What happened

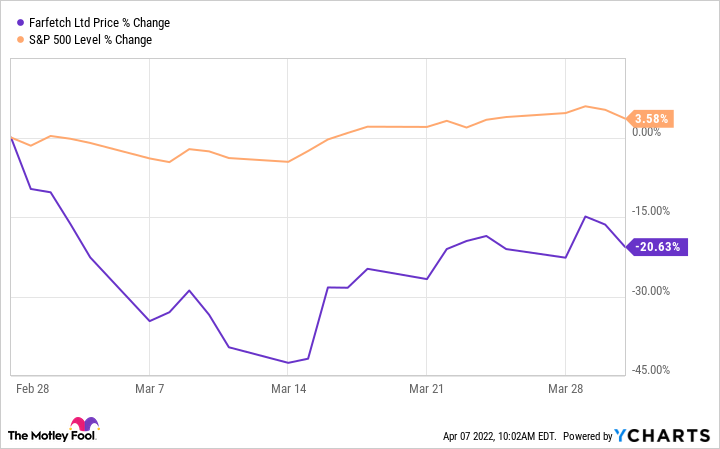

Shares of Farfetch Limited (FTCH 1.00%) fell 20.6% in March, according to data provided by S&P Global Market Intelligence. As bad as that sounds, it rebounded nicely from March lows. For perspective, Farfetch stock was down nearly 43% from March 1 to March 14, dramatically underperforming the market's 5% decline during that time. But after it plunged that far in the first half of the month, analysts began to warm up to the stock, believing it now offers investors an attractive entry point.

So what

Farfetch is based in the United Kingdom and does business in the fashion retail market. The company reported financial results for 2021 on Feb. 24, positively surprising analysts and causing the stock to spike higher. There are many parts to the business, including first-party and third-party sales on its marketplace, brick-and-mortar retail sales, and fulfillment revenue. And each showed year-over-year growth in 2021, which was encouraging.

Image source: Getty Images.

However, fears began mounting for Farfetch stock as Russia invaded Ukraine. For perspective, 6% of the company's gross merchandise volume (GMV) -- the value of the transactions on the platform -- in 2021 came from Russia. And not only does Russia make up a meaningful portion of Farfetch's business, but Europe as a whole is an outsize part of the business, and the entire region is being disrupted by the ongoing conflict.

Therefore, at the end of February, we found out Farfetch is still growing. And in the first half of March, the stock plummeted. These two factors combined mean that the valuation for Farfetch stock got a lot sweeter, and analysts started taking note, leading to a rebound in the second half of March.

For perspective, Farfetch stock reached a price-to-sales (P/S) valuation of 15 in early 2021 when shares were hitting their all-time high. It's steadily dropped since and started March with a P/S of four. But it hit a P/S of just 2.2 in mid-March -- too cheap for some analysts. According to The Fly, JPMorgan analyst Doug Anmuth said the stock was undervalued on March 16. And on March 25, Societe Generale analyst Abhinav Sinha upgraded Farfetch stock to a buy, also citing its low valuation.

Now what

For 2022, Farfetch's management believes its digital platform GMV will grow between 28% and 32% year over year. It grew 33% in 2021. And it believes its brand platform GMV will grow between 20% and 25%. It grew 20% in 2021.

The brand platform represents Farfetch's brands that are shipped and sold in third-party outlets, whereas the digital platform represents first-party and third-party sales on Farfetch's own online marketplace. Digital platform GMV was about eight times larger than brand platform GMV in 2021, so it's encouraging this remains the larger growth opportunity in the coming year.

Farfetch still has a lot to prove -- consider it still has substantial operating losses ($476 million in 2021 alone). However, if you've been watching Farfetch stock, this is one of the best valuations it's ever had. And adoption appears to be ongoing -- reason for cautious optimism.