Scientists have been talking about and working on CRISPR gene editing for years. But this dynamic technology soon may be reaching a critical point. It's getting closer to becoming a reality for companies -- and patients.

CRISPR Therapeutics (CRSP -1.35%), which uses the CRISPR technique, plans on submitting its candidate for blood disorders for regulatory approval at the end of this year. CRISPR Therapeutics and its partner Vertex Pharmaceuticals have reported favorable data from clinical trials in sickle cell disease and beta thalassemia. This is a definite positive. And the following two charts add to my optimism that CRISPR technology may soon be a big thing.

Is it time to buy CRISPR Therapeutics? Let's look at the charts.

Image source: Getty Images.

Cheaper and more efficient

First, a quick note about how CRISPR works. It's a technology to edit the genome that's cheaper and more efficient than others. It uses an enzyme called Cas9 to cut DNA at a particular spot so that a repair process can begin. This could be a game changer for those suffering from genetic diseases.

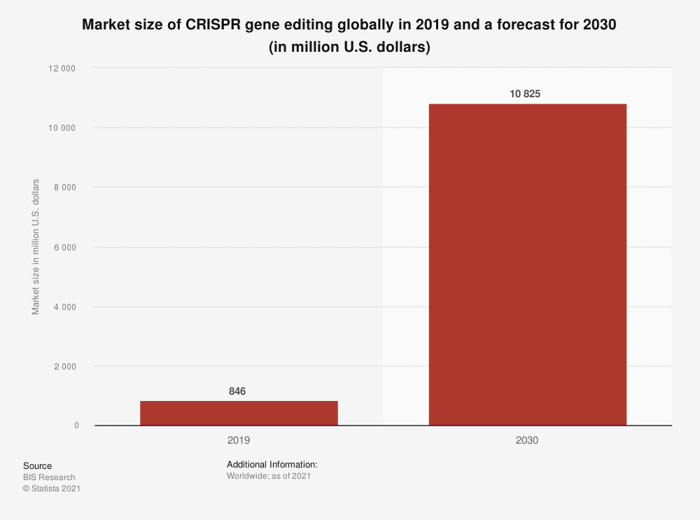

The first chart below shows the global market size of CRISPR gene editing in 2019 and a forecast for 2030. The market is set to increase by a mind-boggling 1,179% to reach more than $10 billion by 2030. This shows that, if companies are able to prove their CRISPR methods work, rewards could be huge.

Image source: Statista.

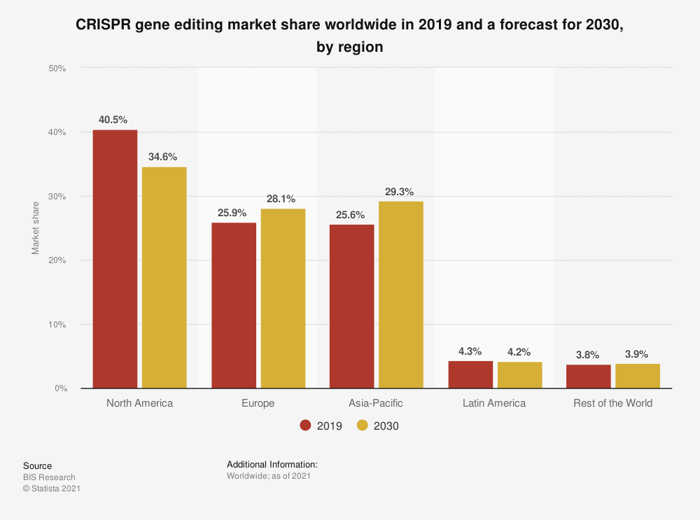

Now let's look at the second chart. This one shows CRISPR gene editing market share worldwide. Right now, North America is far ahead when it comes to market share. That share is set to decline somewhat by 2030.

But the drop isn't dramatic. And at the same time, market share is set to pick up in most other regions. This is positive because it shows worldwide growth in this exciting technology.

Image source: Statista.

Positive for CRISPR companies

All of this is positive for CRISPR Therapeutics and its rivals. Today's CRISPR gene editing companies aren't yet at the commercial stage. But when they get to the finish line, they could see explosive growth.

Does this mean that now is the time to bet on CRISPR Therapeutics? It's a safer bet then other CRISPR gene editing players because it's closer to market with a product. And it's received a big handful of cash from its partner Vertex.

Still, until regulators offer the company's product candidate a nod, CRISPR Therapeutics carries a decent amount of risk. If regulators don't approve the product, the shares could crash. That means it's best to invest only what you can afford to lose -- or leave this potentially game-changing stock to aggressive investors for now.