While I don't consider myself a true value investor, the market's rough start to 2022 has brought forward many cheap-looking valuations that have caught my attention.

Of course, cheap valuations alone mean nothing unless the underlying operations are sound.

Today, let's look at three companies that seem to unite these two worlds, offering forward price-to-earnings ratios below 10 with businesses that look poised to only grow stronger over time.

Image source: Getty Images.

FedEx

Much like Pepsi has thrived for years in Coca-Cola's shadow, FedEx (FDX 1.37%) has quietly continued growing alongside United Parcel Service in the U.S. ground shipping industry. Since 1998, FedEx has grown from less than a 10% market share to over 30% as of 2021, trailing only UPS in revenue generated from ground shipping.

What makes the relationship between FedEx and UPS even more interesting is that despite similar sales over the last year of $92 billion and $97 billion, respectively, FedEx's market capitalization is only one-third as big as its primary peer. Market caps act as a price tag for stocks and, in this case, help highlight a pretty significant discrepancy between two similarly sized operations.

So, what causes this large of a difference?

Free cash flow margins.

FDX Free Cash Flow data by YCharts

Despite having similar revenue totals, UPS generated three times as much free cash flow as FedEx, thanks to its more efficient capital spending.

I'm focusing on FedEx instead of UPS because FedEx's focus on small and medium-sized e-commerce businesses makes it uniquely positioned to benefit from an increasingly entrepreneurial global economy. While UPS shares this focus, FedEx has truly doubled down on its e-commerce capacity over the last few years, trading off short term profitability in favor of long-term cash flows -- across both its ground and freight segments.

With U.S. e-commerce expected to grow by 50% over the next four years, according to Statista, FedEx should see solid top-line growth and improving margins from this portion of its business as it matures.

Second, FedEx plans to finally integrate its acquisition of Europe-based TNT fully by the end of April, streamlining operations among the combined companies' flight routes and airports. While this acquisition has dragged on for years, the synergies from this purchase may finally take hold, making it pivotal for investors to watch in the upcoming quarters.

Having restarted its dividend growth early in 2021, FedEx now yields 1.5% while maintaining a tiny payout ratio of 16% -- leaving ample room for increases in the future.

Thanks to this dividend growth potential, the prospect of improving margins over the coming years, and its forward price-to-earnings ratio of only 9.9, FedEx makes for an excellent value stock to consider for the long term.

Crocs

Having dropped over 50% from its 52-week highs, beloved foam shoe creator Crocs (CROX -0.45%) has seen its price-to-earnings ratio drop to a rarely seen 6.4.

Perhaps due to concerns around its $2.5 billion acquisition of fellow plastic shoe company Hey Dude, Crocs shares have been roughed up despite posting 65% and 150% sales and earnings growth, respectively, in 2021.

However, Hey Dude projects to be immediately accretive to both the top line and earnings, making the market's sentiment toward the stock confounding. Furthermore, Hey Dude's line of shoes created from recycled plastic pairs nicely with the clog maker's plan of reaching a net-zero carbon impact by 2030.

Adding even more validation to bullish Crocs investors, the company's growing return on invested capital (ROIC) over the last five years has been simply phenomenal.

CROX Return on Invested Capital data by YCharts

ROIC essentially measures a company's profitability compared to the capital circulating in the business.

Historically, higher ROICs offer stronger outperformance potential, making Crocs' mark of 98% incredibly promising. Furthermore, stocks with consistently increasing ROICs tend to outperform the broader stock market -- making me wonder if Crocs' brightest days may still be ahead.

As long as Crocs has a single-digit price-to-earnings ratio, its growth potential and this operational efficiency make it far too tempting for value investors not to consider buying.

NVR

Using its unique, asset-light operating model (as far as home builders go), NVR (NVR -0.22%) offers investors an additional layer of security in an otherwise secular housing industry.

By not participating in land development activities and avoiding direct land ownership, NVR removes many risks that other home-building stocks face. Instead, it signs lot purchase agreements that generally require the company to deposit up to 10% of the total lot price -- freeing up massive amounts of capital to be used elsewhere.

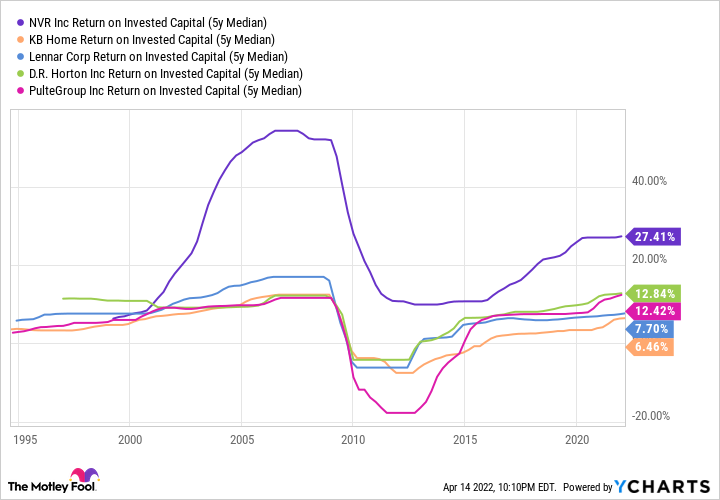

Due to this differentiation from its peers, NVR holds a best-in-class ROIC among its largest peers in the residential construction sector.

NVR Return on Invested Capital (5y Median) data by YCharts

The most important thing to note from the chart above is NVR's performance after the housing bubble and financial crisis from 2008 to 2010. While its ROIC faced unavoidable pressure, it still managed a 10% mark as its S&P 500 peers plummeted into negative territory.

Sporting metrics this strong over its history, it may not surprise you to find out that NVR has smashed the broader market during its publicly traded history -- rising nearly 500% in just the last decade alone.

On top of all this, NVR is a share-repurchasing wizard.

NVR Shares Outstanding data by YCharts

Highlighting the power of these buybacks, NVR grew net income by 10% in 2021 but saw earnings per share rise by 16% due to a lower share count.

Thanks to this outstanding ROIC, share buyback history, and forward price-to-earnings ratio of only nine, dollar-cost averaging into a position with NVR seems like a sound idea.