If you think Wall Street has had a pretty good year, take a closer look at the cryptocurrency space. While the broad-based S&P 500 has delivered a perfectly respectable 23% return year-to-date, the aggregate value of all digital currencies has risen by a blistering 185% to $2.21 trillion since the year began.

On a nominal basis, Bitcoin (BTC 1.15%) has led the charge. The world's largest cryptocurrency by market cap has gained 58% on a year-to-date basis and tacked on almost $346 billion in market value. As of Dec. 18, it accounted for roughly 40% of the entire market cap of the crypto universe.

Bitcoin's solid performance in 2021 is a reflection of its growing utility in the real world -- El Salvador made Bitcoin legal tender in September -- and investors' perception of its value in light of rapidly rising inflation. Investors also rallied around the much-anticipated Taproot upgrade, which now allows for more complex smart-contract-based transactions on Bitcoin's blockchain.

Image source: Getty Images.

But for as good as Bitcoin has been in 2021, a number of high-growth stocks have handily outpaced its return. In terms of sheer year-to-date performance, these three high-growth stocks crushed Bitcoin.

Moderna: Up 182%

Perhaps it comes as no surprise that one of the top-performing growth stocks in 2021 is a coronavirus disease 2019 (COVID-19) vaccine developer. Moderna (MRNA -2.45%) was higher by 182% for the year through this past weekend, which more than triples Bitcoin's year-to-date gains.

Although there are more than a dozen drug developers working on, or already producing, a COVID-19 vaccine, Moderna's vaccine (mRNA-1273) sits in rarified territory. That's because initial large-scale studies demonstrated a vaccine efficacy (VE) of 94.1%. Only the Pfizer/BioNTech vaccine delivered a higher initial VE (95%). While VE isn't the end-all when it comes to effectiveness and end goals, it has vaulted Moderna into the spotlight as one of two key players in inoculating a significant portion of the developed world.

The mutability of the SARS-CoV-2 virus is also working in Moderna's favor. As new variants emerge, the likelihood of COVID-19 become endemic and requiring people to receive booster shots or variant-specific vaccines grows. In other words, Moderna could find that, rather than enjoying a one-time pop from initial inoculations, it's sitting on a recurring revenue gold mine.

However, one thing investors should understand is Moderna only has one revenue-producing asset at the moment: mRNA-1273. Even though it'll be one of the three best-selling drugs in the world this year, there's a lot of risk for a drug developer valued at almost $120 billion that has just one drug on pharmacy shelves.

Image source: Getty Images.

Upstart: Up 242%

Another high-growth stock that ran circles around Bitcoin in 2021 is cloud-based lending platform Upstart (UPST -1.25%). Even after retracing more than 65% from its all-time high, Upstart has more than quadrupled the yearly gain of the world's biggest cryptocurrency.

What makes Upstart so exciting is the company's artificial intelligence-driven lending platform. Instead of relying on a decade's-old and relatively stodgy method of evaluating people for loans (i.e., using a FICO score), Upstart's platform relies on AI, machine-learning, and data from loans already originated on its platform, to determine the creditworthiness of prospective borrowers. Not only does this democratize the process by opening up lower borrowing rate opportunities to those without "prime" FICO scores, but it also leads to on-the-spot approvals that significantly reduces costs for lenders.

Throughout much of its existence, Upstart has focused on improving loan access and helping banks make personal loans. But with its acquisition of Prodigy Software, it's moved into auto lending. Comparatively, auto loan originations are more than eight times the size of personal loan originations. If all goes well here, Upstart would have an inside track to disrupting lending practices in the $4.5 trillion mortgage loan origination space.

If you're wondering why Upstart has lost over 65% of its value in the past two months, look no further than rising inflation and the expectation of higher interest rates. Higher rates usually means fewer loans taken out by people and businesses. Nevertheless, with Upstart on the leading edge of innovation in the lending space, it's well-positioned to keep growing at a fast rate even with methodical interest rate hikes by the Federal Reserve.

Image source: Getty Images.

Marathon Digital Holdings: Up 224%

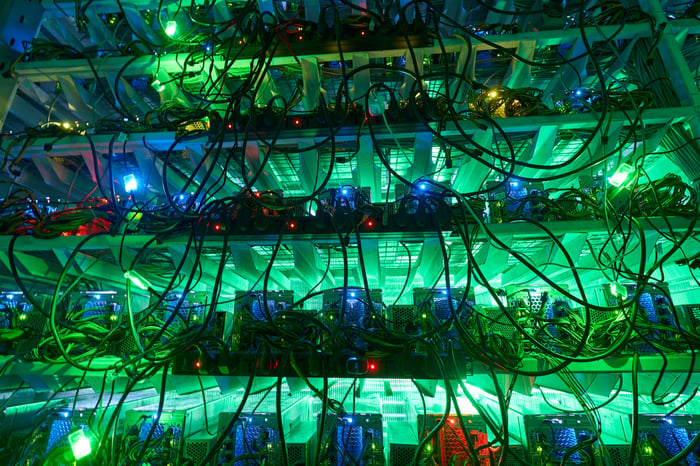

Maybe it's ironic that one of the fastest-growing companies to crush Bitcoin in 2021 is none other than cryptocurrency mining stock Marathon Digital Holdings (MARA -0.42%). Despite falling almost 70% from its all-time high, Marathon Digital is still higher by 224% for the year.

Cryptocurrency miners are people or businesses that use high-powered computers to solve complex mathematical equations to validate groups of transactions (known as a block) on a blockchain as true. For being the first to resolve a block, crypto miners are given a "block reward." With Marathon Digital focused on mining Bitcoin, it receives 6.25 Bitcoin for every block it resolves first. This means a Bitcoin block reward is worth about $290,000.

As of the end of November, Marathon had approximately 31,000 miners in operation, and should be north of 133,000 active miners in its fleet by the midpoint of 2022. Crypto mining is one of the few instances where bigger is better. More miners in operation with improve the company's hash rate and give it a better chance of resolving Bitcoin blocks.

While Bitcoin mining might sound like a great way to gain exposure to the world's top digital currency, it's arguably the worst way to invest in Bitcoin. Competition is increasing on a daily basis, and block rewards halve every four years. This means more businesses are competing for a consistently shrinking pie over time.

The one advantage Marathon offers relative to other crypto miners is that it also acquired $150 million worth of Bitcoin as an investment earlier this year. Even if mining activity becomes far less profitable, it'll still have assets on its balance sheet in the form of Bitcoin tokens. Nevertheless, it's unquestionably the least appetizing of the three stocks mentioned here.