The investment community often makes little effort to distinguish Unity Software (U 2.04%) and Roblox (RBLX -3.66%). In their own way, each company plays a role in spatially laying out the metaverse.

However, both companies differ significantly in both their approach and target audience. Thus, investors should make an effort to understand the differences between the two and discern which stock could potentially offer a more substantial payoff.

Image source: Getty Images.

The building blocks of the metaverse

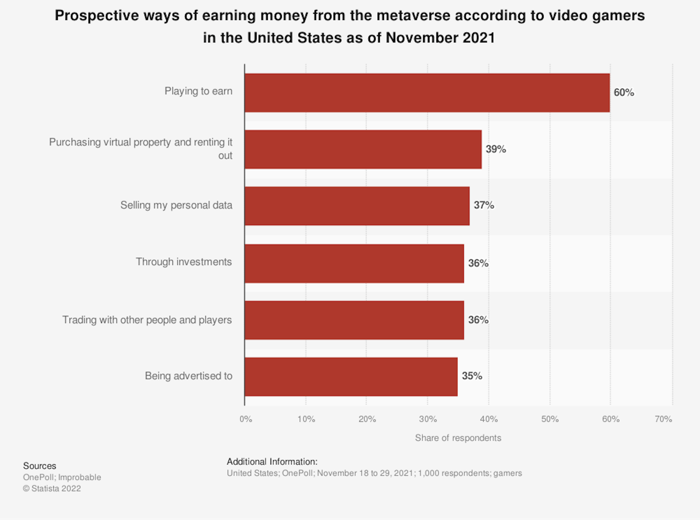

Indeed, the potential for revenue generation has drawn many investors into the metaverse. According to OnePoll, the majority of gamers expect to make money in the metaverse directly through gaming. Also, a smaller number expect to derive revenue from data sales, investments, property rental, and other sources within the metaverse.

When developers and investors think about metaverse building blocks, Unity and Roblox come to mind. Both ecosystems support the creation of spaces and offer avenues by which developers can profit from creations.

Despite this commonality, Unity and Roblox are not exactly the same. Unity bills itself as the "world's leading platform" for creating and using real-time, 3D content. In other words, it is the game development engine that helps develop, operate, and monetize real-time content for various devices, including PCs, smartphones, and headsets supporting AR and VR. Users utilize Unity's game engine for applications such as film, architecture, engineering, military, and many other applications, making it a tool for professional developers.

In contrast, Roblox fosters a community that seeks to bring people together to "play, learn, communicate" and engage in other collaborative activities related to game development. These users develop interactive experiences through Roblox Studio.

Moreover, Roblox has become popular with both amateurs and professionals. About 52% of its daily active users were 13 or under in Q4. However, its popularity for adults and corporate engagement has increased. For instance, users can build a virtual Chipotle on the platform, a restaurant that has utilized Roblox to promote National Burrito Day. Such partnerships have helped the platform gain traction among the general population.

Comparing the stocks

Although both easily fit the description of a growth stock, the differing approaches have brought divergent results. In 2021, Unity reported revenue of $1.1 billion, a 44% increase versus 2020 levels. This led to a loss of $533 million in 2021, far higher than the 2020 loss of $282 million. Rising operating expenses due to stock-based compensation expenses drove most of the higher losses.

Roblox grew revenue faster, with 2021 revenue increasing 108% over 12 months to $1.9 billion. Also, like Unity, its 2021 losses widened. Roblox reported a loss of $492 million, up from $253 million in 2020. General and administrative expenses more than tripled due to hiring and rising labor costs. Also, the company increased year-over-year spending on research and development by 165%. Both categories also covered some stock-based compensation costs, which rose due to the IPO that year.

Still, Roblox has fallen somewhat short on stock performance. Since it debuted in March 2021, it has fallen by about 35%, far below Unity's flat growth over the same period.

Nonetheless, this period was not easy for investors in either stock. Unity stock has lost about half of its value since peaking last fall. Roblox stock took a more significant hit, falling by almost two-thirds from its November high.

U data by YCharts

Still, that drop has helped make Roblox a significantly cheaper stock from a revenue perspective. It sells at a price-to-sales (P/S) ratio of 11.6, far below Unity's sales multiple of 23.9. While that does not necessarily undermine the investment case for Unity, it certainly has become the more expensive growth stock.

So, Unity Software or Roblox?

Although both stocks support those who want to derive income from the metaverse, Roblox appears better positioned to deliver higher returns. Not only is its valuation lower, but it has also produced significantly faster revenue growth.

Admittedly, Unity's target market of professional developers will likely make it the more fundamental metaverse building block. That factor should help its stock outperform the indexes. Nonetheless, its higher cost amid lower revenue growth makes it less likely to surpass the potential gains from Roblox.