Last year, inflation emerged as a serious economic problem. In the U.S., inflation recently hit near 40-year highs. Spending more to acquire fewer goods and services is not a fun activity. Fortunately, turning to the stock market is a great way to beat inflation in the long run.

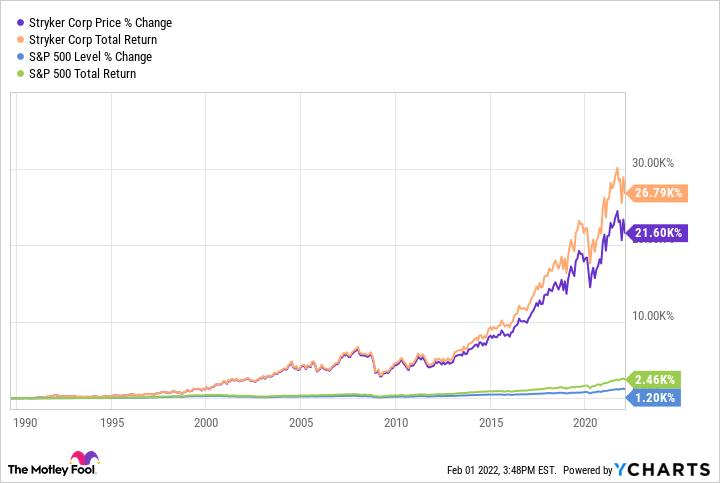

In the past 30 years, the S&P 500 has delivered a compound annual growth rate of 8.66% -- and that's adjusted for inflation. To be sure to tame inflation, it's even better to invest in stocks that have a history of delivering above-average returns -- and that have the tools to continue doing so. One such stock is medical devices specialist Stryker (SYK -0.62%).

Recent financial results

Stryker is one of the largest medical devices companies in the world by market cap, and it is one of the leaders in several of its business areas. For instance, within its orthopedics division, it is one of the leading providers of surgical options and implants for joint replacement and the treatment of bone fractures. Many of Stryker's products are crucial to various critical medical procedures, but the company's business was harmed by the COVID-19 pandemic -- just like that of other medical devices giants.

Selective procedures decreased amid the outbreak, leading to lower sales for some of Stryker's products. Still, Stryker managed a decent fiscal 2021 despite having to navigate various surges of COVID-19 cases due to new variants. The company grew both its revenue and earnings -- even when compared to its pre-pandemic days.

For 2021, the company's net sales came in at $17.1 billion, representing a 19.2% increase over 2020. That's also a 14.9% increase from 2019. Stryker's major business segments also saw sales increases during the year compared to its pre-pandemic days. On the bottom line, the company's adjusted earnings per share of $9.09 grew by 22.3% over 2020 and 10% compared to 2019.

Once the outbreak subsides for good (whenever that happens), the company's business will once again operate at full strength.

Image source: Getty Images.

Longterm tailwinds

Stryker looks like an excellent, long-term bet for helping investors beat the market and inflation. Here are several reasons.

First, the healthcare industry is on a solid upward trend, in part because the world's population is aging. In the U.S., adults 65 and older will make up nearly 25% of the country's population by 2060, compared to 16% in 2019. People need more medical care as they age; it is one of the largest expenses for seniors. The aging population will only increase the need for the kinds of products and services Stryker offers.

Second, Stryker has a long and storied history of innovation, including more than 10,000 patents that help protect its business from competitors. The company has a solid brand name and reputation along with deep relationships within the industry. Stryker's ability to navigate the highly regulated healthcare system gives it an advantage, especially over newcomers.

One of the company's main growth drivers today is its Mako robotic-arm-assisted surgical system, a minimally invasive system to help surgeons perform knee and hip replacement procedures. Before surgery, the Mako system can be loaded with a 3D virtual model of a patient's anatomy, which results in a personalized experience throughout the operation -- and leads to improved patient outcomes. No wonder the system continues to see strong demand.

Opportunities like these illustrate why Stryker looks well-positioned for the long term despite intense competition from other companies like Intuitive Surgical. The company's current forward price-to-earnings ratio is 25.6, which looks reasonable compared to the industry average of 27.7. At these levels -- and considering the overall strength of its business -- this healthcare company looks like a strong buy-and-hold stock.