What happened

Freshworks (FRSH 0.22%) stock sank 25.4% last month, according to data from S&P Global Market Intelligence. December was a tough month for many growth-dependent software-as-a-service (SaaS) stocks, and the company's share price wilted amid the pullback.

There wasn't much in the way of business-specific news driving the sell-offs, but the software company was coming off a nearly 30% stock slide in November, and there also wasn't any major positive news to shift investor sentiment last month. The company's share price is now down roughly 54% from market close on the day of its September initial public offering (IPO).

Image source: Getty Images.

So what

Freshworks provides human resources and customer management software, positioning it as a competitor to Salesforce.com and other players in the space. The company' stock jumped 21% from its IPO price on its first day of trading, but it's been mostly downhill from there.

Despite posting sales and earnings beats when it reported third-quarter earnings results in November, the stock lost ground following the release due to guidance the market found underwhelming and the business swinging to a free cash flow loss in the period. Freshworks stock also saw a partial lockup expiration early in November, which opened the door for insiders to sell their shares on the market. In conjunction with investors generally shying away from growth-dependent SaaS companies in December, these factors appear to have led to continued sell-offs for the stock.

Now what

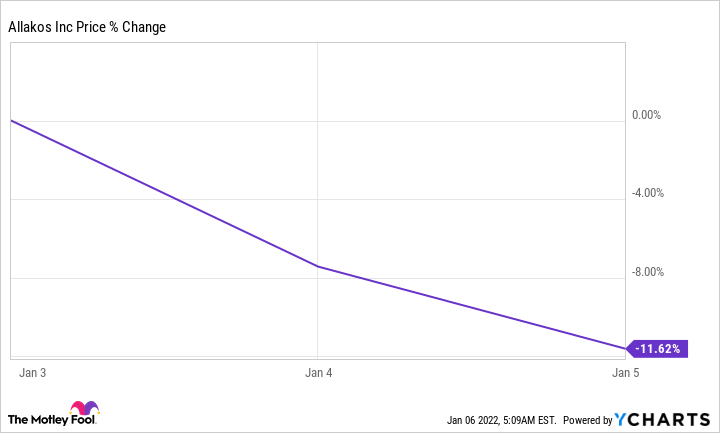

Freshworks stock has continued to lose ground early in January's trading. The company's share price is down roughly 11.6% in the month so far.

The Federal Reserve appears to be on track to significantly raise interest rates this year and cut back on its bond-purchasing initiatives, and investors are abandoning highly growth-dependent stocks in response. Unsurprisingly, Freshworks stock is getting caught up in the pullback.

The company will likely publish its fourth-quarter results in February, and management is guiding for a non-GAAP (adjusted) loss per share between $0.05 and $0.07 on revenue between $99 million and $101 million. For the full-year period, the company is targeting an adjusted loss between $0.20 and $0.22 per share on revenue between $365.5 million and $366.5 million.

Freshworks stock is now valued at roughly $6.7 billion and trades at approximately 14 times expected sales in 2022.