When the topic of dividends comes up, people don't often think of tech stocks. But that could be a mistake. Not only do some tech stocks pay a dividend, but some also grow the payout in addition to buying back shares. Those that can do it while executing a great strategy can produce fantastic returns for shareholders.

Apple (AAPL 0.19%), Microsoft (MSFT -4.49%) and Accenture (ACN -2.25%) check all of those boxes. And the stocks have returned 352%, 210% and 144%, respectively, since the start of 2019. It's still not too late to buy shares. Here's why.

Image source: Getty Images.

1. Apple

Apple products are everywhere. The iOS mobile operating system for its iPhones has 58% market share in the U.S. and 28% worldwide. Sales have reached $378 billion over the past 12 months. The company's high-margin service offerings continue to make up a larger portion of that revenue. Even its streaming service -- a small player in the industry -- just won an Academy Award for best picture in last week's Oscars. It's an amazing company. But there's another reason to be excited.

As its products have become more widely adopted for personal use, those customers want the same experience at work. And company's are giving in. A 2020 survey of 1,000 IT professionals by Parallels found that 55% of companies supported Apple's devices and 30% allowed its employees to choose between a Mac and a Microsoft Windows device. It shows up in the global market share data. And it can become a source of stable revenue potentially insulate the stock a bit from a downturn in consumer spending.

Image source: Statista.

Apple also pays a $0.22-per-quarter dividend. The 0.5% yield might not be much. But the company will pay out nearly twice as much per share as it did in 2014. It has also bought back nearly one-third of the outstanding shares over that time. All things considered, it's a company with clear tailwinds no matter how the stock price moves in the short term.

2. Microsoft

Apple might be making headway in the office. But Microsoft isn't sitting on its hands. And it has a growth avenue of its own to pursue. The company once known almost exclusively for productivity software has morphed into a diverse technology conglomerate. Its $185 billion in trailing-12-month revenue is roughly evenly split between its three business segments.

The productivity and business processes segment is a basket of enterprise-focused products and services including the office suite of applications, LinkedIn and cloud-based enterprise resource planning (ERP) and customer relationship management (CRM) tools. The intelligent cloud unit consists of server and cloud services that power the back end of a business. But more personal computing -- the third segment -- is where management has been making noise.

It includes the ubiquitous windows software. But it is also home to devices and gaming. That's where Microsoft's Xbox console and its Game Pass subscription business have many investors excited lately.

