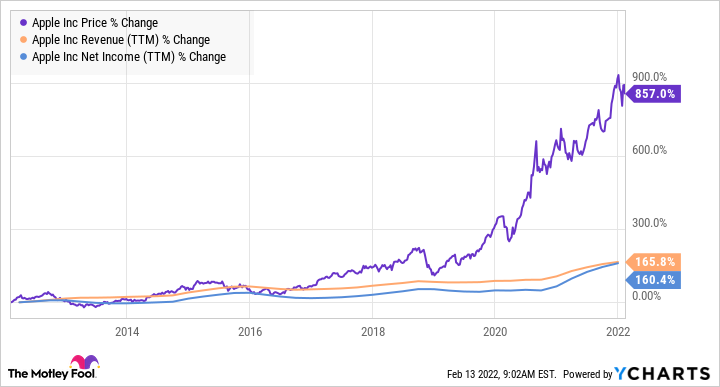

The last decade has been a terrific one for Apple (AAPL 0.51%) investors as the tech giant has witnessed a tremendous increase in revenue, earnings, and stock price thanks to the success of its various product lines and the growth of its services business.

The next decade, however, could be a better one for Apple, as it is reportedly working on new technologies that could help it tap into nascent but fast-growing industries that are expected to be worth hundreds of billions of dollars. Don't be surprised to see Apple clocking faster growth over the next 10 years than in the previous one.

AAPL data by YCharts

Let's look at the potential products and markets that could shape Apple's growth in the coming decade.

Self-driving cars could unlock a big opportunity for Apple

A Bloomberg report in November 2021 claimed that Apple is working on an autonomous electric car that may hit the market as early as 2025. That timeline may seem a tad ambitious given that Apple engineers were reportedly looking at a timeline of five to seven years in early 2021 to release a self-driving car, especially considering that the tech titan may be looking to release a fully autonomous vehicle.

The reports indicate that Apple may have already completed the bulk of the engineering work on the processor that would power such a car, apart from fine-tuning the software that would be running the vehicle. This would be an entirely new market for Apple, but Morgan Stanley analyst Katy Huberty estimates that the company's strong supply chain and its prior record of disrupting markets it enters into indicates that it has a chance to make a dent in this nascent space.

A new Apple Store in Berlin. Image source: Apple.

As it turns out, Huberty estimates that entry into the autonomous electric car market could help Apple double its revenue and market cap in the long run. With the global autonomous vehicle market expected to grow at an annual rate of 63% through 2030 as per a third-party estimate, Apple could strike gold over here if it manages to deliver a compelling product and disrupt the autonomous vehicle market.

So there is a possibility of Apple becoming more than a purveyor of iPhones, iPads, MacBooks, and wearable devices in the coming decade if it can successfully enter the auto industry.

The metaverse could be another catalyst

When asked about the metaverse on the company's January earnings conference call, Apple CEO Tim Cook said that "this area is very interesting to us." Cook added that Apple already has more than 14,000 applications in its App Store that provide augmented reality (AR) experiences to customers.

So it isn't surprising to see why there are several rumors of Apple working on a headset that's expected to support both AR and virtual reality (VR). Recent chatter indicates that Apple may already be working on an operating system that will power its headset, and the company may also create an app store for the same that's expected to put special focus on video gaming, videoconferencing, and video streaming.

So Apple could eventually dive into both the hardware and the software side of the metaverse. That would put it in a solid position to make the most of the multibillion-dollar metaverse opportunity. Third-party research estimates that the global VR headset market could grow at an annual pace of 28% through 2028, while the overall metaverse market is expected to clock nearly $830 billion in revenue by then.

Apple already has an installed base of more than 1.8 billion devices. This solid ecosystem could be a big boon if the company decides to enter the metaverse since it will already have a huge number of customers to whom it can cross-sell its headsets, which in turn can also drive the growth of its services business.

Smartphone dominance will be a long-term tailwind

The global smartphone market was reportedly worth $274 billion last year, and it is expected to clock an annual growth rate of 7.6% through 2030. At this pace, smartphone sales would generate close to $530 billion in revenue by the end of the decade.

Apple is in a nice position to take advantage of this secular growth. The company controlled 17.4% of the global smartphone market last year per IDC's estimates, up from 15.9% in 2020. Apple's market share growth last year was a result of the company's dominant position in the 5G smartphone market. That's good news for the company, as 5G smartphone adoption is expected to increase in the coming years.

Sales of 5G devices are expected to jump from $105 billion last year to nearly $664 billion in 2030. Apple controlled 28% of the 5G smartphone market in the first half of 2021. Rumors indicate that it may be making moves to strengthen its position in this space with the launch of a budget-friendly 5G device that could substantially increase its sales. As a result, Apple is setting itself up to make the most of the long-term opportunity in 5G smartphones.

The big picture

Apple could become more than just a seller of smartphones and tablets. Additionally, its services business could also spike big-time with the addition of metaverse-related devices such as a headset that could help it sell more applications.

As a result, it won't be surprising to see Apple's earnings grow at a faster annual pace than analysts' expectations of 15% for the next five years. If Apple clocks a 20% annual earnings growth rate for the next 10 years, its non-GAAP earnings could increase from $5.61 per share last year to almost $35 per share at the end of the forecast period.

The stock is now trading at 28 times earnings, and a similar multiple after 10 years would translate into a stock price of $980 based on the company's estimated earnings mentioned above. That means Apple stock could rise nearly 470% over the next decade from its closing price of $172 on Feb. 11, which is why it would be a good idea for investors to continue holding this tech stock, as it seems built for more upside.