What happened

Shares of Carnival (CCL -0.13%) (CUK -0.22%) rose as much as 3.7% in early trading on Monday, bucking a falling market overall. The reason was falling oil prices, which are down 2.9% as of 11:10 a.m. ET. Carnival is currently up 1.9% after giving up some of its early gains.

So what

The biggest news of the day is oil prices declining to around $95 per barrel. This not only lowers input costs for cruise ships, but also gives consumers a little more money to spend on discretionary purchases like a cruise.

Image source: Getty Images.

There's also been progress on the reopening of cruises with Canada welcoming its first cruise ship over the weekend after a two-year ban. As travelers get more comfortable taking flights and cruises the industry could enter a new phase of growth.

Now what

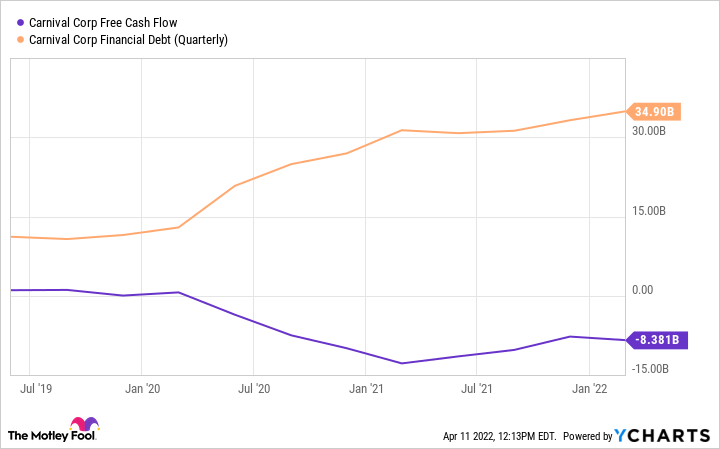

While today's drop in oil prices may be an incremental positive, Carnival still has a lot of challenges ahead. Debt has more than doubled over the last two years and the company is still burning cash.

CCL Free Cash Flow data by YCharts

Given the uphill battle returning to positive cash flow and a more sustainable debt load, this isn't a bounce I'm buying. With Carnival and cruise lines generally, I would like to see operations return to some level of normal before seeing if these companies are a value or not. A small move in oil isn't enough to change that fundamental thesis.