Pharmaceutical giant Pfizer (PFE 1.93%) has been at the front of the industry, developing treatments for COVID since the pandemic started. While it's unfortunate that the world continues to grapple with various strains of the virus, most recently the omicron variant, Pfizer's products remain in high demand, which will likely boost its 2022 business results.

Below we will put some numbers to just how much Pfizer's treatments boosted its business this year and why 2022 could continue the trend, making it a surefire winning stock this year.

COVID treatments remain in high demand

It's been about a year since the first COVID vaccines were made available in the United States, and the race has been on to ramp up the production and distribution of doses. Several companies worked to develop vaccines, but it has become a two-company market. The vast majority of doses administered in the U.S. have come from Pfizer and Moderna, two companies that developed the vaccines using mRNA technology.

Image source: Getty Images.

Pfizer and Moderna have produced mRNA vaccines that use a genetic code from the virus to trigger the human body to produce an antibody response. It's like the vaccine hands the immune system instructions that say "Hey, make these spike proteins."

Traditional vaccines use a weakened form of the whole virus that teaches the body to defend against it. Essentially like how the body builds up immunity once a person gets chickenpox, but the weakened virus doesn't actually make them sick. Both vaccine types achieve a similar result, but pharma companies can more quickly and easily replicate the genetic code for production than the actual virus itself.

Demand for the vaccine has escalated, primarily due to the virus's ability to mutate into new variants. Pfizer's vaccine originally called for a two-dose treatment plan, but with variants emerging, many have received a third shot (called a booster). Pfizer's original forecast for 2021 called for 1.3 billion doses, however, it ended up making around 3 billion doses in 2021. Management is now forecasting that Pfizer will produce roughly 4 billion doses in 2022.

A profit windfall for Pfizer

It's a tragic and challenging time for society as the pandemic continues, but Pfizer's leadership position has created massive benefits for the company. First, the actual sales of its vaccine have been tremendous, contributing an expected $36 billion to 2021 revenue. For reference, Pfizer generated $41.9 billion in revenue in 2020; that means the COVID vaccine has almost doubled Pfizer's business!

PFE EBIT Margin (TTM) data by YCharts

What's more, this has been profitable for Pfizer. The company's profit margins before interest and taxes, referred to as EBIT margin, have risen over the past year as the vaccine business grew. The company has also significantly increased its free cash flow to more than $29 billion over the past twelve months compared to $11.6 billion in 2020. More free cash flow makes a business more robust, giving Pfizer more money to invest in research and development of new products, pay more in dividends, or strengthen its balance sheet.

As the omicron variant spreads, it seems increasingly likely that COVID is not entirely disappearing in the immediate future. Pfizer recently developed an oral antiviral tablet to help treat early-stage COVID symptoms, which management estimates could see 80 million treatment courses produced in 2022. While today we are focusing on the next twelve months, Pfizer could potentially see business from its COVID treatments for multiple years ahead.

The stock is still attractive

Investors have responded to Pfizer's COVID success; the stock has been up 56% over the past year, a large move for a company with a massive $329 billion market cap. Still, the market might not be giving Pfizer enough credit.

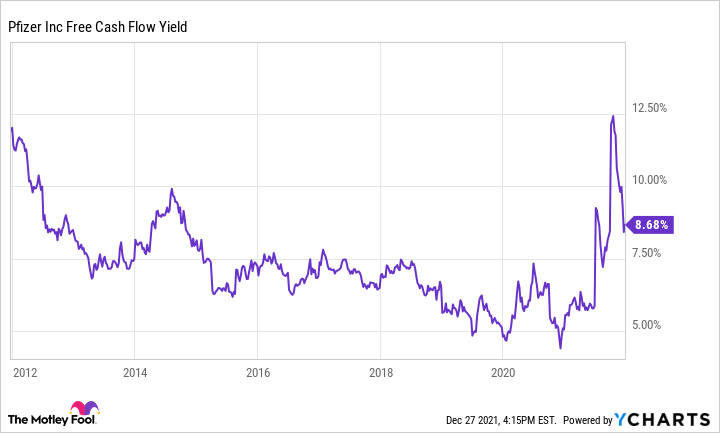

PFE Free Cash Flow Yield data by YCharts

If we wanted to value a stock by the amount of free cash flow investors receive per share, we could look at free cash flow yield; this percentage reflects how much of the share price we are receiving in free cash flow. We want as much free cash flow as we can get for our money because it pays dividends, funds new products, and generally creates value for shareholders -- it's like a company's "life force." Accounting or non-cash items can impact earnings, so free cash flow can offer a fresh take on a stock's valuation.

We can see above that the increase in Pfizer's free cash flow this year made the yield rise because free cash flow grew faster than the share price. Now that shares have started to rise, the yield is coming down, but we are still near multi-year highs, implying that the stock is offering you more "bang for your buck" than it has for most of the past ten years. In other words, it's still cheap. As COVID remains firmly entrenched in our world, Pfizer remains poised for success in 2022.