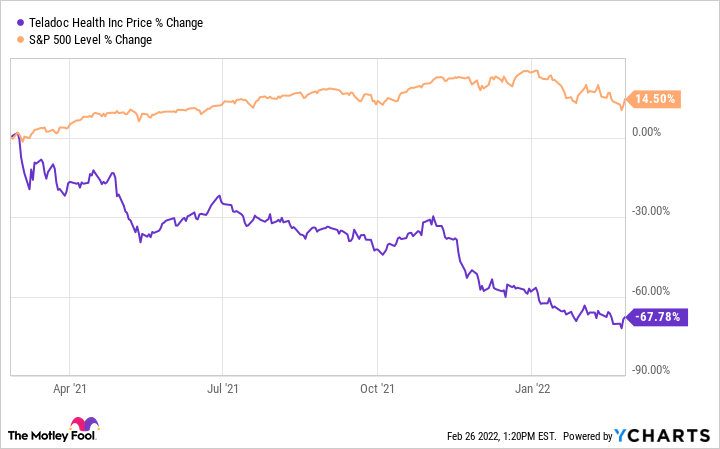

After rising significantly during the pandemic's peak, shares of telehealth specialist Teladoc (TDOC 0.08%) have been southbound for much of the past year. The company's value has been cut by nearly 68% in the past year. What's going on with this company?

Perhaps investors felt as though Teladoc's stock had risen too far too fast and a correction was in order. Whatever the rationale for Teladoc's recent struggles i-- n the stock market, there are excellent reasons to be bullish on the company's prospects.

Let's consider why this healthcare giant could be an excellent buy-and-hold stock.

1. A promising industry

Telehealth services became very popular during the pandemic. Government-imposed lockdowns -- coupled with the fact that many healthcare facilities were swamped with COVID-19 patients -- made it a bit more difficult for people to receive basic services, such as consultations, prescriptions, and referrals to specialists. Telemedicine helps patients access these services from the comfort of their homes.

But this isn't just some pandemic trend. Companies such as Teladoc existed before the outbreak started, and the telehealth industry likely has a bright future. That's because receiving some basic services from the comfort of one's home -- 24 hours a day, seven days a week -- beats having to drive several miles for these same services. A 2018 study found that telemedicine provides cost savings of $19 to $121 per patient visit. That's not a trivial amount.

According to some estimates, the industry will expand at a compound annual rate of 32.1% through 2028. Teladoc itself estimates it has a $261 billion total addressable market in the U.S. alone. As one of the leaders in the telemedicine market, Teladoc is expected to grab a decent share of that space in the coming years.

Image source: Getty Images.

2. Building a competitive edge

Teladoc is likely to face increasing competition from various companies in the healthcare industry. To remain one of the big players in the market, it will have to build a sustainable competitive edge. Thankfully, it looks as though Teladoc is doing exactly that. The company's platform arguably benefits from a network effect, meaning the value of its services increases as more people use it. Teladoc has an extensive network of more than 50,000 physicians with over 450 sub-specialties. This network is highly attractive to the company's potential clients.

The more consumers seek its services, the more likely Teladoc is to draw even more physicians onto its network. It will be difficult for newcomers to completely topple Teladoc from its pedestal. The company ended last year with 53.6 million paying members, representing 3% year over year growth. It conducted roughly 15.4 million visits during the year, which was 38% higher than a very busy 2020. With a growing membership and increased utilization, Teladoc's revenue will continue on its upward trajectory as well.

The company's top line for 2021 grew by 86% year over year to roughly $2 billion. The company does remain unprofitable. Its net loss per share for the year clocked in at $2.73, which was better than the net loss of $5.36 it reported in 2020. In my view, Teladoc's immense opportunities in the telemedicine market, coupled with its competitive edge, will help it grow its revenue and turn consistent profits eventually.

3. The price is right

After dropping substantially in the past year, Teladoc's shares are trading near their pre-pandemic levels, and that's despite the boost its business received during the outbreak. Since the telehealth giant isn't yet consistently profitable, it is best to look at its forward price-to-sales (P/S) ratio for clues as to whether it is reasonably valued. To get a more accurate picture, let's compare it to that of American Well, one of Teladoc's biggest competitors.

TDOC PS Ratio (Forward) data by YCharts

While Teladoc's forward P/S is a bit higher, it isn't unreasonably so. Further, Teladoc is recording substantially higher revenue, top-line growth rates, and total visits than American Well is. In other words, Teladoc's shares are arguably worth a slight premium (at the very least) compared to those of its competitor. At current levels, Teladoc's stock looks like a screaming buy. And given that the telemedicine industry is here to stay, patient investors who hold on to the company's shares should be handsomely rewarded down the road.