What happened

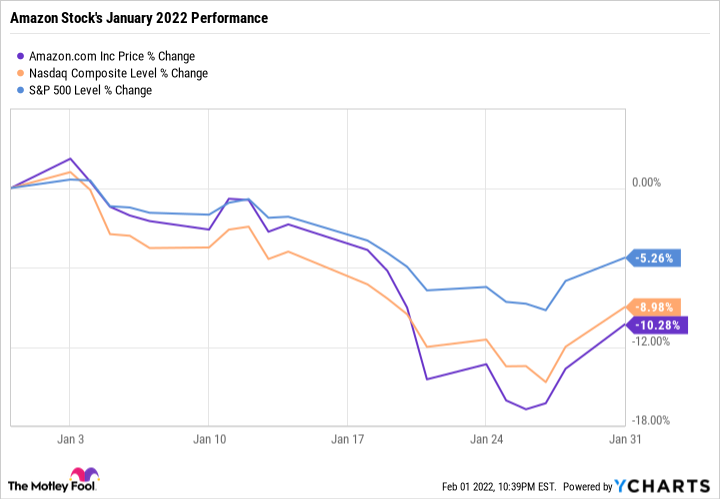

Shares of Amazon (AMZN -1.64%) fell 10.3% in January, according to data from S&P Global Market Intelligence.

The main driver for the e-commerce and cloud-computing giant stock's decline was weakness in the overall market, as we'll explore in a moment.

Image source: Getty Images.

So what

Market dynamics were probably entirely to blame for Amazon stock's weak start to 2022. In January, the S&P 500 and tech-heavy Nasdaq Composite indexes were down 5.3% and 9%, respectively. The Nasdaq is arguably the better index in which to gauge Amazon stock's relative performance.

As the below chart shows, Amazon stock closely mirrored the Nasdaq's moves throughout the month and performed just a little worse than it did.

Data by YCharts.

The market performed poorly in January because the Federal Reserve is on track to soon begin raising interest rates. As would be expected, interest rate-sensitive stocks were hurt the most last month. This group includes growth stocks in the technology realm -- such as Amazon -- and utilities, among others.

Widening our time lens beyond just one month, the below chart shows how Amazon stock has performed since the start of 2020. It was a strong performer in 2020, thanks in large part to the pandemic-driven surge in online shopping. However, it struggled in 2021. Taken the two years together, along with 2022 through Feb. 1, Amazon stock has performed almost exactly the same -- just over one percentage point better, to be exact -- as the Nasdaq Composite.

Data by YCharts.

Now what

Investors can expect material news very soon. Amazon is slated to report its fourth-quarter and full-year 2021 results after the market close on Thursday, Feb. 3. An analyst conference call is scheduled for the same day at 5:30 p.m. ET.

For the fourth quarter, Amazon guided for revenue of $130 billion to $140 billion, which represents growth of 4% to 12% year over year. Wall Street is expecting revenue of $137.7 billion, or growth of 9.7%. Analysts are also projecting adjusted earnings per share (EPS) will drop 73% to $3.74.

The company's bottom line was no doubt hurt by increased shipping costs stemming from supply chain issues and higher employee wages.

Guidance should be particularly important. You can read my earnings preview here.