To make money investing in marijuana businesses, you need to appreciate the industry trends and act accordingly. But not every trend that's claimed to be harkening the arrival of Cannabis 2.0 is actionable, some trends are just noise.

Let's examine two of the most important trends in cannabis so you'll understand how to evaluate companies' plans and stock performance in the appropriate context.

Inspecting cannabis plants. Image source: Getty Images.

1. Falling valuations

In my view, the most under-discussed trend in cannabis stocks right now is their falling valuations.

Consider the following chart of cannabis industry leaders Trulieve Cannabis (TCNNF 0.41%), Cresco Labs, OrganiGram Holdings, Curaleaf Holdings, and Tilray Brands:

TCNNF PS Ratio data by YCharts

As you can see, these five leading marijuana companies have experienced marked drops in their price-to-sales (P/S) ratios over the last two years, bringing them closer to the market's average P/S near 3. In the same period, the trailing-12-month revenue of each of these companies has posted moderate to extremely rapid growth.

TCNNF Revenue (TTM) data by YCharts

Since revenues aren't falling, plummeting stock prices are the cause of deflating valuations. Uncertainty over rising interest rates has been driving a general downturn in growth stocks, and cannabis stocks have been hit especially hard. Even shares of profitable competitors like Trulieve faced a decline of more than 55% in the last 12 months. Of course, deeply unprofitable businesses like Tilray were hit even harder, falling by more than 66%.

So investors now have an opportunity to buy quality cannabis cultivators at a relative bargain, and it's unlikely that valuations will return to their prior heights anytime soon. Just be aware that stocks with more-grounded valuations might be less vulnerable to sharp drops when people are fleeing to value in times of market turbulence.

2. Consumer demand is slated to increase

As great as the last few years have been for cannabis companies in terms of revenue growth and market growth, there's an extremely powerful trend that's going to continue making things even better through 2025: exploding consumer demand.

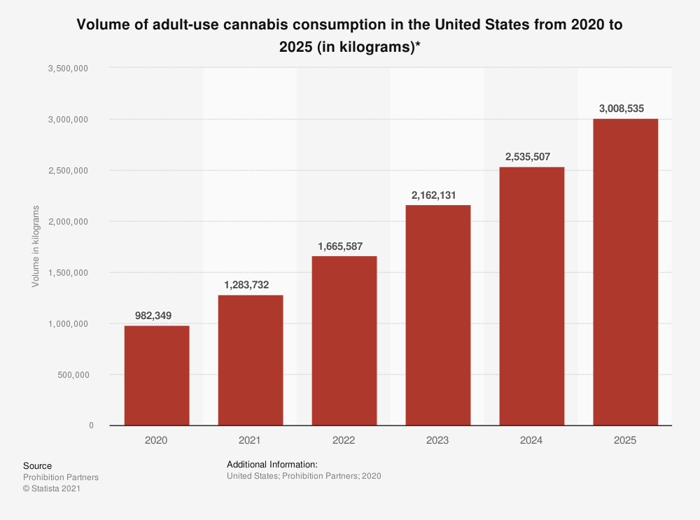

If you are skeptical that demand will keep rising, check out this projection:

Image source: Statista.

In short, the U.S.-based consumption of adult-use marijuana is going to more than double 2021's level over the next few years.

That means well-functioning companies like Trulieve have a high chance of continuing to expand their sales at a rapid clip without compromising their earnings growth, especially if they continue to perform bolt-on acquisitions that bolster their ability to meet demand.

On the other hand, investors should be aware that the risk of companies prioritizing revenue growth over profitability and investor rewards is higher than ever. Remember, it's entirely possible for businesses to grow themselves into an untenable position financially, especially when they're massively expanding their cultivation and distribution facilities at the same time. And with consumption predicted to increase so much by 2025, it's hard to blame them for wanting to.