Moving further into earnings season for growth stocks here in the United States, it is more important than ever to keep a long-term outlook in mind as we comb through updated financials across the market.

Three such U.S.-based growth companies to keep an eye on are Roku (ROKU 5.41%), Kinsale Capital Group (KNSL 0.24%), and Pool Corporation (POOL 2.49%). These stocks offer promising long-term outperformance potential despite operating in wildly different industries, in which they have unique, specialized niche markets.

Today we will look at one specific metric to watch for from each company's upcoming earnings -- and why it may just set investors up for multibagger returns further down the road.

Image source: Getty Images.

1. Roku

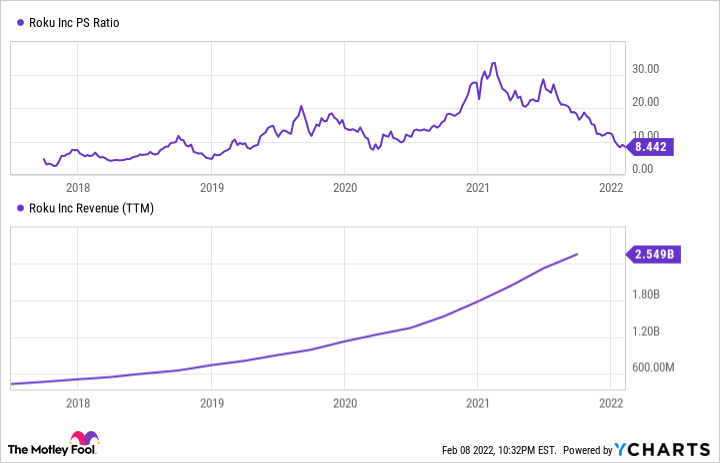

Down over 60% in the last six months, television streaming specialist Roku has been crushed by the recent growth stock sell-off. Despite shedding its image as a technology hardware company and posting annual revenue growth of 66% year over year, the market has reeled in the company's share price, leaving it to trade at a price-to-sales (P/S) ratio of only 8.4.

ROKU PS Ratio data by YCharts

As the chart shows, this is its lowest P/S ratio since 2020, when revenue was less than half of today's totals. Furthermore, Roku's platform sales have rapidly expanded to account for 86% of total sales as of Q3 2021, leaving player revenue to account for the remainder.

This shift toward platform sales is vital to investors since it owns a gross margin of 65% compared to the player segment's negative margin. These platform sales are made up of content distribution and advertising activities and represent the core of Roku's long-term growth story.

This segment can be measured using the average revenue per user (ARPU) metric, which saw 49% growth year over year to more than $40 during the company's most recent quarter. This increase was driven primarily by total monetized video ad impressions doubling year over year as traditional cable advertisers shifted to advertising on streaming services such as Roku.

Looking ahead to Roku's earnings report on Feb. 17, it will be pivotal to see this ARPU continue growing through a combination of continued advertising strength and the Roku Channel's steady rise in popularity. Since this ARPU stems from Roku's higher-margin platform segment, continued growth here should lead to higher profitability over the long term.

2. Kinsale Capital Group

Trading 20% below its 52-week highs, an investment in excess and surplus (E&S) insurance specialist Kinsale Capital Group seems to be a very intriguing proposition.

KNSL Net Income (TTM) data by YCharts

Offering a beautiful blend of profitability at a discounted price, Kinsale has seen skyrocketing net income growth and a shrinking price-to-earnings ratio, shown in the charts above.

Even better, Kinsale is the only publicly traded company to focus purely upon the E&S insurance market, helping it deliver a solid combined ratio of 84%. For insurance companies, the combined ratio adds incurred losses and expenses and divides it by premiums earned, meaning that any figure less than 100% shows the company to be profitable.

This bit of math makes Kinsale's mark of 84% masterful and goes a long way in explaining how the company generates a robust 24% profit margin.

Despite trading with a market capitalization, or company price tag, of $4.5 billion, Kinsale has quietly amassed a $1.6 billion investment portfolio that yields about 1.9% annually in income.

With earnings approaching on Feb. 18, analysts are expecting net income growth of 71% year over year for the quarter. Watching earnings per share will be of particular importance as the fair value change from its investment portfolio adds or subtracts to this income. Primarily consisting of fixed maturities, it will be essential to track the fair value change of this portfolio as the bond market remains in flux due to impending rate hikes.

3. Pool Corporation

Up roughly 1,200% over the last decade, flawlessly named Pool Corporation has seen its stock take a hiatus of late, dropping around 20% below its 52-week highs. Posting 28.4% annualized returns over the last 25 years, the swimming pool equipment distributor has quietly been one of the most successful investments of its time and has blown past the S&P 500's average return of 9.6%.

Leading the charge for the company is its glorious return on invested capital (ROIC) growth.

POOL Return on Invested Capital data by YCharts

ROIC is a way to measure the returns generated from a company's assets, with a figure above 10% considered promising. This standard makes Pool's mark of 53% simply stunning. Furthermore, this ROIC has been steadily growing over the last decade for the company, a trend that has historically led to outperformance across stocks in the market.

As we look ahead to Pool's earnings call on Feb. 17, this ROIC figure will be of utmost importance as it looks to continue capitalizing on the strong housing market here in the U.S.

Best yet for investors, only 18% of Pool's revenue comes from new pool construction, with the vast majority coming from recurring sources such as maintenance, repair, accessories, and refurbishment. Thanks to the sturdy nature of these ongoing sales, Pool's ROIC should continue to shine, making it an intriguing stock to keep on your watchlist in February.