Microsoft (MSFT 0.51%) is a behemoth with a market cap of $2.3 trillion. Behind this huge success are several business segments that would be giants in their own right if they were stand-alone companies.

With so many large divisions, it can be challenging for investors to grasp what's happening. So let's take a deep dive into one such segment for Microsoft: gaming.

Image source: Getty Images.

How does Microsoft's gaming division measure up?

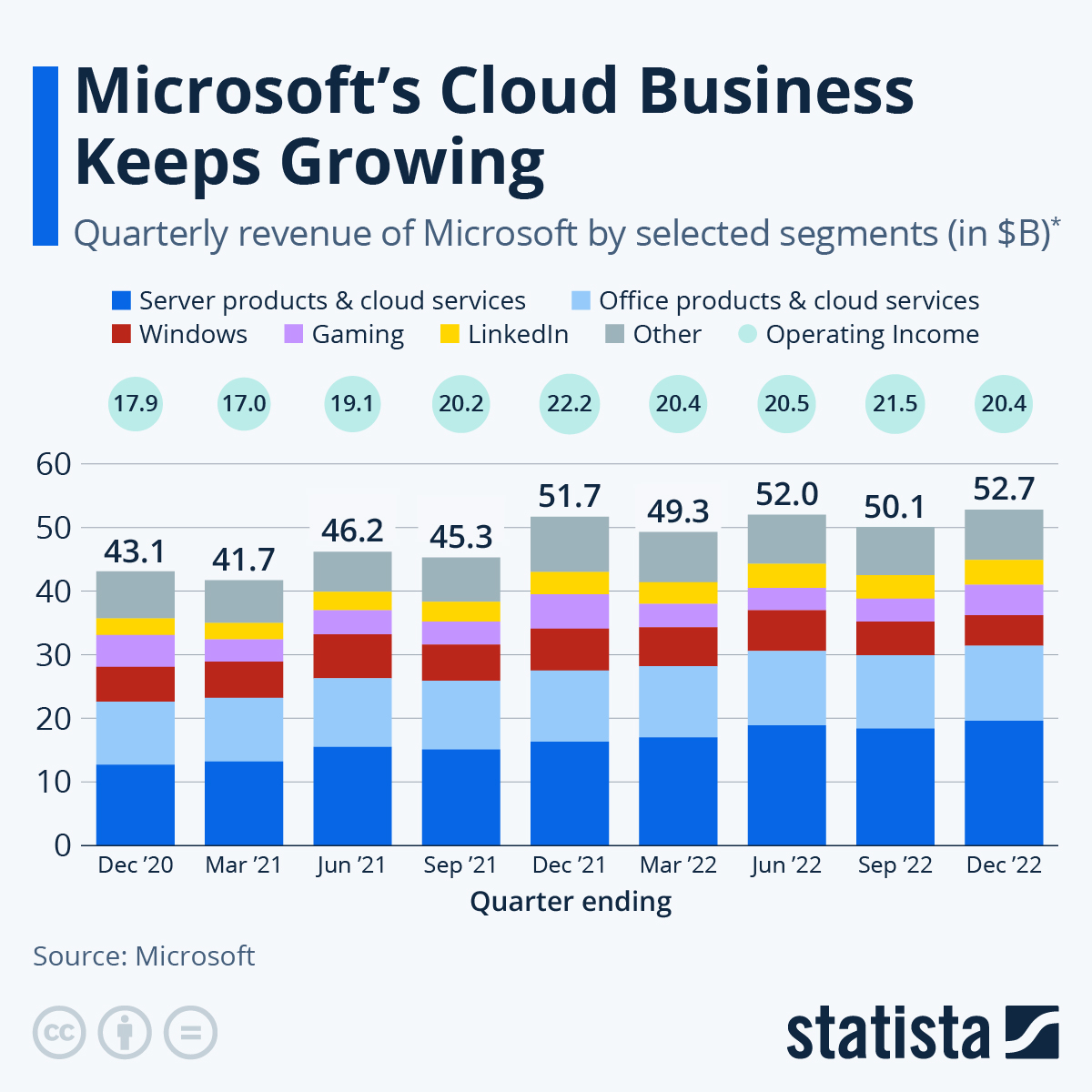

Microsoft's gaming segment delivered $5.4 billion of revenue in its most recent quarter (the period ending Dec. 31, 2021). That represented slightly more than 10% of the company's overall revenue of $51.7 billion. Considering it's only 10% of revenue, you might be tempted to view the segment as an afterthought, but that would be a mistake.

It's important to note that while gaming is only 10% of Microsoft's revenue, it's still a juggernaut in the gaming industry. Consider that Electronic Arts, a significant player in the gaming industry in its own right, generated $6.5 billion of revenue in all of 2021.

