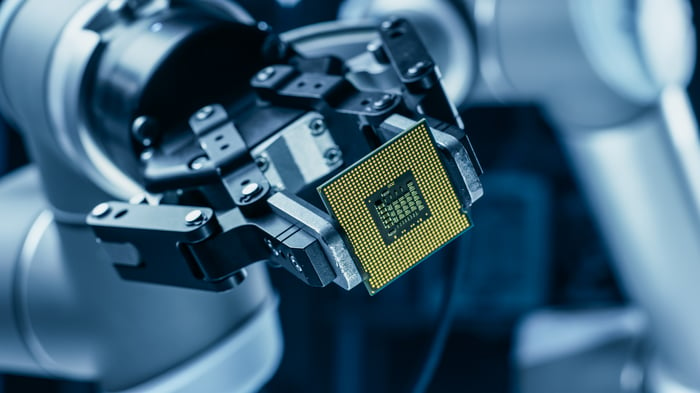

It's hard to overstate the importance of the semiconductor sector right now. It produces the advanced computer chips that are critical to powering the most popular consumer products, from smartphones to cars.

Global manufacturers across many industries are grappling with persistent shortages of these components, as the pandemic triggered production shutdowns across Europe and Asia. But shortages are also a symptom of a more powerful driving force -- soaring demand as our lives shift further into the digital realm, and our appetite for intelligent technology grows.

Global semiconductor sales are expected to top $600 billion in 2022 and could be worth $1 trillion per year by the end of this decade. These five stocks can help you take advantage of that powerful trend.

Image source: Getty Images.

1. Cohu

Cohu (COHU 2.91%) is a minnow of the semiconductor industry with a valuation of just $1.3 billion. But that's not a true reflection of its importance, because while it doesn't produce any chips itself, it provides testing and handling equipment critical to the manufacturing process.

The company's equipment is used to inspect and handle chips used in consumer products, industrial applications, mobility (think 5G networking), and even the automotive industry. Its defect-detection capabilities are important in ensuring the final product fits within quality standards before it reaches the end-user.

The new car industry has been one of the hardest hit by semiconductor shortages during the pandemic. Cohu has shifted its focus to that segment, which has become its largest, representing 17% of the company's total revenue. As new vehicles are fitted with a plethora of sensors and digital features, chipmakers are increasingly demanding Cohu's Neon inspection system, which is designed for handling semiconductors used in such applications.

Cohu had its biggest ever year in 2021, generating $887 million in revenue and $3.45 in earnings per share. Its stock, therefore, trades at a price to earnings multiple of just 8.1, which is a 68% discount to the iShares Semiconductor ETF. That means Cohu stock would need to more than triple to trade in line with its peers in the industry.

2. Advanced Micro Devices

When it comes to state-of-the-art hardware, Advanced Micro Devices (AMD 2.45%) has become a household name. It produces some of the most sought-after semiconductors in the industry, with a lengthy portfolio of A-list customers.

AMD's chips can be found in top-selling gaming consoles like Sony's PlayStation, Microsoft's Xbox, and even Tesla's Model S and Model X electric vehicles. But that's not all -- the company also produces graphics cards for virtual reality purposes, designed to work with Meta Platforms' Oculus line of headsets, making it a potential player in the future of the metaverse.

AMD is firing on all cylinders from a financial perspective, delivering its highest full-year revenue result ever in 2021 of $16.4 billion, representing 68% growth over 2020. It also expanded its gross profit margin from 45% to 48%, helping the company more than double its non-GAAP earnings per share to $2.79.

AMD faces some incredible opportunities in the coming years across virtual reality, data centers, and gaming, making it the ultimate semiconductor stock offering broad exposure to the industry.

Image source: Getty Images.

3. Axcelis Technologies

The next semiconductor growth stock investors should buy now and hold is Axcelis Technologies (ACLS 0.34%). In a similar fashion to Cohu, Axcelis provides crucial equipment to semiconductor producers. Its ion implanters are essential to the fabrication process for chipmakers, and investors are taking notice of the company's value to the industry.

Since hitting its pandemic-low price in March 2020, Axcelis stock has soared by over 350%, making it one of the best performers in the entire sector. It has backed this up with a solid operational performance, nearly doubling its earnings per share to $2.88 in 2021, thanks to soaring demand for equipment in its Purion Power Series line.

That line of ion implantation equipment is used to fabricate chips for a wide range of segments including automotive, mobile, and even artificial intelligence. The company has released a series of announcements since September 2021 informing investors of large shipments of its Purion Power Series products to semiconductor producers across the globe.

Axcelis is so confident in its position that it just announced a share buyback program, with the goal to return $100 million to shareholders -- adding yet another reason to buy its stock.

4. Micron Technology

Micron Technology (MU 3.01%) is a top producer of memory and storage chips, and while this portion of the market might seem less glamorous, it's equally important (and profitable). Micron's products are most often used in personal computing and data center applications, but it's making rapid progress in high-growth segments like mobile and electric vehicles, especially those with autonomous (self-driving) features.

Smartphones with the capability to run on the 5G network require up to 50% more memory than their 4G-enabled counterparts -- plus double the storage capacity -- and Micron produces the fastest mobile DRAM product available today. That offers the company a sizable opportunity for organic growth merely through the global transition to 5G.

But traditional end markets like the data center, personal computing, and graphics still generate the bulk of Micron's revenue, which topped $27.7 billion in fiscal 2021. Analysts think that will grow to over $32 billion in 2022, alongside $9.04 in earnings per share, with one Wall Street firm, in particular, betting Micron stock could more than double from its current price.

Image source: Getty Images.

5. Nvidia

The final semiconductor growth stock investors should buy and hold is Nvidia (NVDA 3.72%), which is one of the hottest names in the sector. It produces arguably the best graphics-related chips in the world, popular among gamers and super-computer operators alike. But its fastest-growing segment actually relates to the metaverse, placing a fine point on the company's constant innovation.

Nvidia's Omniverse project is a virtual-world simulation platform, with real-time collaboration capabilities for creators who use the company's RTX graphics cards. Developers can build virtual environments, whether they're for games or metaverse applications, and it's driving strong growth for the company. Omniverse falls under Nvidia's professional visualization segment, which grew revenue by 100% in 2021 -- the fastest of all the company's businesses.

But traditional gaming still generates most of Nvidia's top line. Aside from the hardware aspect, its cloud-based GeForce Now platform is used by over 14 million gamers to access their favorite titles, eliminating the need for patches or updates.

Nvidia might have the most exciting future of all semiconductor companies as it continues expanding beyond simply producing chips. And with over $34 billion in estimated revenue in the current fiscal 2023 year, it's a financial powerhouse worthy of your portfolio.