On Thursday, financial software company Blend Labs (BLND -2.92%) delivered its fourth-quarter numbers, and investors have responded to the report by sending the stock to new lows. The shares are now off by more than 70% from their high of around $21, and well below last summer's initial public offering price of $18.

I can't say that I blame investors for running from Blend Labs. The company's forecast was terrible and implies that 2022 will be a year of struggle and challenges. So why am I optimistically holding my shares in the face of more pain ahead?

Discussing Blend's terrible guidance

Blend Labs operates a software platform that banks can use to build digital customer experiences. Its specialty is mortgage lending, and its tools take a lot of the paperwork and back-and-forth out of the loan approval process.

Image Source: Getty Images.

The company's revenue was $363 million in 2021, which makes the company's 2022 projection for 2022 revenue in the $230 and $250 million range -- a contraction of 31% at the midpoint -- look shockingly bad. If a young company like Blend is seeing growth collapse, that must mean that the business is failing, right?

Well, not so fast.

Blend sells its products on a usage-based billing model, so its clients pay more as they use its platform more. However, its clientele is highly concentrated in the U.S. mortgage industry, which is anticipating something of a drought as interest rates rise from their recent extremely low levels. Blend management expects the number of overall mortgage applications in the U.S. to fall by 35% in 2022, and refinancing applications could fall by as much as 70%. Blend's revenue model means that its top line will take a direct hit from this slump in demand.

Some critical stats

Based on Blend's customer data, the business itself is solid. It ended 2021 with 343 banks using its platform, up by 52 year over year. And it has a net revenue retention rate of 147%, which illustrates that its established customers are spending more with it over time. That's a very substantial revenue retention rate given the decline in mortgage activity.

Secondly, Blend is rapidly picking up market share. Management estimates that its customers process 24.9% of mortgages, up from just 13.8% at the beginning of 2019. This figure includes both banks already live on the platform and pending launches like mortgage lending specialist Mr. Cooper, which should go live with Blend's platform midway through this year.

Would some of the largest lenders in the mortgage industry like, Mr. Cooper and Wells Fargo, use Blend's product if it wasn't doing what it's supposed to? I would have to think not, which is why I believe the company's struggles are the result of a challenging period in its core market rather than any inability to serve its clients.

Could the worst be over?

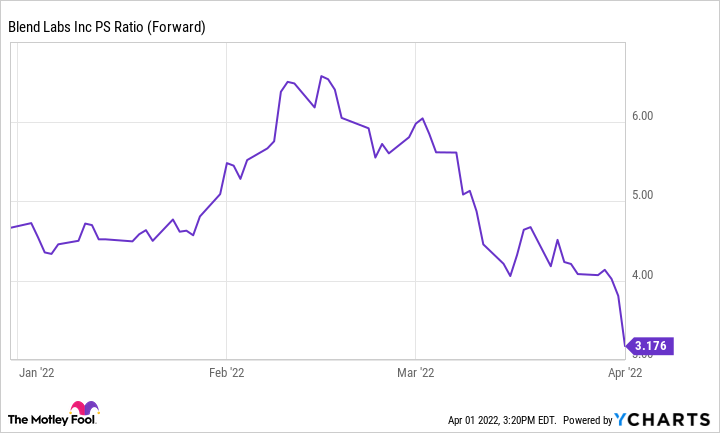

Blend's stock price is now a small fraction of what it was early in its public life, and its valuation has come down as well. Its price-to-sales ratio is now between 3 and 4, which seems cheap for a software company, even if this one isn't profitable yet.

BLND PS Ratio (Forward) data by YCharts

I don't think investors looking for a stock that can provide a quick bounce should be looking at Blend. The company is working through severe challenges in the slowing mortgage industry. However, its stock price already reflects the bad news.

Assuming the mortgage industry eventually begins to pick up, Blend could be in a position to return to growth, and investors might see all of its progress reflected in the stock price. Blend won't make you rich overnight. Still, if the company's problems are genuinely due to temporary macroeconomic headwinds, patient investors could see a glorious rebound story play out over the next several years.