What happened

StoneCo (STNE -1.74%) stock sank by 27.9% in February, according to data from S&P Global Market Intelligence. The Brazilian fintech's valuation declined further as investors sold out of riskier types of stocks, and may also have been impacted by analyst coverage.

Evercore ISI analyst Sheriq Sumar published a note on StoneCo on Feb. 18, giving the stock an "in line" rating (the equivalent to a hold rating) and lowering his one-year price target on it from $40 per share to $19 per share. While that downward revision was substantial, the new price target still suggested roughly 71% upside at the time of the note's publication.

Image source: Getty Images.

So what

The price of StoneCo stock has swung wildly since the company's initial public offering in October 2018.

While the Brazilian fintech player has continued to add new merchant customers and boost total payment volume conducted through its platforms at encouraging rates, its stock has been pummeled over the last year of trading. A challenging economic backdrop in Brazil, losses incurred by the company's credit business, and its pause on lending to small and medium-sized businesses due to new regulatory standards have engendered a degree of investor pessimism, and the stock continued to slide last month as "risk-off" sentiment gripped the market.

Now what

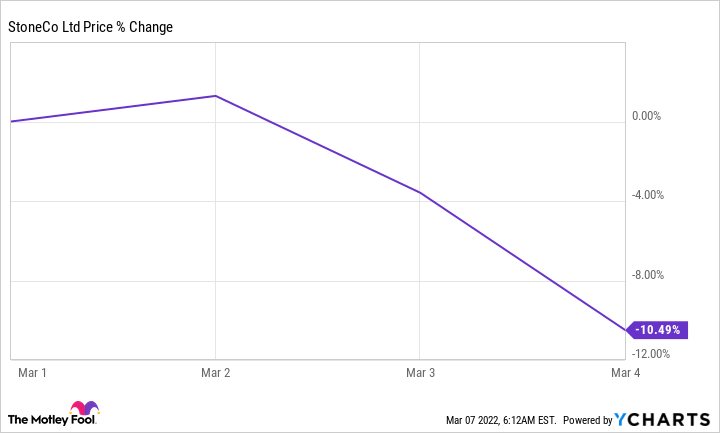

Thus far in March, StoneCo -- like many other growth stocks -- has lost more ground. Its share price was down roughly 10.5% in the month as of this writing.

StoneCo is scheduled to publish its fourth-quarter report after the market closes on March 10. The company does not typically provide performance guidance, but its results will be under the microscope as investors look to see how the business is faring amid macroeconomic challenges and the headwinds facing its credit business.

StoneCo now has a market capitalization of roughly $3 billion and is valued at approximately 22 times this year's expected earnings and 2 times expected sales. For risk-tolerant investors, I think that recent sell-offs have created a worthwhile buying opportunity, but investors should proceed with the understanding that the stock could continue to see more turbulent trading in the near term.