One year ago, nearly to the day, SpaceX added another feather to its cap.

In a competition with some of the biggest defense contracting heavyweights in the United States -- Lockheed Martin (LMT 0.27%) and Northrop Grumman (NOC -0.21%), along with their partner Blue Origin, and Leidos (LDOS -0.19%), the new owner of space powerhouse Dynetics -- SpaceX walked away the winner. For $2.9 billion, SpaceX will build a Human Landing System (HLS) to return NASA astronauts to the moon.

The losers in this competition were not pleased.

Both Leidos and Blue Origin complained vociferously to the Government Accountability Office. (Blue Origin even took its complaint to court). In the end, though, even after several months of legal wrangling, SpaceX remained victorious -- but now, the losers in the original HLS contest will get a second bite at the apple. As NASA announced last month, it's preparing to open up a second round of competition to build lunar landers.

And this time, SpaceX won't be allowed to bid.

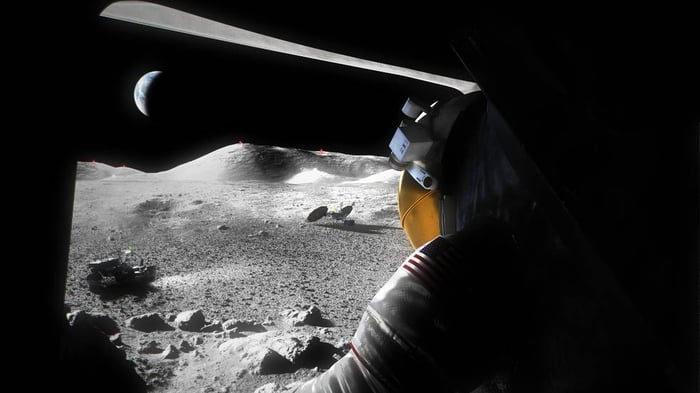

Image source: NASA.

Moon Wars II: Revenge of the Runner-Ups

NASA will pursue "two parallel paths for continuing lunar lander development and demonstration," says the space agency.

SpaceX plans to land an HLS on the moon twice as part of NASA's Artemis III mission no earlier than April 2025, first without astronauts on board, and then with.

With that accomplished, NASA will exercise its option to have SpaceX build a second lunar lander for a second demonstration mission post-2025.

Separately, NASA will hold a Sustaining Lunar Development (SLD) competition "open to all other U.S. companies" (i.e., not open to SpaceX) "to provide a new landing demonstration mission from lunar orbit to the surface of the Moon."

NASA has two goals with the SLD. First, to ensure redundancy in services so that if a problem arises with one lunar lander, it will have a backup system available. Second, to certify two separate companies with two separate lander variants -- and then make these companies bid against each other to win future NASA work. In theory, this should result in lower prices for NASA and the U.S. taxpayer.

We know that one of these two companies will be SpaceX, but who will be SpaceX's competition?

Picking SpaceX's competition

NASA will issue a draft solicitation in the coming weeks, then hold an "industry day" to give would-be bidders more information on what it seeks in an alternative lunar lander. Odds are that Blue Origin and Leidos will be bidding again on the SLD. Investors can anticipate that Boeing (BA 1.63%) will also take a look, as will Northrop Grumman and Lockheed Martin (either on their own, or in cooperation with Blue Origin).

The exact list of bidders won't be known until after the agency issues a formal Request for Proposals this summer. Whoever does bid and win, though, will need to meet a very aggressive schedule. NASA hopes to put its second lander on the moon "as early as the 2026 or 2027 timeframe," says NASA.

Billions of dollars at stake

Time is one element of this competition. The other is money.

For its part, NASA should be able to fund a second lander variant -- at the right price. In total, the Artemis moon project will consume $7.5 billion, or 29%, of NASA's $26 billion requested budget for fiscal 2023 toward the cost of landers, rockets, and other space assets. NASA has earmarked $1.5 billion of this specifically for lunar landers, up from $1.2 billion in fiscal 2022. Between the two years, that's nearly enough cash to cover the $2.9 billion cost of SpaceX's first HLS.

Assuming this level of funding can be maintained through 2025 and beyond, it should suffice to pay for both a second SpaceX lander and an alternative lander variant from a second company -- assuming it doesn't cost much more than SpaceX's HLS did.

What does this mean for investors? SpaceX has won a lander contract, but it's a private company. However, there may now be a chance to invest in a space company that both wins a moon contract and is a publicly traded stock. At this point in the competition, it's impossible to say which of Boeing, Lockheed, Northrop, or Leidos offers the best chance of success -- but at least we know those four are the companies to watch.

Which of these four space stocks has the most to gain from a winning SLD bid? Leidos is the smallest in terms of both market capitalization ($15 billion) and revenues ($14 billion), as well as the cheapest in terms of both price-to-earnings (15x forward earnings) and price-to-sales ratio (1.1).

If one were to bet on a winner at this early stage, I'd say Leidos has the most to gain should it end up next to SpaceX on the moon.