Per the interim results of a phase 3 clinical trial published April 11, Veru's (VERU) oral drug sabizabulin cut deaths by an impressive 55% when administered to hospitalized patients with severe COVID-19. With promising data like that, it's no surprise that its shares popped by upward of 190% on Monday and remain up by more than 200% over the last five days.

Still, it takes more than a favorable clinical trial snapshot to make for a good investment in biotech. And with such a sharp spike in its share price, investors are right to wonder if there's any upside left. Let's analyze Veru's latest accomplishment as well as a few of its other victories to see if it might be a worthy addition to your holdings.

Image source: Getty Images.

This isn't just a pandemic play

The first thing to appreciate about Veru is that it isn't an infectious disease biotech, nor is it interested in becoming one despite its work on sabizabulin.

Veru's drug development pipeline is focused on therapies for breast cancer and prostate cancer, though it also has a reproductive health division with a pair of products that brought in $61.3 million in sales during 2021.

Right now, the company isn't profitable, but has recently been making progress toward profitability, as shown below:

VERU Revenue (Annual) data by YCharts

The catch is that its sales have decelerated this year, with its quarterly net revenue falling by 3% year over year in the first fiscal quarter of 2022, which ended Dec. 31, 2021. If it can secure a regulatory approval for sabizabulin, that shouldn't be a problem any more.

Management plans to seek an Emergency Use Authorization (EUA) for the drug this year, which is the only therapy in Veru's pipeline that has any chance of being commercialized in the next couple of years.

In late 2021, it got the regulatory go-ahead for its benign prostatic hyperplasia therapy called Entadfi. Though the total global market for the medicine is only around $200 million, it'll still help to stabilize Veru's top line.

Risks abound

On paper, Veru has the potential to become a profitable growth stock thanks to its base of revenue from its reproductive health products paired with an anticipated windfall from sales of sabizabulin.

The trouble is that if you buy the stock today, you'll be paying a huge hype tax thanks to the buzz from the positive sabizabulin results. As early movers cash out their positions while the hype remains high, they'll leave the later arrivals holding the bag. Of course, savvy investors will be quick to point out that the existence of the "hype tax" is in the eye of the beholder, as Veru's sky-high stock price may actually be warranted if it can realize significant profits from commercializing sabizabulin.

And therein lies the second problem. If the market has already priced in the expected benefits from selling sabizabulin, there will be a hefty penalty for investors if Veru gets rebuffed by regulators.

At its present valuation, that's a recipe for disaster.

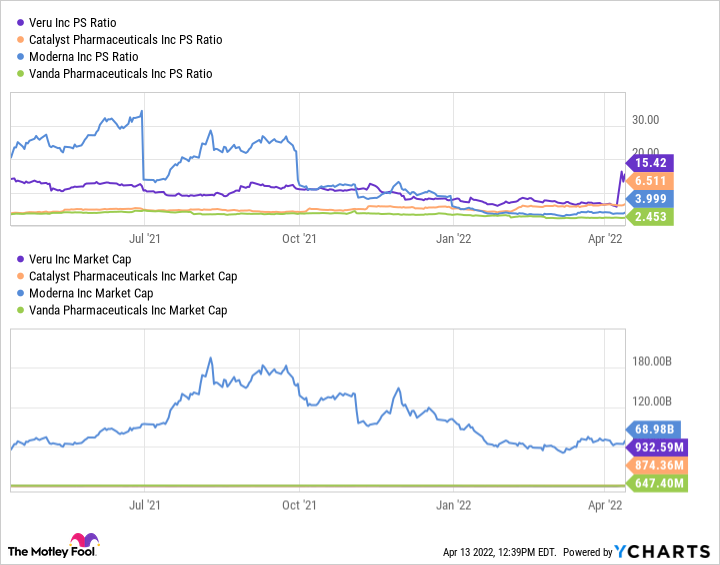

VERU PS Ratio data by YCharts

In short, Veru's price-to-sales (PS) ratio is currently significantly higher than little-known biotechs of similar size and pipeline maturity like Catalyst Pharmaceuticals and Vanda Pharmaceuticals, not to mention household names like Moderna.

That doesn't mean it's a bad stock, just that its inflated valuation puts it at risk of a tailspin on any bad news -- or even no news whatsoever. Keep in mind that there could be a lot of reasons why a drug like sabizabulin might not sell that well, starting with the prospect of the pandemic subsiding and fewer people being hospitalized with COVID-19. Competitors could also develop other interventions or preventative medicines that make the drug obsolete.

And so, if you're a conservative investor, this definitely isn't the stock for you to buy.

On the other hand, if you're comfortable with rolling the dice, Veru could well be a winner over the next few years, and it's entirely possible that sabizabulin will be just the start of the company's ascent. Just don't put all of your eggs in this one basket, as it's a risky one, even with favorable clinical trial results in hand.