Microsoft's gaming division is poised to grow even larger

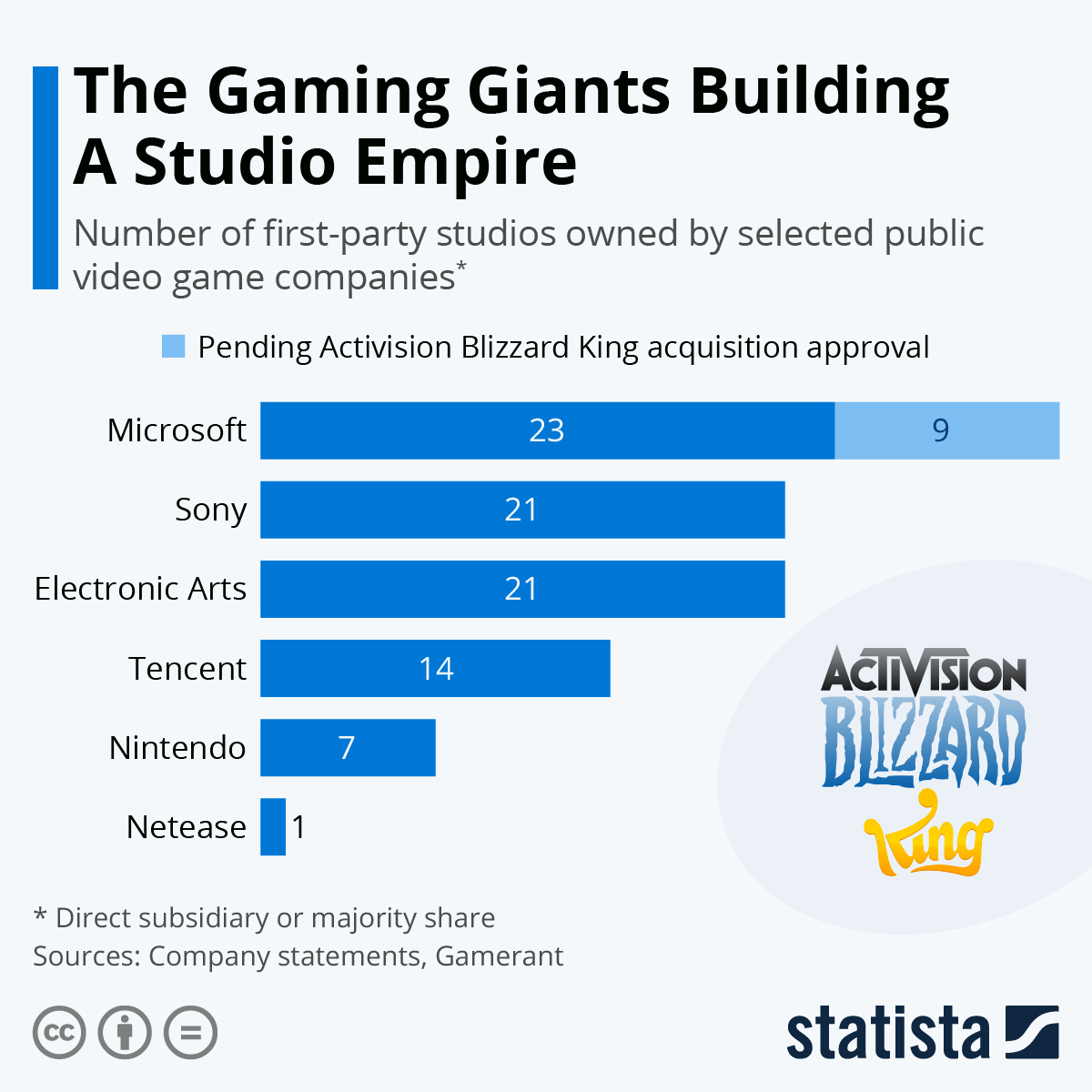

Despite its size, Microsoft's gaming segment continues to grow by leaps and bounds. Case in point: its pending acquisition of Activision Blizzard (ATVI).

On Jan. 18, Microsoft announced the nearly $70 billion deal. Microsoft will add another nine game-development studios to its impressive stable -- assuming the deal receives regulatory approval. Activision Blizzard franchises such as Call of Duty, Overwatch, and World of Warcraft will join Microsoft's existing titles such as The Elder Scrolls, Minecraft, and Halo.

Microsoft's buyout of Activision Blizzard will help bolster its Xbox/PC Game Pass -- video game subscription services that offer users a rotating inventory of titles to play in exchange for a monthly fee. Over the long term, Microsoft may leverage its ownership of popular franchises by releasing new titles first on its Xbox platform -- or it may choose to make particular games wholly exclusive to Xbox.

What it means for the future

Microsoft's size means that its investors have to keep an eye on multiple segments if they want to remain well-informed about its fundamentals. While segments like Server and Office (along with their cloud services) generate more revenue, Gaming is still an essential part of Microsoft's strategy.

CFRA projects that Microsoft's three-year revenue compound annual growth rate should jump to 20% following the completion of Activision Blizzard (CFRA estimates it at 17% if excluding the acquisition). Moreover, the research firm notes that Microsoft's gaming segment should grow revenues at 25% or more through 2023.

There are plenty of reasons to own Microsoft, and its gaming division is certainly one of them. It's a segment that is poised to drive growth for the company for years to come.