Looking for big gains in 2022? At the end of each year, many investors look to the underperformers, or "dogs," of the year to do just that. In that light, some may want to look toward the telecom sector, which has produced long-term wealth but had a rough 2021.

As the pandemic has raged for the past two years, mobile and broadband subscriptions have grown above the level of gross domestic product (GDP), fueling gains for many telecom stocks in 2020. But midway through 2021, the sector fell out of favor. Broadband subscription growth slowed, leading to fears of market saturation after the pandemic bump. Investors also seem to fear that with all wireless providers showing net additions in a saturated market, something eventually has to give. Highly aggressive promotions for free 5G devices have only added to fears of margin-killing price wars.

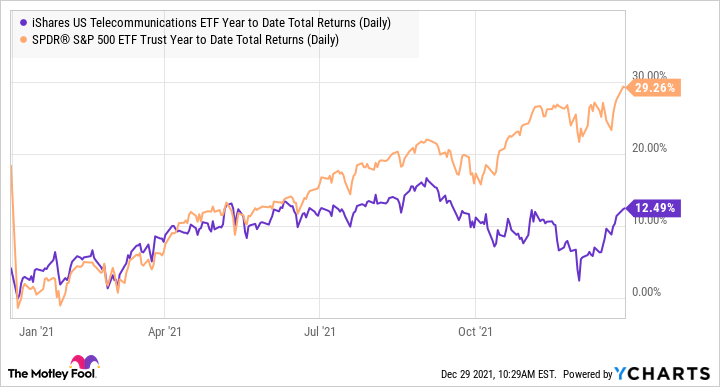

With many leading telecom stocks down or lagging far behind the 29% gains of the S&P 500 this year, stronger players may be primed for a bounce in 2022. And the best-positioned telecom, in my opinion, could be in for very solid gains this coming year.

IYZ Year to Date Total Returns (Daily) data by YCharts

The best 5G network should win in 2022

Although it started the year off strong through July, T-Mobile US (TMUS 0.55%) fell from late August through December, and is down 12% for 2021 as of Dec. 28.

So what happened? It's hard to pinpoint, but the sell-off likely related to raging price wars in the wireless industry. That's not really the fault of T-Mobile, but rather of its competitors, which may be acting out of desperation.

Additionally, the company is still integrating its huge Sprint acquisition, which it closed in April of 2020. Upfront integration costs are currently weighing on profits, as is the company's aggressive 5G buildout. At the time of the acquisition, T-Mobile had the lowest churn in the industry, but Sprint had the highest. And while T-Mobile is converting Sprint users over to its own network, some of the Sprint churn is going to competitors. So while T-Mobile is still handily growing net subscribers, net adds may have underwhelmed some who were expecting more this year.

Fears over rising interest rates could also be making investors look at "cheaper" stocks. Some investors may have taken just a cursory glance at T-Mobile's current profits, which seem low, and its valuation, which seems high at a price to earnings (P/E) ratio of 45, compared to a competitor such as Verizon Communications (VZ 2.85%) that trades at a P/E of 10. T-Mobile also doesn't pay a dividend, and non-dividend-paying growth stocks have had a rough end to the year.

But these factors should lead to a turnaround in 2022

In 2022, however, T-Mobile should get through these headwinds. The Sprint conversion should be completed by June, and profits and free cash flow should begin to inflect upwards.

At the end of that period, T-Mobile will have by far and away the best 5G network in the industry, thanks to the valuable mid-band spectrum Sprint brought over with it. Mid-band offers a great balance of markedly higher speeds than 4G, yet still enough range to reach far from the tower. Mid-band spectrum is a key piece -- perhaps the key piece -- to the 5G revolution.

T-Mobile just completed its mid-band 5G buildout to cover 200 million people -- a feat that competitors AT&T (T 1.17%) and Verizon won't achieve for at least another two years. And by that time, T-Mobile says it will have covered 300 million people with mid-band. Neither AT&T nor Verizon has announced plans to cover 300 million people with mid-band as of yet.

Those last 100 million people are really hard to cover, as they span five times the land mass. Rural markets are fertile ground for T-Mobile, as those markets contain some 40% of the U.S. population. Furthermore, T-Mobile is really underpenetrated in those areas, with a market share in the low to mid-teens. Once T-Mobile can boast mid-band 5G that its competitors lack, it could really dominate in the rural U.S.

Finally, T-Mobile just hit 500,000 subscribers for its new 5G wireless broadband offering. Wireless broadband is a new product enabled by 5G technology, especially mid-band, and though it contributes next to nothing now, it could be a pretty big profit center for T-Mobile.

Think about it: Cable companies have to dig up ground and lay either fiber-optic or traditional cable in order to reach customers. Wireless broadband, however, comes from wireless towers -- which the wireless companies have already built out for their mobile networks -- so the incremental cost for wireless players is almost zero. That means T-Mobile could offer a solid broadband connection for a much lower price and still be profitable.

Cash returns are forecast for 2023, but could they come earlier?

T-Mobile has forecast a share repurchase in 2023, once it completes its integration and reaches its leverage target. However, given that T-Mobile is currently accelerating the pace of integration, and has a history of exceeding its guidance, I wouldn't be surprised if the share buyback starts in late 2022.

In 2022, T-Mobile should be past the worst of the Sprint churn; more people will have 5G phones, and many may experiment with wireless broadband; and the company's share repurchase could kick in early. Down some 12% in 2021, T-Mobile is a defensive stock with a great setup for 2022.