Snap (SNAP -2.72%) is having a rough first few months of 2022. The stock price is down considerably as investors balance the camera and photo-centric social media company's valuation against the short-term and long-term prospects of the businesses it's involved in.

One bright spot for Snap investors in 2022 is that revenue looks poised to rise as advertisers covet the opportunity presented by its hundreds of millions of daily active users. On the flip side, a headwind for the rest of the year is the privacy changes by smartphone manufacturers, making it more challenging to deliver targeted ads on its app. Let's look closer at each below.

Image source: Getty Images.

Green flag: Soaring revenue

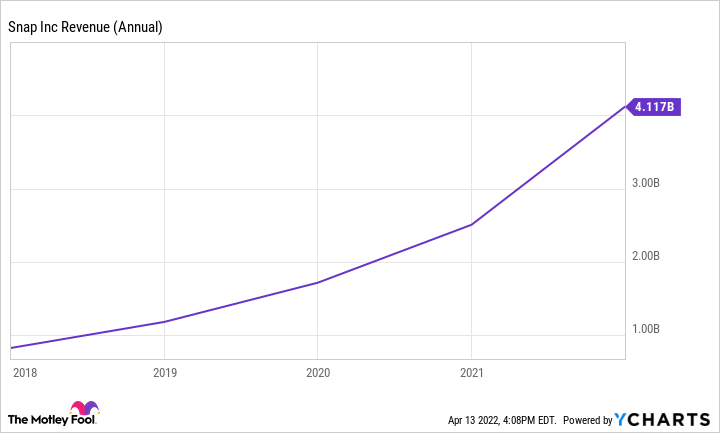

In its fourth quarter, which ended Dec. 31, Snap increased revenue 42% year over year. The figures were even better for the entire year, with revenue rising 64% to $4.1 billion. Snap is home to 319 million daily active users. The social media app is free to join and use. Snap's primary revenue source is showing advertisements to users browsing the app.

Marketers are wildly interested in the opportunity to influence such a large group of consumers. A vast majority of Snap users are between 13 and 24 years old. Indeed, 90% of Snap users in developed markets are within the age range mentioned above. Why is that important to marketers? Because these consumers have not yet made commitments to brands and are primed to be influenced. For instance, a 14-year-old has probably yet to decide which brand of toothpaste they will buy repeatedly or what car brand to stick with. By getting to these consumers early, brands can attract a customer that offers arguably the highest lifetime value.

SNAP Revenue (Annual) data by YCharts

That can partly explain why Snap's revenue soared from $59 million in 2015 to $4.1 billion in 2021. Management expects the momentum to continue into 2022 and guided investors to expect revenue growth of 37% at the midpoint in the first quarter.

Red flag: Privacy headwinds

Apple (AAPL 1.27%) has recently implemented changes to its IOS software, making it more challenging to deliver precision advertising. In other words, brands may see more dollars spent on ads shown to consumers who are not qualified prospects. For instance, an advertisement for a local steak restaurant in San Diego may be delivered to a Phoenix user who also happens to be a vegan. The reduction of this kind of waste is partly why so many advertisers have shifted more dollars to digital channels.

From 2019 to 2021, digitals' share of all ad spending increased to 64.4%, up from 52.1%. Marketers spent $763 billion globally in 2021, so the shift has been massive. Apple's privacy changes threaten to lower the return on investment for businesses, which is a red flag for Snap in 2022.

Here's what Snap chief business officer Jeremi Gorman had to say about how the company is dealing with the changes:

Our sales team is working hard to help advertisers adapt to the new measurement paradigms brought about by Apple's iOS privacy-related changes. Our advertising partners who prefer to leverage lower-funnel goals, such as in-app purchases, have been most impacted by these changes. We are seeing these advertisers migrate to mid-funnel goals where they have greater visibility, such as install or click.

SNAP data by YCharts

It's encouraging to see that Snap is taking a proactive approach to mitigating the risks posed by Apple's new policy. Still, the ongoing adjustments will be a headwind for Snap that investors should follow as the year progresses. That said, it appears that Snap's stock has already paid the price for the risks this factor adds to the company's prospects (see chart). Investors confident in Snap's ability to respond effectively cannot be blamed for jumping in and buying shares at these discounted prices.