With 2021 drawing to a close, investors have a lot to like about the S&P 500's more than 20% gain this year. But after the eggnog has been sipped and the carols have been sung, there's a good chance minds will wander toward the year ahead.

If you're looking for solid well-rounded companies to buy and hold in 2022, you've come to the right place. United Parcel Service (UPS 0.34%), Norfolk Southern (NSC 0.39%) and Emerson Electric (EMR -0.46%) are three industry-leading blue chip businesses that deserve a look.

Image source: Getty Images.

The complete package

Daniel Foelber (United Parcel Service): Finding an industry-leading blue chip business that combines growth, value, and income is a tall order. But there is one stock out there that really is the complete package. That company is UPS, which is poised to post its best year on record once it reports its fourth-quarter and full-year earnings.

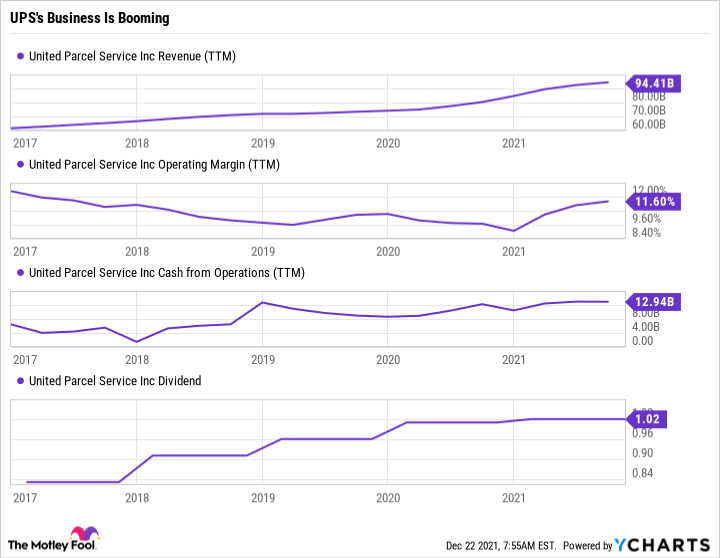

UPS the company is likely to pay you and your neighbors a visit this holiday season, delivering goodies from a one-door open van. But you may not be as familiar with UPS the stock. This chart sums up what makes UPS's business so powerful.

UPS Revenue (TTM) data by YCharts

Over the past five years, UPS has grown revenue by over 50% while sustaining a double-digit operating margin and generating a ton of cash flow that it has used to pay and raise its dividend. UPS's growth has really accelerated over the last two years as the pandemic added fuel to the already roaring e-commerce fire. In UPS's case, a lot of the credit deserves to go to its new CEO Carol Tomé, who took the reins in March 2020. Since then, she has expanded the company's routes and taken a laser-focused approach to tapping into small and medium-sized businesses that previously lacked the same tools available to their larger competitors.

Entering 2022, UPS is the undisputed industry-leading package delivery company. Its international footprint makes it one of the largest industrial companies in the world. At the top of its game in a growing industry, there's so much to like about UPS and its 2% dividend yield.

Norfolk Southern will pay dividends for many years to come

Lee Samaha (Norfolk Southern): If you are going to buy and hold a dividend stock forever, you need to make sure the company will be around for a very long time, and be able to pay and grow its dividend.

In that context, it makes sense to look at one of the major railroads in the U.S.: Norfolk Southern. Railroads occupy a unique position in the marketplace as they own their infrastructure and command powerful market positions within their geographies. For example, Union Pacific and BNSF dominate the West Coast, while CSX and Norfolk Southern are key players on the East Coast.

As long as there's a need to move physical products around the U.S., there'll be a need for railroads like Norfolk Southern. In addition, all the major railroads have an earnings growth opportunity from the continued adoption of precision scheduled railroading (PSR) management techniques. The wide-scale adoption of PSR, a set of management principles intended to run the same amount of volume using fewer assets, is the main reason why railroads have massively outperformed the market in recent years.

A quick look at Norfolk Southern's third-quarter earnings shows the railroad making continuous improvement, with trains getting longer and heavier while the workforce was reduced. It all resulted in a significant improvement in the operating ratio (operating expenses divided by revenue, so a lower number is better) from 62.5% in the third quarter of 2020 to 60.2% in this year's third quarter.

Management believes it can lower the operating ratio over time while growing revenue, which means more earnings and ultimately more dividends for investors.

Charge up your passive income with this Dividend King

Scott Levine (Emerson Electric): You don't have to be the most experienced investor on the block to know that there are no guarantees when investing in stocks. Even the most sapphire-hued of the blue chips represent a modicum of risk -- especially when it comes to dividend payers. What seems like a rock-solid payout today could eventually crumble. That being said, for those investors who are looking for the best chance of picking up a blue chip that will continue to return a steady stream of passive income into their portfolios, I think Emerson Electric, with a forward dividend yield of 2.3%, is one stock that should power their excitement.

For 65 consecutive years, Emerson Electric hasn't only paid a dividend -- it's increased the payout as well, contributing to its distinction as a Dividend King. A provider of automation solutions to a wide swath of industries including automotive, power generation, and medical, Emerson Electric also helps to meet the heating and cooling needs of residential and commercial customers. Aside from its ability to mitigate the risk of a downturn in any one of the individual markets it serves, I find the company's attention to growth industries particularly appealing. Last week, for example, Emerson Electric announced the acquisition of Mita-Teknik, a provider of automation solutions for the wind industry, which will soon be one of the cheapest forms of electricity and, thus, more attractive to power producers.

Of course, there's no guarantee Emerson Electric will avoid short-circuiting in the coming years, but management's prudent approach to the dividend suggests that this company is well positioned to maintain its royal title for the foreseeable future. Over the past 10 years, Emerson Electric has averaged a conservative payout ratio of 59.8%. Additionally, the company generates strong cash flow, positioning itself to pursue further acquisitions without jeopardizing its financial health. In 2021, for instance, Emerson Electric reported $3 billion in free cash flow, representing about 16.4% of its top line -- a superior performance to the 13.1% and 15.2% it reported in 2019 and 2020, respectively. Clearly, this is a dividend darling that forward-looking investors can get supercharged about.