While the market hasn't been in the best shape so far in 2022, that doesn't mean these woes will continue for the rest of the year. And even if they do, history tells us that the market eventually recovers from corrections. These otherwise stressful events create opportunities to buy shares of great companies for a discount.

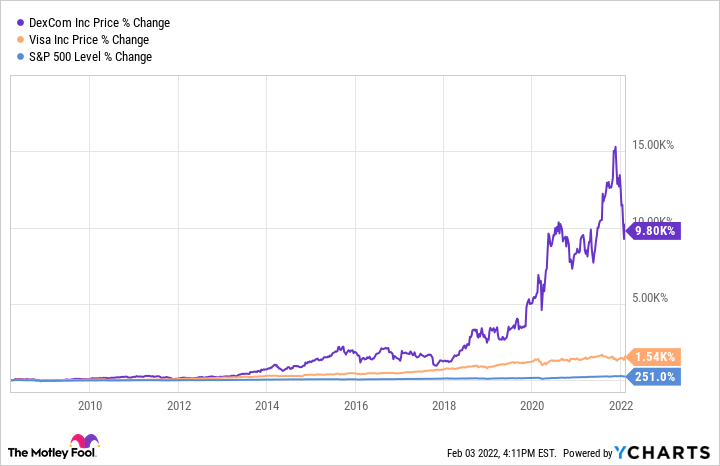

That's why investors shouldn't shy away from purchasing stocks right now. On that note, let's look at two companies that would be great additions to your portfolio this year and beyond: DexCom (DXCM -3.52%) and Visa (V -0.64%).

1. DexCom

Despite a recent sell-off, medical devices specialist DexCom has a bright future. The company currently makes most of its money from the sale of its G6 continuous glucose monitoring (CGM) system and accessories, which help diabetes patients keep track of their blood glucose levels. In recent years, the rapid adoption of this technology has been the driving force behind DexCom's revenue growth.

For the full 2021 fiscal year, it expects to report revenue of $2.4 billion, an increase of about 27% compared to a year ago. Analysts expect the company's revenue to grow 18.5% annually through the next five years. Here are two reasons DexCom can continue performing well:

First, it is currently working on the G7, a successor to the G6. According to the company, this new model will be 60% smaller and result in even better health outcomes for diabetes patients. DexCom has submitted an application to regulators in the U.S. for the G7, and the device could earn clearance sometime this year.

Image source: DexCom.

Given the success of the G6, investors can reasonably expect DexCom's next-gen device to see similar levels of enthusiasm within its target population. Second, the company has a massive market to tap.

In the U.S., the company estimated that the type 1 diabetes market is less than 50% penetrated while the market for type 2 diabetes patients on intensive insulin is less than 25% penetrated. Last year, DexCom entered into countries in which it previously had no presence, including Bulgaria, Latvia, Lithuania, and Estonia.

The company expects its ventures into these new countries and others to significantly increase its addressable population outside the U.S. to roughly 19 million people -- up from 6 million people -- by the second half of 2023.

Keep in mind, the U.S. is a leader in CGM penetration, meaning there is an even greater potential in these other countries. The number of people with diabetes is also on an upward trend that will only propel CGM sales even higher.

According to some estimates, the CGM market will expand at a compound annual rate (CAGR) of 10.1% through 2028. Investors looking to benefit from this rapid increase can hardly do better than this healthcare stock.

2. Visa

Visa helps process and facilitate credit card transactions, and the company makes money by charging transaction fees. The company's business benefits from the network effect. That is, the value of its services increases as more people use it. The more that customers join Visa's payment network, the more it attracts businesses onto this network, and vice versa.

While a few companies compete with Visa in this area -- most notably Mastercard -- Visa's strong network effect practically guarantees that it will remain one of the dominant players in this market for the foreseeable future. The company continues to deliver solid financial results, too.

In the first quarter, the company saw net revenue grow 24% year over year to $7.1 billion. That was on the back of a 20% year-over-year increase in payments volume and a 21% year-over-year increase in processed transactions. Meanwhile, net income grew 27% to $4 billion compared to the year-ago period.

Image source: Getty Images.

Visa's business did suffer during the pandemic as payment volume decreased, but the company's rebound from these issues has been relatively strong. More important, though, is the company's long-term thesis. As card payments continue to overtake other methods -- including cash and check -- companies like Visa will benefit.

And despite the seeming ubiquity of card payments in many parts of the world, Visa believes there remains significant room for card transactions to replace cash ones. During the company's first-quarter earnings conference call, CEO Al Kelly said the following:

While cash displacement is certainly a reality, global personal consumption expenditure of cash and check grew at a CAGR of 2% over the 10 years ending in 2019. When we look at the opportunity ahead, if you assume global cash grows at 1% annually, industrywide digital penetration of personal consumption expenditure wouldn't reach 90% for several decades.

The company currently sees an $18 trillion opportunity for card payments to replace payments by cash and check.

Visa isn't alone in trying to tap into this opportunity, but as an undisputed leader in the field with a solid competitive edge, the company can be expected to grab a decent slice of this market. That's why it remains an excellent stock to buy and hold through this tumultuous year and beyond.