The explosive price action on meme stocks like AMC (AMC -0.88%) and Gamestop (GME 1.50%) in 2021 put the idea of a "short squeeze" on the minds of retail investors, who are now looking for the next potential stock that might vault higher.

While these meme stocks ended up being extreme squeezes, to a lesser extent short-sellers have beaten down insurance tech company Lemonade (LMND 8.23%) as well. Here's why it could be a short-squeeze candidate in 2022.

Image source: Getty Images.

What is a short squeeze?

Before we explain a short squeeze, let's start with explaining shorting itself. When a stock is sold short, investors are borrowing shares to sell them in the hopes of buying back the shares later on at a lower price. As an example, if I short 10 shares of XYZ stock at $100, I receive $1,000 from the sale and owe the broker 10 shares of XYZ stock. Let's say that three months later, XYZ trades at $80 per share, and I buy back those 10 shares to "cover" my short position. I spend $800 to buy those 10 shares and return them to the broker; the $200 difference between what I received from the initial sale and what I spent to buy back the shares is my profit (minus any potential fees and commissions from the transactions).

A short squeeze occurs when many short-sellers try to buy back shares to cover their short position all at once. This action creates a buying frenzy of too many buyers going after too few available shares and it can push the stock price much higher in a short amount of time. When this happens, shorts try harder to buy shares because they lose money as the share price increases, which only feeds into the buying frenzy.

This chart shows the percentage of Gamestop's publicly traded shares sold short at the time of its short squeeze. Gamestop's stock was so heavily shorted that short-sellers were reborrowing shares that were already lent out to other shorts. This is how the percentage can exceed 100%, and this extreme level of shorting caused a significant jump in Gamestop's share price.

GME Percent of Float Short data by YCharts

Why is Lemonade so heavily shorted?

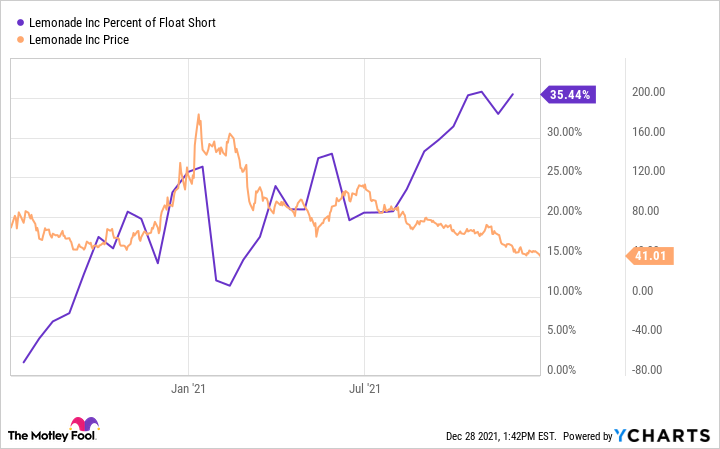

This chart shows how shorts have increasingly pressured Lemonade's stock over time. About 35% of Lemonade's shares are short; not as much as Gamestop, but this is still a high number that makes Lemonade among the most shorted stocks on Wall Street.

LMND Percent of Float Short data by YCharts

So why has Lemonade been such a popular stock with short-sellers? Lemonade is entering the insurance industry as a disruptor, using artificial intelligence-powered bots and a mobile app to go direct to customers and provide a digital experience that appeals to younger users.

Insurance is a fiercely competitive, multi-trillion-dollar industry worldwide, and large, existing players like Geico dominate it. Lemonade is heavily spending on marketing to penetrate this massive, competitive space while simultaneously building new product offerings.

Through the nine months of Lemonade's 2021 fiscal year, the business has generated $87.4 million in total revenue but posted a $171 million net loss. The company is spending more on sales and marketing alone than its total revenue this year.

The prospect of rising interest rates has become increasingly prominent throughout 2021, and investors are selling off stocks of unprofitable or speculative companies. Lemonade is in that group, down nearly 80% from its highs earlier this year.

What might send Lemonade soaring in 2022?

It often takes some event or catalyst that puts a short squeeze into motion. In Lemonade's case, that catalyst could be progress in developing its automotive insurance product that shows the market that Lemonade could become a serious insurance competitor.

Its automotive insurance product, Lemonade Car, launched a week before the company posted its third-quarter results. At the same time, it announced its acquisition of Metromile, an existing insurance technology company involved in automotive insurance. Lemonade is acquiring Metromile in an all-stock deal worth approximately $200 million, subtracting the $300 million in cash on Metromile's balance sheet.

The acquisition gives Lemonade billions of miles in driving and claims data to help hone its algorithms faster, as well as an existing auto insurance presence throughout the country that should expedite how quickly Lemonade can grow Lemonade Car. The automotive insurance industry is worth more than $300 billion in the United States alone, so it's a big growth opportunity for Lemonade.

If investors grow more convinced of Lemonade's ability to disrupt insurance in the coming quarters, the change in sentiment could be what the stock needs to send short-sellers scrambling to cover their positions.