Over the past decade, there's been a lot of innovation in business software; many aspects of how companies operate have steadily migrated to cloud-based software solutions. Bookkeeping automation software Bill.com Holdings (BILL -2.26%) is one of the latest examples, a booming stock that's up more than 500% since going public in late 2019.

Investors tend to have a natural question with most multi-baggers: Is there room for more upside, or has the train already left the station? Today I'll help answer that question, showing you what pain points Bill.com solves for businesses and whether the stock can still be a long-term winner.

Image source: Getty Images.

What does Bill.com do?

Bookkeeping is an age-old duty of any business. It's traditionally been very cumbersome, relying on mountains of paperwork and manual data entry as workers track records across many systems.

Bill.com is a cloud-based software solution that automates various aspects of bookkeeping. It can automatically pay and receive invoices and sync with other accounting and record-keeping software to keep the information accurate and current.

In other words, it streamlines the back-end operations of businesses, eliminating much of the risk of human error. Bill.com's core business serves 135,000 small and medium businesses; it also has 15,500 customers that use Divvy, a company it recently acquired for $2.5 billion, and another 223,000 from acquiring Invoice2go for $625 million.

Growing like wildfire

Bill.com was growing at a solid clip before the pandemic, but growth has dramatically accelerated in recent quarters. Investors should note that much of this added growth is due to the addition of Divvy and Invoice2go; however, organic revenue did increase 85% year over year in the company's most recently reported quarter (ending Dec. 31). Analyst estimates expect revenue growth to slow back down to around 30% to 40% per year once the acquisitions are included in the prior year's comparable growth numbers.

BILL Revenue (Quarterly YoY Growth) data by YCharts

The company isn't profitable or able to produce free cash flow yet. However, Bill.com has significantly increased its sales and marketing expenses following its acquisitions, likely to cross-sell to its existing and acquired customers. Sales and marketing totaled nearly $81 million in the company's quarter ending Dec. 31, compared to just $14 million the previous year.

Bill.com has excellent gross profit margins at 78% in its last quarter, up from 74.1% a year ago. As revenue grows, it should begin to outpace sales and marketing expenses. Investors will want to look for the business to turn free-cash-flow positive, a significant sign that profitability is around the corner.

But commanding a blazing valuation

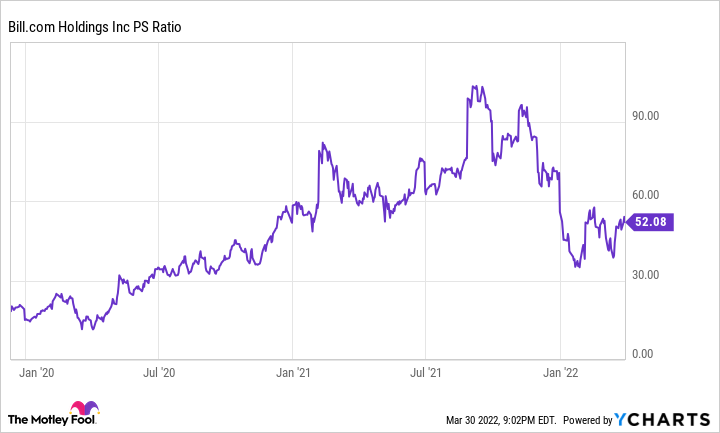

Bill.com has been one of the most expensive stocks on Wall Street; its price-to-sales ratio surpassed 100 at its peak and still sits above 50, despite share prices pulling back more than 30% from their highs.

The stock is still more expensive than its lows during the March 2020 "COVID-19 Crash," but the business is fundamentally different following its acquisitions. I don't think investors can call Bill.com "inexpensive," but a long-term investor should see the company catch up to its valuation if the business can keep executing.

BILL PS Ratio data by YCharts

That's the problem with stocks trading at a premium -- if investors feel that a stock no longer deserves such a valuation, it can drop sharply and quickly. That's the risk any investor faces buying shares at these levels.

Bill.com seems like a promising software company with room to grow over the long term. However, investors may benefit from being patient in buying shares. If one believes in the company's vision, financials, and growth potential, a dollar-cost average strategy would enable someone to build a position, absorbing any potential volatility slowly.