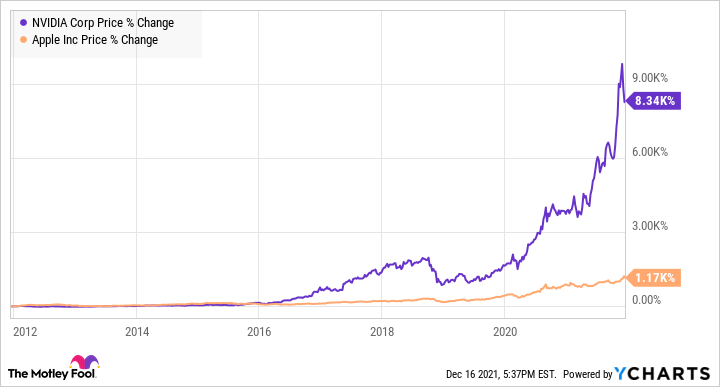

Nvidia has a market cap of $707 billion. It is worth noting that the graphics card specialist's market cap has grown at a much faster pace than that of Apple's in the past decade.

NVDA data by YCharts

Nvidia shares have stepped on the gas since 2016. They have gone supersonic in the past couple of years as it has become clear that its graphics cards play an important role in powering several applications ranging from gaming consoles to personal computers to data centers and autonomous vehicles. The massive demand for Nvidia's graphics cards is evident from the company's recent results.

The company has generated $19.3 billion in revenue in the first nine months of fiscal 2022, a jump of 65% over the prior-year period. Its adjusted earnings have increased 81% in the first nine months of the year to $3.12 per share. This terrific growth has been driven by two key catalysts -- gaming and data centers.

Nvidia absolutely dominates these two markets. The company has an 83% share of discrete graphics cards that power gaming PCs, while its share of the booming data center accelerator market reportedly stood at 80.6% a year ago. The good part is that both these markets are expected to add billions of dollars of revenue in the future. The GPU (graphics processing unit) market, for instance, is expected to clock a 33% annual growth rate through 2028 and hit $246 billion in value, according to a third-party estimate.

The use of GPUs as data-center accelerators is increasing at 42% a year, a pace that's expected to continue through 2027. Throw in budding catalysts such as the omniverse and self-driving cars, and it is easy to see why Nvidia's earnings are expected to increase at an annual pace of close to 40% for the next five years. That's way higher than Apple's projected earnings growth rate of 15% over the same period, which further indicates why Nvidia could be a solid candidate to overtake Apple's market cap in the next 15 years.

2. ASML Holding

Apple was unable to make enough iPhones and iPads last quarter due to supply chain constraints arising out of the global chip shortage, and that cost the tech giant $6 billion in revenue. ASML is one company that could help get more chips into the hands of Apple and others that are suffering from a lack of chips on account of the semiconductor shortage.

This is probably one of the reasons why ASML stock has been a top performer in 2021 and has outpaced Apple's gains by a significant margin this year.

AAPL data by YCharts

It won't be surprising to see this trend continue as the demand for ASML's machines that help foundries make chips has gone through the roof. Net bookings for ASML's machines increased to 6.2 billion euros in the third quarter of 2021, more than double as compared to net bookings of 2.87 billion euros in the year-ago period.

The Dutch giant reported a 32% increase in revenue during the quarter to 5.24 billion euros. The fact that ASML's bookings increased at a faster pace than the actual revenue indicates that it can sustain its impressive top-line growth by fulfilling more of its orders and turning the backlog into actual sales. The company is on track to finish 2021 with 35% revenue growth, and Wall Street's estimates suggest that it can keep growing at such an impressive pace for a long time to come.

Venture capital firm Air Street Capital estimates that ASML could hit $500 billion in market cap next year, which would be a huge jump over its current market cap of $311 billion. What's more, ASML's earnings are expected to grow at almost 30% a year for the next five years, which is double Apple's projected growth.

ASML seems to be in a solid position to deliver on Wall Street's forecasts as the semiconductor market is expected to generate $1 trillion in revenue by 2030, a big jump from 2018 levels of $466 billion. Foundries would need to spend more money on equipment to cater to the huge demand, and this could supercharge ASML in the long run as it is the biggest player in the market for photolithography machines.

3. Amazon

Amazon is yet another stock that has easily outpaced Apple's gains in the past decade.

AAPL data by YCharts

Amazon's focus on diversifying itself from a vanilla e-commerce company into a leading provider of cloud computing services, video streaming, music streaming, and on dominating the markets it operates in has helped the company grow at an eye-popping pace and hit a market cap of $1.7 trillion. This tech stock is expected to keep up its tremendous growth in the coming years, with earnings expected to increase at a compound annual growth rate of 36%.

Again, this is much higher than Apple's projected growth rate. That's because Amazon is on track to take advantage of several fast-growing end markets. For instance, the company's Amazon Web Services (AWS) cloud computing division holds a 32% share of the $150 billion cloud infrastructure market. Third-party estimates peg the size of the global cloud computing market at $927 billion by 2027, which should ensure a high pace of growth in the AWS segment.

Amazon's AWS revenue had jumped 39% year over year in the third quarter to $16 billion, outpacing the growth in the e-commerce segments. Meanwhile, Amazon holds 40% of the U.S. e-commerce market that's expected to hit $8 trillion in revenue by 2030. All this indicates that the company's top line could jump big time in the coming years compared to its trailing-12-month revenue of $458 billion.

As such, Amazon stock could continue to be a better growth pick than Apple in the next decade and beyond. It may eventually eclipse the iPhone maker's market cap in the long run, considering its much faster pace of growth.