Are you looking for a safe investment that you can just buy and forget? One stock that will definitely tick off many check marks for you is Bristol-Myers Squibb (BMY 0.16%). The healthcare giant is worth close to $160 billion, has a proven track record, pays a high dividend, and continues to find ways to grow.

But rather than simply telling you all the reasons why it's an easy investment to justify holding in your portfolio, I can also show you through the following five charts:

Image source: Getty Images.

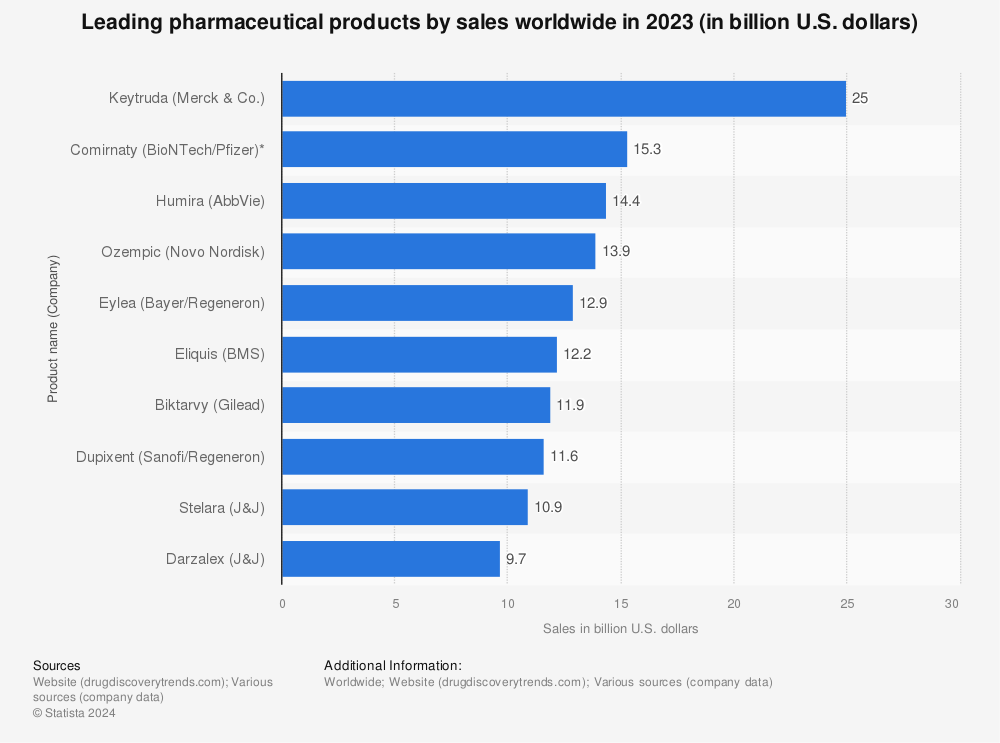

Bristol-Myers has multiple drugs that are top 10 in sales

No drug or vaccine came close to the revenue Pfizer's COVID-19 vaccine generated last year -- and that isn't likely to change this year, either, especially with a fourth dose possibly on the way. But Bristol-Myers was more diverse, and had three of the top-selling pharmaceutical products in 2021:

Revlimid, Eliquis, and Opdivo each brought in more than $7 billion in sales last year. But as well as those three drugs did in 2021, they still only accounted for two-thirds of the company's sales, demonstrating just how diverse its operations are. Healthcare companies would covet even one of those money-making machines, and Bristol-Myers has three of them.

That diversification makes the business a stable one; through 2025, the company projects that its revenue will grow annually in the low-to-mid-single digits. While it isn't an astronomical growth rate, it's a steady one. And combined with strong margins, it should ensure that the business continues to expand its bottom line.

Its gross profit margin is normally well above 70%

To make the most of its revenue, a company needs to be operating efficiently and maximizing its margins. And with gross margins normally above 70%, this is another area of strength for Bristol-Myers:

BMY Gross Profit Margin (Quarterly) data by YCharts

A strong gross margin can help improve profitability and also lead to strong free cash flow, which is demonstrated in the next chart.

Free cash flow has grown significantly in recent years

Bristol-Myers has grown its business over the years through acquisitions. What's impressive is that even amid all those changes, it has been generating plenty of free cash flow along the way. Not only does that show investors that the company knows how to efficiently incorporate new businesses into its operations, but it could mean more cash for further investments in the future.

BMY Free Cash Flow (Annual) data by YCharts

Between 2022 and 2024, Bristol-Myers expects its free cash flow to total as much as $50 billion, as it expects even more money to flow through its business in the near future. And with all that cash, even if it pursues acquisitions, the company may have plenty of room to continue raising its dividend.

The dividend has increased 59% over the past decade

Bristol-Myers currently pays a quarterly dividend of $0.54 vs. $0.34 back in 2012. The company has been steadily raising its payouts, and today the stock yields 3% -- far above the S&P 500 average of 1.3%. With the free cash flow continuing to come in, the company should have room to make more dividend hikes.

BMY Dividend data by YCharts

With growth and dividends, investors can get the best of both worlds with a relatively safe stock in Bristol-Myers. And its relatively low valuation only sweetens the deal today.

Low forward P/E suggests Bristol-Myers is a cheap buy

A forward price-to-earnings multiple can help investors gauge a stock's premium when taking into account what analysts are expecting from its business in the year ahead. And at a multiple of a little over nine, Bristol-Myers looks like a cheap investment compared to other healthcare stocks.

BMY PE Ratio (Forward) data by YCharts

The ultimate buy-and-forget stock?

Year to date, Bristol-Myers stock has risen 17%, outperforming the S&P 500 and its 4% declines thus far. And that's without factoring in its above-average dividend yield. Bristol-Myers' robust and diverse business makes this a top stock to buy right now. It has a little something for all investors -- modest growth, a high dividend, and a good valuation.

There is no shortage of reasons to invest in Bristol-Myers -- and amid all the turmoil in the markets right now, its could be one of the safest long-term stocks to add to your portfolio today.