After reaching an all-time high of over $350 per share on Dec. 30, share prices of Sherwin Williams (SHW 0.45%) are down 30% -- marking a dramatic sell-off in what has historically been a market-beating stock.

Sherwin-Williams stock is now hovering above a 52-week low, despite putting up excellent results during the height of the pandemic in 2020, following that performance with an excellent year in 2021, and guiding for a strong 2022. Here's why investors should consider Sherwin-Williams stock now.

Image source: Getty Images.

How long can the booming housing market last?

Sherwin-Williams, like Home Depot and other companies that benefited from a red-hot housing market, could face slowing growth as mortgage interest rates rise to their highest levels since 2018. In 2020 and 2021, low mortgage interest rates helped buyers afford record-high home prices. The issue now is that housing prices and mortgage interest rates are high, which is a sign we could see housing demand fall.

The chart below shows the Case-Shiller national home price index and the 30-year average mortgage interest rate over the last 20 years.

Case-Shiller Home Price Index: National data by YCharts.

The Case-Shiller index tracks U.S. residential real estate prices. It's basically like the S&P 500 for housing. As you can see in the chart, the index dramatically fell in response to the 2008 financial crisis. But that crash looks like a blip on the chart now. In the last two years, the index has been up a staggering 31%, while 30-year mortgage interest rates are up 33% to an average rate of 4.4%. Put another way, the period of low interest rates is over, and housing prices are now more than double what they were in 2011.

This is bad news for Sherwin-Williams, which benefits when people buy more of its paint to renovate existing buildings or to paint new ones. The company also has a large industrial paint and coatings segment, which may be impacted if economic growth slows.

Strong guidance

Despite these headwinds, Sherwin-Williams is guiding high single-digit to low double-digit year-over-year revenue growth in 2022. It forecasts adjusted diluted earnings per share of $9.25 to $9.65, representing a forward price-to-earnings ratio of 26.5 at the midpoint. Sherwin-Williams isn't a cheap stock, but the industrial company has a history of growing revenue and earnings at an impressive clip while consistently sporting a very high operating margin relative to its peers.

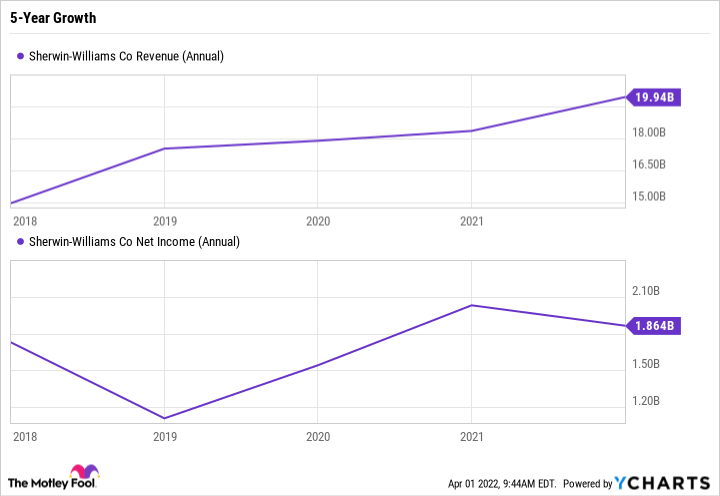

SHW Revenue (Annual) data by YCharts.

Over the past five years, Sherwin-Williams has grown its revenue at a compound annual growth rate (CAGR) of 11% and its net income at a 10.5% CAGR. Income investors may raise their eyebrows at Sherwin-Williams' 0.9% dividend yield. But the company not only is a Dividend Aristocrat -- having paid and raised its dividend for 42 consecutive years -- but also returns a lot of value to shareholders through stock repurchases.

In 2021, Sherwin-Williams paid $587 million in dividends and $2.8 billion in share repurchases. In fact, the company has reduced its share count by 8% between 2018 and the end of 2021, which boosts its earnings per share and benefits existing shareholders.

A quality business that deserves a premium price

Sherwin-Williams is an excellent business that is down big from its high. A slowing housing market would impact the company, but there's no reason why Sherwin-Williams can't keep growing for decades to come.