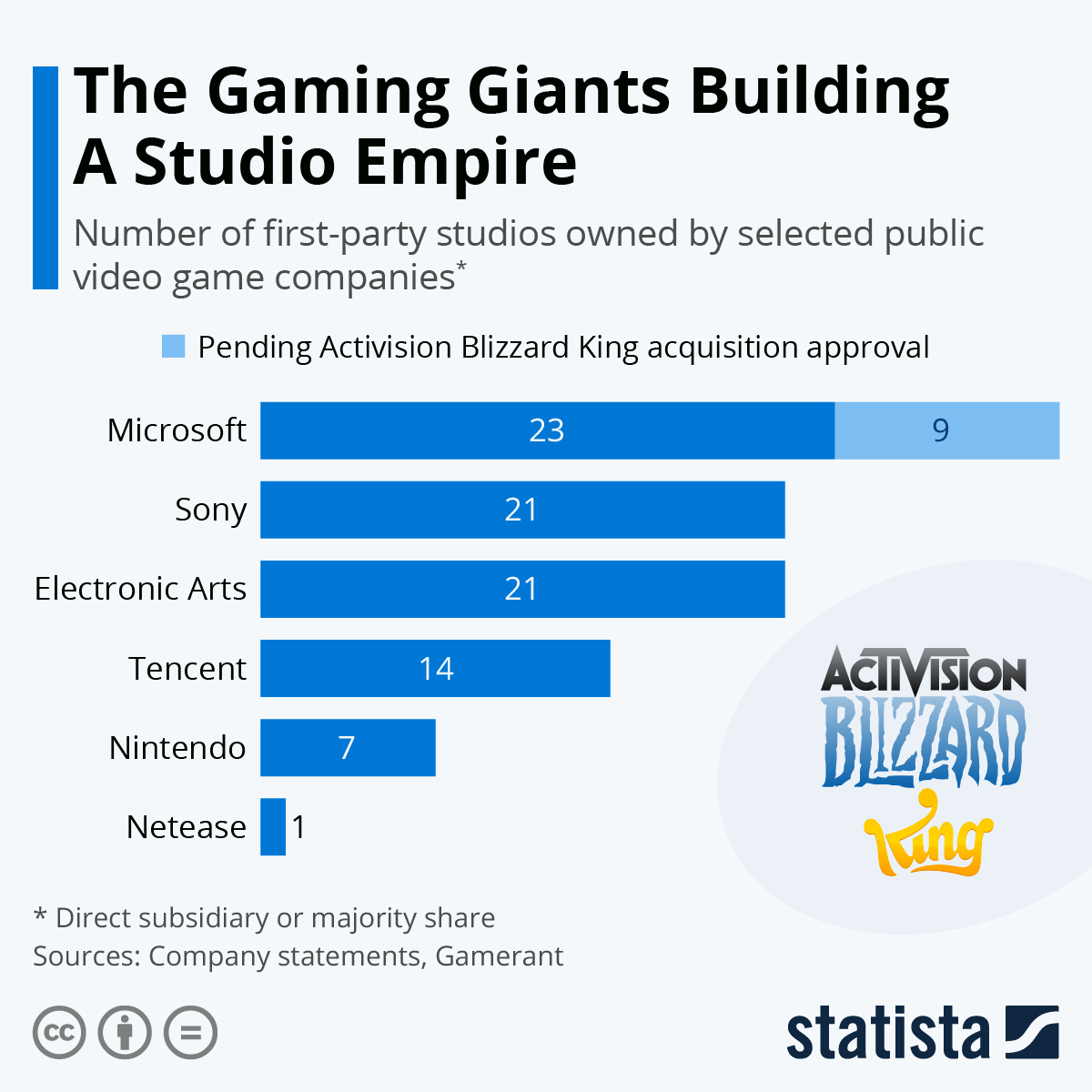

In a proposed $69 billion deal, the company is buying video game developer Activision Blizzard. Unless regulators block it, the deal will add popular games like Call of Duty to its Xbox Game Pass subscription service. It will also make Microsoft the third largest video game company by revenue and the largest measured by the size of its studio portfolio.

Image source: Statista.

To top it off, Microsoft pays a $0.62-per-share dividend. As with Apple, the 0.8% yield isn't much. But it has more than doubled since 2014 while retiring 10% of the shares. Having several steady streams of revenue and a respectable yield make this dividend payer one to buy and hold for the long term.

3. Accenture

Accenture may not be a household name like Apple and Microsoft, but the largest businesses in the world rely on it to help with their digital transformation and outsourcing needs. Of the Fortune 100 companies, it counts 92 as customers. Three-quarters of the Fortune Global 500 are customers. And of the firm's top 100 clients, 98 have been with them for more than a decade.

The success at building long-lasting relationships with its clients has produced financial stability. Accenture has doubled its dividend since 2014 -- the yield stands at 1.14% -- and more than doubled free cash flow over the same span.

In mid-2019, Accenture named its head of North America, Julie Sweet, as the new CEO. She deftly led the company through the pandemic and oversaw revenue growth in all industry groups and all geographic markets in 2021. sales over the past 12 months is 31% higher than the pre-pandemic fiscal year ending August 2019.

The accomplishments haven't gone unnoticed. The stock is up 74% since Sweet took over, easily outpacing the S&P 500, and last fall she was tapped to chair the board of directors. It is truly her company now. And if the past few years are any indication, shareholders are in great hands.

{%sfr}