What happened

Shares of Carvana (CVNA 0.11%) were going in reverse last month. A broader sell-off in growth stocks weighed on the leading online auto retailer, as did a disappointing earnings report from rival Vroom (VRM -2.90%).

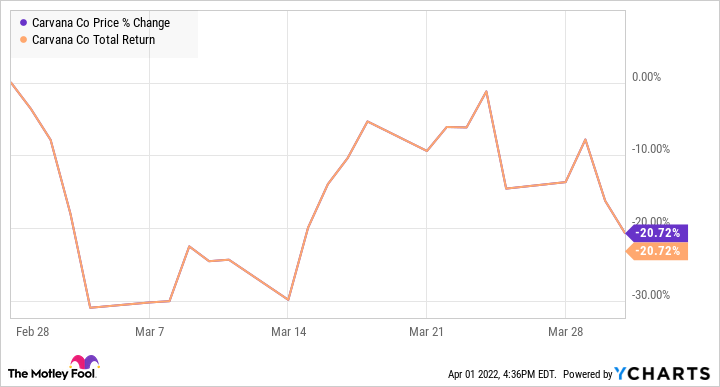

According to data from S&P Global Market Intelligence, the stock finished March down 21%. As you can see from the chart below, it was a volatile month for Carvana, and the stock never fully recovered from a sell-off early in March.

CVNA data by YCharts.

So what

Carvana closed out February on a strong note after it announced the $2.2 billion acquisition of KAR Auction Services' (KAR 0.12%) Adesa U.S. physical car-auction business, and reported better-than-expected revenue in its fourth quarter.

A Carvana car vending machine. Image source: Carvana.

However, negative market sentiment heading into March over rising oil prices, record inflation, Russia's invasion of Ukraine, and rising interest rates combined to sink the stock in the first few days of March.

Vroom stock plunged by 47% on March 1 as Carvana's closest rival reported that its gross profit per car sold fell sharply in the quarter, a sign the company is struggling with tight inventory and elevated used-car prices.

Carvana stock fell 3% that day, and continued to slide over the rest of the week on a broader sell-off in growth stocks even as Morgan Stanley's Adam Jonas issued a positive note on the stock, calling it a "best-in-class auto retailer."

Rising interest rates, inflation, and pressure on the global supply chain all spell trouble for Carvana, and pressure is starting to mount on the U.S. consumer. Most car purchases are financed, and rising interest rates along with record high used-car prices will make it difficult for Americans to buy a vehicle. Record gas prices also add to the challenges for car buyers.

The company opened a new vending machine in California in the second week of the month, but there was little company-specific news about Carvana over the rest of the month, and the stock seemed to move with broader market trends.

Now what

Carvana has wowed the market with its growth rate over the course of its history, but doubts have remained about its ability to turn a profit. In 2021, revenue jumped 129% to $12.8 billion, and the company was marginally profitable on an adjusted EBITDA basis.

Carvana is now trading at a price-to-sales ratio of less than 2, well below its historical level, and the Adesa acquisition should give the company a substantial boost. Despite macroeconomic concerns, the upside potential seems to outweigh the downside here.