With so many investment opportunities available, investing in category leaders is a good place to start. These businesses are typically lauded by customers and have better pricing power than smaller, less established players.

Three leading tech stocks are Nvidia (NVDA 1.72%), Ansys (ANSS -0.23%), and Match Group (MTCH -0.77%). Each has competitors in their respective fields, but none do it better than these companies.

Image source: Getty Images

Nvidia: The leader in graphics

Nvidia makes graphics processing units (GPUs) that have historically been used for generating 3D graphics in computers and gaming systems. Now, this powerful hardware is seeing its usage expand into other solutions like artificial intelligence (AI) and cloud computing, creating a larger market for Nvidia to capture. As much as 70% of the world's 500 current most powerful computers and 90% of new systems utilize Nvidia's GPUs.

This leader has seen tremendous business success over the last few quarters. During its third quarter ending Oct. 31, it grew revenue 65.2% to $7.1 billion. Even more impressive is its accelerating gross margin.

| Quarterly Gross Margin | ||||

|---|---|---|---|---|

| Q3 FY22 | Q2 FY22 | Q1 FY22 | Q4 FY21 | Q3 FY21 |

| 67% | 66.7% | 66.2% | 65.5% | 65.5% |

Data source: Nvidia.

Accelerating gross margin demonstrates a business's ability to flex its pricing power. Whether it means raising consumer prices to generate more revenue, creating products more efficiently and lowering the cost of goods, or pressuring suppliers into cutting their prices, pricing power is Warren Buffett's "single most important factor when evaluating a business."

As more powerful computers are needed to support cloud infrastructure, Nvidia's market opportunity will increase in lockstep. Nvidia also has technology in the autonomous vehicle sector and the metaverse. With a best-in-class product line and involvement with some of the most exciting future developments, Nvidia is poised as a great investment.

Ansys: The leader in engineering simulations

In the past, trial and error was an expensive way to determine whether a part would work. However, there was no other way to test if an idea was valid. Now, engineers can run their design through simulation software to gain valuable insights and optimize the design, all while reducing development costs. Ansys is the leader in engineering simulation software and is double the size of its nearest competitor.

While other competitors have multiple segments, Ansys is focused on simulation software. By keying in on this area, Ansys offers solutions in many fields like optical, semiconductors, and fluids where competitors offer a couple. This allows Ansys software programs to integrate with each other and create layered solutions like structural and thermal analysis on a circuit board. Tying in with Nvidia, computers utilize GPUs when running simulations, demonstrating another use case for Nvidia's products.

Ansys' third-quarter revenue increased 20% and turned 86% of it into gross profit. This led to a GAAP and non-GAAP operating margin of 24.4% and 39.7%, showcasing its strong profitability. Looking forward to the fourth quarter, ANSYS guided negative revenue growth on the low end and 4% growth at the top. While this might disappoint investors, in the previous two years, ANSYS exceeded its top-end internal revenue guidance by 2.3% (2019) and 7.3% (2020). Past results aren't a perfect predictor of what will happen in the future, but management has been known to over-deliver.

As products become more complex, engineering simulation use will only increase. Ansys is positioned to lead the way.

Match Group: The leader in online dating

Today, 40% of relationships begin online, according to Match Group, which has a strong foothold in the space. Business of Apps found Match Group's platforms made up five of the top seven U.S. dating apps, capturing 72% of total users. Match Group has also been innovating, adding features like voices to dating profiles and video rooms.

Revenue increased by 25% during Q3, with the Asia-Pacific region driving the most growth at 59%. This region also generated the most revenue per payer (RPP) at $17.71. The Asia-Pacific region has a much higher population than the Americas and Europe, giving Match Group plenty of payers to capture.

| Paying Customers | ||

|---|---|---|

| Region | Payers (Millions) | Growth (YOY) |

| Americas | 8.309 | 11% |

| Europe | 4.710 | 13% |

| Asia-Pacific & Others | 3.284 | 36% |

Data source: Match Group. YOY = year-over-year.

With its most profitable region growing the fastest and a huge market opportunity, investors should be excited to see if Match can expand these results in 2022.

Winning in their categories

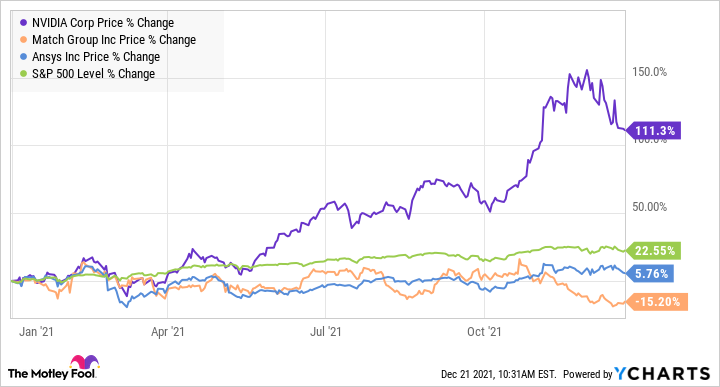

Over the last year, Nvidia has outperformed the market significantly, where Ansys and Match Group have struggled.

After a down year, Ansys and Match Group investors will need to see some results or long-term investors may become impatient. Returns are correlated with quarterly results in the long run, so if Ansys and Match Group continue to execute, their stock performance will follow.

Buying leaders like Nvidia, Ansys, and Match Group can be a formula for success as an investor. Each operates in an important industry with a tailwind blowing in their favor. As 2022 nears, consider buying these leaders with a mindset of holding for three to five years.