What happened

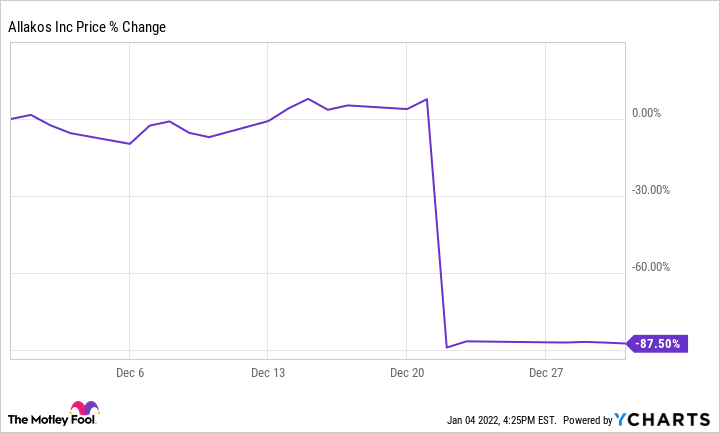

Allakos (ALLK 0.95%) stock sank 87.5% in December, according to data from S&P Global Market Intelligence. The clinical-stage biotech company's share price plummeted after the publication of disappointing trial data for its key treatment.

Allakos published phase 3 Enigma 2 and phase 2/3 Kryptos trial data on its lirentelimab monoclonal antibody as a treatment for eosinophilic gastrointestinal diseases (EGIDs), and the results shocked the market. The results of both studies showed no statistically significant improvement for EGID patients, and investors quickly abandoned the stock.

Image source: Getty Images.

So what

Lirentelimab had shown promising results as a treatment for eosinophilic gastrointestinal diseases in its phase 2 trials, and the phase 3 data caught the market off guard. The crushing study results were followed by a series of downgrades from high-profile analysts.

The day after the trial results were posted, Morgan Stanley analyst Michael Ulz published a note maintaining an equal weight rating on the company's stock but lowering the one-year price target on the stock from $86 per share to $10 per share. H.C. Wainwright's Patrick Trucchio published a note on Dec. 28, 2021, lowering the firm's one-year price target on the stock from $230 to $20 per share. Goldman Sachs' Paul Choi maintained a neutral rating on the stock but was a bit more optimistic, only lowering his price target from $122 per share to $60 per share.

Now what

Allakos stock has continued to slide early in January's trading. The company's share price is down roughly 12% in the month so far.

With speculative and growth-dependent stocks getting hit hard amid recent market volatility, it's not surprising to see the struggling biotech company's valuation lose additional ground. What comes next?

Allakos is pushing ahead with lirentelimab trials for other potential applications even though data points to little efficacy for eosinophilic gastrointestinal diseases. The following quote from the company's press release for the recent trial data outlines the company's next steps:

Although the EGID results are surprising and disappointing, we will continue to analyze the data to understand the results and to determine the path forward for lirentelimab in EGIDs. At present we intend to continue our development efforts with subcutaneous lirentelimab in atopic dermatitis, chronic spontaneous urticaria, and asthma. The atopic dermatitis study is underway and we plan to initiate chronic spontaneous urticaria and asthma studies in 2022 and will continue to advance other programs in our preclinical pipeline.

Allakos now has a market capitalization of roughly $493 million, and its outlook is uncertain to say the least.