What happened

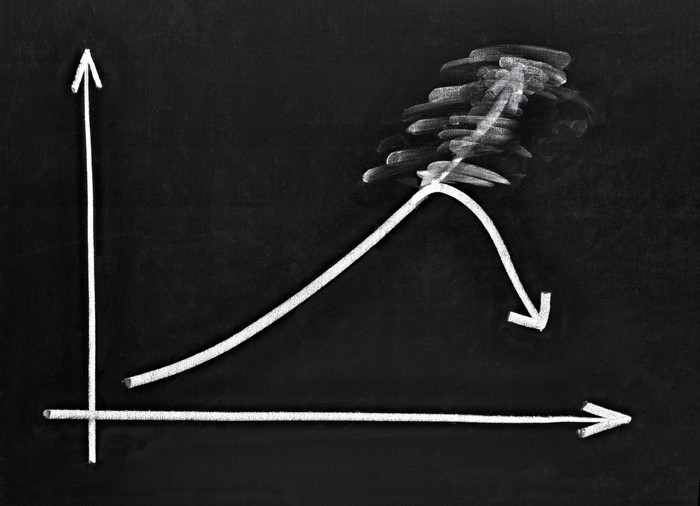

After starting off the new year with a healthy 2%-plus gain yesterday, Nvidia (NVDA 0.76%) stock took a turn for the worse this morning. As of 11:50 a.m. ET, shares of the semiconductor giant are down 4.5% -- erasing all of yesterday's gains and even a bit more.

You can probably thank ASML Holding (ASML -2.05%) for this slump.

Image source: Getty Images.

So what

Yesterday, ASML, a manufacturer of machinery for the production of semiconductor chips that counts both Samsung and Taiwan Semiconductor Manufacturing Company (TSMC) among its customers, according to data from S&P Global Market Intelligence, reported that part of its factory in Berlin, Germany, caught fire on Sunday.

"It is too early to make any statement on the damage or whether the incident will have any impact on" ASML's production of semiconductor manufacturing equipment, the company said. Indeed, "it will take a few days" to find that out. In the meantime, though, Barron's pointed out this morning that if ASML's production is interrupted, it could hinder industry plans to increase semiconductor manufacturing capacity worldwide, and thus prolong the global semiconductor shortage that's already plagued the global economy for more than a year.

Now what

Why might this be bad news for Nvidia?

Barron's explains, "typically supply limitations create better fundamentals [for companies like] TSMC." Another way of looking at that is that, by slowing the expansion of competitors to TSMC, the ASML fire could give TSMC more pricing power when negotiating contract production of semiconductors for Nvidia (at the same time as it makes it harder for Nvidia to have companies other than TSMC make its chips for it). This would be one possible reason why investors are looking at ASML's fire as bad news for Nvidia.

Of course, there's also always the possibility that they're looking at Nvidia stock, which costs 93 times earnings, and thinking "that's kind of expensive." Seems to me, that would be a pretty good reason to sell.