The healthcare system is a complicated industry, but filled with opportunity; it's valued at nearly $12 trillion globally. Healthcare is virtually guaranteed never to go away, and there will always be a constant demand for innovation and growth as people seek to treat diseases and ailments more effectively.

This could mean that many new and exciting companies emerge over time, but don't forget the established healthcare blue-chip stocks that have proven themselves for decades, growing with the industry and evolving to stay relevant. You can buy these three proven healthcare stocks with confidence and hold them for the next decade or longer.

Image source: Getty Images.

1. Medtronic

Medical-device company Medtronic (MDT -1.78%) has been creating essential products for the healthcare industry since 1949. The company makes devices for many treatment areas, including cardiovascular, surgical equipment, brain and spine, and diabetes. Medtronic generates more than $30 billion in annual revenue and has grown its top line an average of 6.5% annually over the past decade.

Medtronic enjoys strong brand power within the industry. Its products go into people's bodies and are often life-saving, which means that doctors need to trust the reputation of the products they use. Medtronic's large size also gives it the deep pockets to continually research and develop new products, including more than 200 regulatory approvals awarded in the past 12 months.

MDT Total Return Price data by YCharts

The stock has an excellent track record, outperforming the market over the long term. Medtronic is an outstanding dividend stock; the company has raised its payout over the past 44 years. Investors can enjoy a dividend yield of 2.2%, and with a dividend payout ratio of 49%, the company has the financial breathing room to grow its dividend for years to come.

2. Cardinal Health

Healthcare company Cardinal Health (CAH 0.45%) is one of the world's largest pharmaceuticals and lab equipment distributors. As a distributor, Cardinal Health is a "middle-man" between drug manufacturers and patients who need those products in the field. Cardinal Health serves roughly 90% of U.S. hospitals, 60,000 pharmacies, and 10,000 doctor's offices to bring pharmaceutical products to millions of patients.

Pharmaceutical distribution is big business. Cardinal Health did more than $162 billion in revenue in its fiscal 2021. The company's massive role in the pharmaceutical industry got it swept up in the opioid crisis, including a massive class-action lawsuit that Cardinal Health recently agreed to settle for $6.4 billion last summer. Investors can start looking forward now that this uncertainty is mainly behind the company.

CAH Total Return Price data by YCharts

The company's outperformed the S&P 500 for years and constantly puts cash in shareholder pockets with a dividend. Cardinal Health's dividend yields 3.4% today, and management has increased the payout for 26 years. The dividend consumes only 51% of Cardinal Health's cash flow, so investors can feel good about the company's ability to cut that check moving forward.

3. Stryker Corporation

Medical-technology company Stryker Corporation (SYK -0.45%) designs and sells products for applications in surgical, neurotechnology, orthopedics, and spine. In a similar field as Medtronic, Stryker is important to healthcare professionals working on patients in surgery or putting devices in their bodies. Stryker isn't as big a company, though; its revenue in 2021 was $17 billion, and its top line has grown an average of 7.5% over the past decade.

Management has aggressively acquired other companies; its most recent deal saw it acquire Vocera Communications for $3 billion in cash. Vocera is a platform for managing care-provider workflow and communications, helping nurses and other hospital staff work more efficiently. Stryker's acquisitions help the company expand its business into new opportunities.

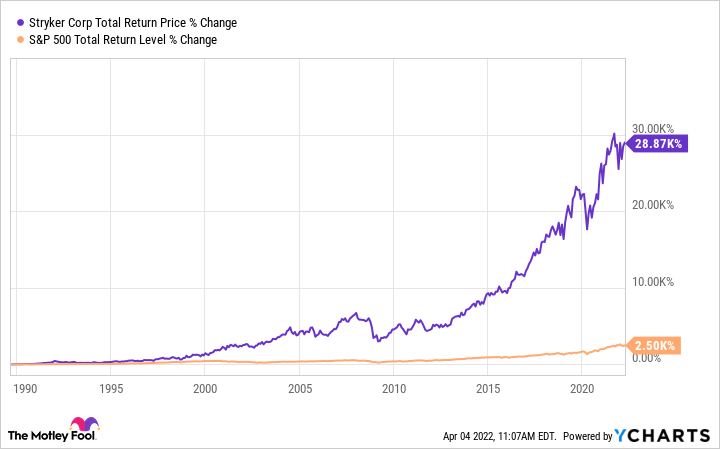

SYK Total Return Price data by YCharts

Over decades, the stock's performance speaks to the quality of management's approach and a high level of execution. Investors have also benefited from a solid dividend that yields 1% but has grown for the past 28 years. Past results don't guarantee future success, but investors can see that Stryker's ability to make strategic acquisitions has generated great returns over time.