Investors are thirsty for news heading into Boston Beer's (SAM 2.52%) upcoming earnings report. The owner of hit brands like Twisted Tea and Dogfish Head beer was forced to reduce its outlook several times over the last few months as consumer demand shifted away from Truly hard seltzer, which had enjoyed soaring growth through earlier phases of the pandemic.

Those trends hadn't stabilized as of Boston Beer's previous update back in mid-February, making investors worried about another downgrade to the sales and earnings outlook ahead. Let's take a look at the report set for Thursday afternoon, April 21.

Image source: Getty Images.

All about Truly

Boston Beer markets a wide portfolio of craft beers, but the Truly hard seltzer franchise has taken center stage lately. Soaring demand for the product helped depletions, a measure of consumer sales, soar by a blistering 37% in 2020.

In contrast, a surprisingly sharp and quick pivot away from hard seltzer sent Boston Beer's financial results lower last year. Depletions rose just 15% in 2021 compared to management's initial forecast of around 40%. The company posted net losses, too, as it took write-off charges on extra inventory and paid other brewers fees for failing to meet production quotas.

The big question is where demand will stabilize for hard seltzer after gains slowed to 13% in 2021 from 160% in the prior year. Further deceleration might mean growth in brands like Twisted Tea and Samuel Adams are offset by losses in the hard seltzer niche.

Getting worse before the rebound

The short-term outlook is especially weak for the first and second quarters, which might include weak beer shipments as distributors shift to a lower-inventory approach. Costs are soaring on inputs, too, and price increases likely won't fully offset these boosts until the second half of 2022. Those factors help explain why the stock is underperforming right now.

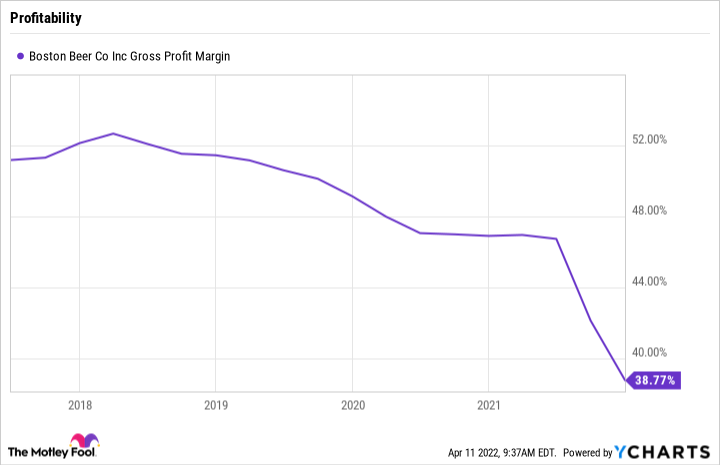

SAM gross profit margin. Data by YCharts.

If Thursday's announcement resolves some of that uncertainty, then the stock might bounce back from that slump. But investors will need concrete evidence of a rebound ahead, including a gross profit margin that's moving back toward 50% of sales after it cratered to below 40% late last year.

The murky outlook

CEO Dave Burwick and his team issued an unusually wide outlook in February that reflected the uncertainty they had about demand, distributor inventory choices, and COVID-19 pressures. Much of that cloudiness will have cleared over the following few weeks, though, meaning we'll likely get a more focused outlook on Thursday.

Currently, that forecast calls for growth in depletions to range from 4% to 10%, with gross profit margin improving to between 45% and 48% of sales. For context, growth was 15% last year and gross margins landed at 39%. Constellation Brands (NYSE: STZ), which recently reported its earnings results, is targeting around 9% annual growth this year.

If Boston Beer can stretch toward the high end of those targets, investors can feel more confident that the business is rebounding from the hard-seltzer hit. Unfortunately, that clarity might not arrive until the beer company's fiscal second-quarter report in a few months.