If your New Year's resolutions included becoming wealthier, turning to the stock market is a great way to accomplish that goal. Since the S&P 500 recovered from the market crash in early 2020, it has more than doubled despite lingering economic woes.

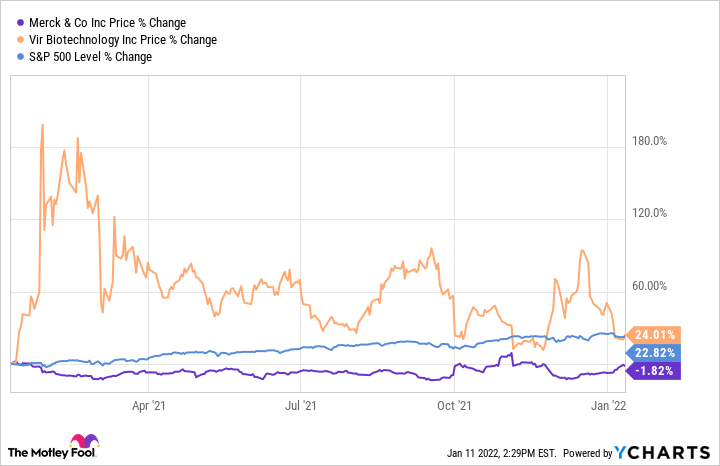

Investing in great companies will continue to be an excellent wealth builder in 2022 and beyond. But which stocks should you buy right now? Let's look at two excellent options in the healthcare sector: Merck (MRK 3.14%) and Vir Biotechnology (VIR -4.66%). Here's why both of these companies look attractive at the moment.

1. Merck

When it comes to Merck, one thing is for sure: The company's blockbuster drug Keytruda is practically unstoppable. The medicine is approved to treat multiple forms of cancer, and its sales continue to grow at a rapid clip. In the third quarter, Merck's revenue from Keytruda jumped by 22% year over year to $4.5 billion.

According to some estimates, Keytruda is well on its way to becoming the best-selling medicine in the world by 2026. That means it will continue to drive top-line growth for the pharma giant. But Merck's business extends far beyond this product. In Q3, the drugmaker's total sales increased by an impressive 20% year over year to $13.2 billion.

Merck's HPV vaccines Gardasil and Gardasil 9 also performed well with combined sales coming in at roughly $2 billion, 68% higher than the year-ago period. The company's animal health segment produced solid results too. Revenue from this unit increased by 16% year over year to $1.4 billion. The animal health industry is projected to grow at a good clip in the coming years, and as one of the leaders in this field, Merck is well-positioned to benefit.

Image source: Getty Images.

Merck's business seems to be strong, but why buy right now? Here are two reasons. First, the company has underperformed the market of late, likely in part due to valuation concerns coupled with headwinds brought forth by the pandemic. But after this ordeal, Merck's forward price-to-earnings (P/E) ratio stands at 11.2 -- close to its five-year low. It's also lower than the average forward P/E ratio of 13.3 for the pharma industry.

Second, Merck completed the acquisition of Acceleron Pharmaceuticals in November. The cash transaction cost Merck $11.5 billion. However, the deal helped bolster Merck's pipeline thanks to Acceleron Pharma's lead product candidate, sotatercept, a potential treatment for pulmonary arterial hypertension in phase 3 clinical trials. Management has high hopes for sotatercept, which could eventually help Merck diversify its revenue stream.

This transaction made Merck even more attractive than it already was, and given the company's reasonable valuation, now may be a great time to pull the trigger.

2. Vir Biotechnology

Vir Biotechnology isn't as well-established as Merck, but the company could have a memorable year. Vir developed an antibody treatment for COVID-19 called sotrovimab in collaboration with GlaxoSmithKline. While there are plenty of companies fighting for a piece of the coronavirus treatment market (including Merck itself), sotrovimab may well emerge as one of the leaders in this space.

That's because Vir recently reported data from a preclinical trial showing that sotrovimab looks effective against the omicron variant of the coronavirus. This highly contagious variant continues to progress, both in the U.S. and abroad. In the U.S., cases of omicron now make up the vast majority -- more than 95% -- of new cases of the disease.

And while some existing treatments may remain effective against illnesses caused by omicron, others may cease to be of use. That opens the door for sotrovimab to grab an increasingly higher market share, leading to higher sales for Vir Biotechnology and its partner, GlaxoSmithKline. The two entities have already signed contracts to deliver 1.7 million doses of sotrovimab to various governments worldwide. That number may rise as some governments could exercise options to purchase additional doses of the antibody treatment.

While Vir does not have any other products on the market, the company boasts several exciting pipeline candidates, including a few potential HPV treatments in phase 2 clinical trials, among other programs. Vir has partnered up with larger companies, such as Gilead Sciences, to develop some of its candidates. Data readouts from at least one of the company's studies for HPV treatments should come in this year, and if the results are positive, expect Vir Biotechnology's stock to take off even more. The biotech will use the cash it will get from sales of sotrovimab to advance its pipeline programs.

Vir Biotechnology looks riskier than Merck since it does not have a lineup of drugs that compares to that of the pharma giant. But sotrovimab could help the stock soar as the company starts recording increasing sales of its crown jewel. That, coupled with its pipeline, make it an intriguing biotech stock to consider. In short, 2022 should be an excellent year for Vir.