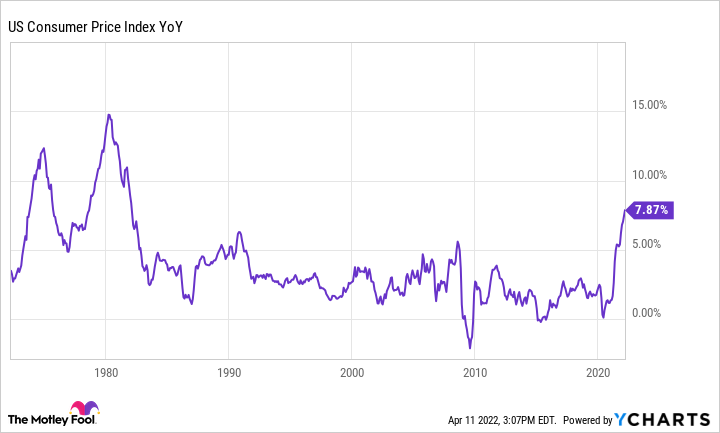

Supply chain bottlenecks and stubbornly high inflation have begun to significantly affect U.S. businesses. In recent months, inflation has surged into high-single-digit territory for the first time in decades. Meanwhile, consumer confidence is starting to erode. That's putting the squeeze on many companies: Costs are rising, but increasing prices to compensate could drive customers away.

Costco Wholesale (COST 1.01%) seems immune to these pressures, though. The company just posted another month of double-digit sales growth, and profit is growing at a healthy clip. That makes Costco stock a solid choice for investors looking to hedge against inflation.

U.S. Consumer Price Index, data by YCharts.

Another big sales increase

Costco's comparable sales surged 17.2% in March, while total sales climbed 18.7% to $21.6 billion. This performance comfortably beat analysts' expectations.

A shift in the timing of Easter boosted sales growth by roughly 1.5 to 2 percentage points. The huge spike in gasoline prices over the past year also drove some of Costco's sales growth. Still, on an adjusted basis -- holding gasoline prices and exchange rates constant -- comparable sales rose 12.2% year over year last month. Higher store traffic accounted for most of this increase.

This strong top-line growth was broad-based. Costco recorded double-digit growth in adjusted comp sales in the U.S., Canada, and its other international segment. Ancillary businesses that suffered during the peak of the pandemic recorded especially strong growth, particularly Costco's gas stations, its food courts, and its travel business.

Costco's sales performance was especially impressive because it came on top of adjusted comp sales gains of 11.1% in March 2021 and 12.3% in March 2020. By contrast, adjusted comparable sales rose 5.9% in March 2019. In short, the acceleration in Costco's sales growth that began during the early months of the COVID-19 pandemic is proving quite durable.

Image source: Costco Wholesale.

Wielding its scale to win

In early March, Costco reported that net income jumped 37% year over year to $1.3 billion in the second quarter of fiscal 2022. Discontinuing a $2-per-hour pay premium that Costco had instituted early in the pandemic drove a little more than half of its profit growth. However, even excluding this factor, the company's earnings growth kept pace with its sales growth, despite base wage increases, rising product costs, and higher freight costs.

This highlights how the current inflationary environment has launched a virtuous cycle for Costco. Thanks to its scale and curated product offerings, Costco has more bargaining power with suppliers than do its rivals, allowing it to limit price increases. By keeping its own prices low, the warehouse club giant becomes an even more attractive place to shop, driving growth in sales and membership fee revenue. That allows Costco to absorb higher costs without damaging its profitability and reinforces its scale advantages.

Of course, it doesn't hurt that the average household income for Costco members is around $100,000. While inflation is forcing lower-income households to make tough choices about spending, most Costco shoppers can afford to increase their spending.

A great stock for fighting inflation

Following the company's excellent March sales report, Costco stock surpassed $600 for the first time. The stock pulled back a bit on Monday, but it still trades at a premium valuation of roughly 45 times the company's projected fiscal 2022 earnings. Costco shares have nearly doubled since last March.

Investors shouldn't expect Costco stock to continue making such spectacular gains. But the company has shown an impressive ability to grow sales and earnings at a robust clip despite the headwinds from inflation and supply chain chaos. Few other retailers can make the same claim.

Thus, for investors who are worried that inflation will remain elevated beyond 2022, Costco stock looks like a solid choice.