Over the last two decades, social media has captured the attention of millions of people around the world. These social platforms have changed the way the world communicates -- for better or worse. As they have grown larger, many of the companies who created these platforms have gone public, which makes them compelling investment opportunities.

When it comes to social media stocks, there are two metrics you need to know: monthly active users (MAUs) and average revenue per user (ARPU). The former measures engagement -- how many people actively use the platform. The latter shows how well the company has monetized that engagement. Bearing that in mind, let's see how well Pinterest (PINS 0.43%) is performing.

Image source: Getty Images.

Can Pinterest fix its MAU problem?

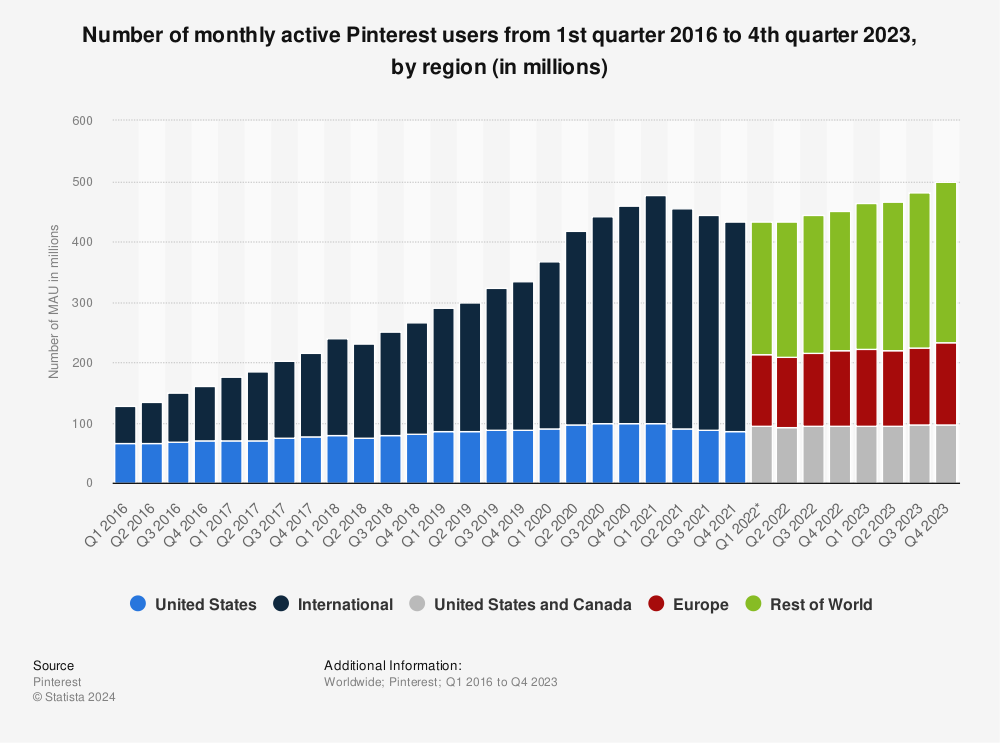

The biggest knock on Pinterest is that its MAU numbers are in decline.

And while it's undeniable that MAUs have fallen, it's important to put that fact in context. MAUs have only fallen 6% over the last 12 months, while Pinterest's share price has dropped 64%. Moreover, as I've pointed out before, Pinterest management telegraphed that the company's MAUs were stabilizing in January. If Pinterest can staunch the bleeding and report a leveling out (or even modest growth) in its MAUs when it reports first-quarter earnings results (around the end of April), the stock should rip higher.

Pinterest: an advertiser's dream come true?

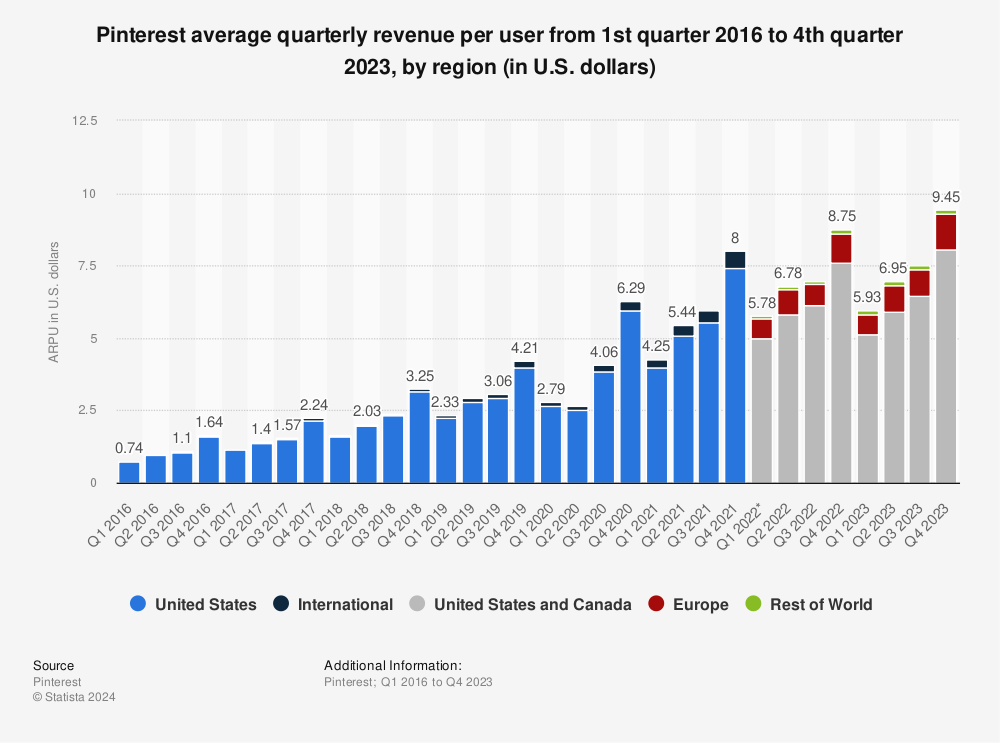

While opinion varies on whether Pinterest can turn around its MAU figures, its ARPU figures leave little room for doubt. The company continues to show significant year-over-year growth.

In its most recent quarter, Pinterest generated $7.43 per American user and $0.57 per international user. That represents 25% year-over-year growth in the domestic segment and 62% abroad. With international users outnumbering domestic users four to one, Pinterest has plenty of room to grow its ARPU figures.

Recent privacy changes to Apple's iOS have changed the advertising landscape, making it harder for advertisers to track purchases and downloads. However, Pinterest offers a unique value proposition to advertisers. Imagine a user who has searched for "birthday cake." Pinterest's artificial intelligence will likely sprinkle in ads for cake box mixes, sugar substitutes, and icings among the pictures, videos, and recipes it displays.

Since its users engage with interests rather than other users, it is easier to make assumptions about a user's motivation and what ads to show them.

Pinterest remains a long-term buy

I believe that Pinterest will stabilize its MAUs in 2022. There's no doubt that the company, like many others, saw a surge of interest during the pandemic. That resulted in inflated MAU figures that were almost impossible to maintain.

Even so, Pinterest's U.S. MAU figures are more or less unchanged from the end of 2019. This group of around 86 million monthly users is impressive, even more so when considering its draw to advertisers. Moreover, Pinterest's appeal should only grow stronger as concerns over digital privacy expand. Targeting ads to users' interests -- without tracking their purchases or downloads -- will give Pinterest a leg up in the battle for online ad dollars and make Pinterest a stock to own now and in the future.