Biotech stocks are down big since last summer. But the scientific progress isn't slowing. The media's focus on gene editing, messenger RNA (mRNA), and monoclonal antibodies may have waned, but some patients are already benefiting. And new therapies are making their way through clinical trials.

That's why I'm looking at Regeneron Pharmaceuticals (REGN 0.32%), Intellia Therapeutics (NTLA 1.17%), and BioNTech (BNTX 0.74%) as potential big winners over the next few years.

Image source: Getty Images.

1. Regeneron Pharmaceuticals

Admittedly, shares of Regeneron are doing just fine. They've nearly doubled since the beginning of 2020. The company was thrust into the American consciousness when its COVID-fighting monoclonal antibody cocktail, REGEN-COV, was used to treat the president. That drug brought in $7.5 billion in 2021, but it's likely just a blip on the financial radar. It doesn't work as well against newer variants, and the Food and Drug Administration (FDA) significantly cut the situations in which it could be used.

For the foreseeable future, shareholders' fortunes are mostly riding on Eylea and Dupixent. Eylea treats macular degeneration, and global sales of the drug grew 19% last year to $9.4 billion. Regeneron doesn't get all of the sales. It's marketed by Bayer AG outside the United States. Regeneron also has a partner for its asthma and dermatitis treatment, Dupixent. Sanofi records international sales of that drug. Worldwide, revenue came in at $6.2 billion for 2021 -- 51% higher than the year before.

It could have a lot more growth ahead. Just last month, Sanofi raised its estimate for Dupixent peak sales above $14 billion. Add in Regeneron's growing sales of its cholesterol and cancer drugs, plus more than 30 candidates in development, and the bull run might just be getting started for shareholders.

Data source: Regeneron Pharmaceuticals. Chart by author.

2. Intellia Therapeutics

Nearly a year ago, another Regeneron collaboration produced what would once have been considered a miracle. Regeneron and its partner, Intellia Therapeutics, announced last June that they had successfully edited genes inside the human body, or in vivo, to treat a disease.

The results have been confirmed and reinforced with an update earlier this year. Although NTLA-2001 -- the CRISPR-based drug candidate -- roused the scientific community with its ability to turn off a gene that causes misfolded proteins to build up in the liver, it's the endless possibilities that have Wall Street excited.

Management expects to share data from another in vivo candidate in the second half of this year, and it has roughly a dozen more programs in its pipeline. Those include another partnership with Regeneron and one with Novartis.

Discovery doesn't happen in a straight line, so there will likely be ups and downs. But a company that has proven the ability to edit genes inside the human body, and partnerships with two of the most innovative pharmaceutical companies around, should help investors keep a long-term view.

If history teaches us anything, it's that more miracles are just over the horizon. As a bonus, shares of Intellia are currently trading for less than they were before the big announcement last June.

3. BioNTech

Speaking of miracles. BioNTech and partner Pfizer did what any expert in 2019 would have thought impossible. Together, they developed, manufactured, and began distributing a vaccine, named Comirnaty, for the novel coronavirus in less than a year. It's an amazing story that has been written about extensively.

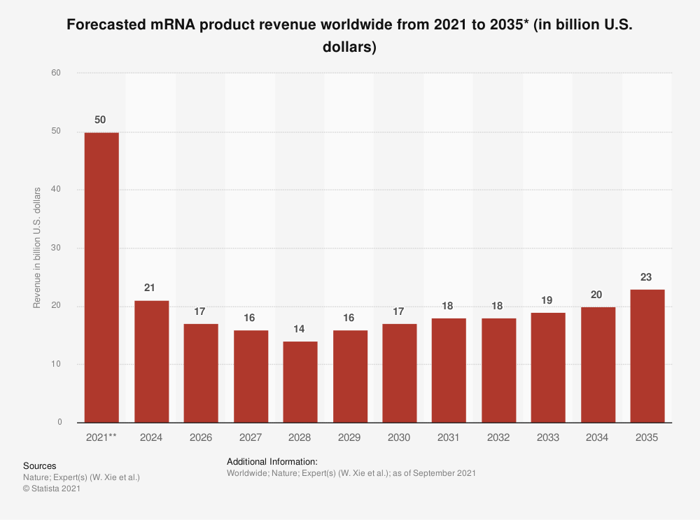

Even before 2020, BioNTech was known for using mRNA, a technology that feeds cells genetic instructions to make specific proteins. The ability to rapidly design a drug led the pair to sell $37 billion in Comirnaty last year. Pfizer is estimating another $54 billion this year. But creating that vaccine might only be an early chapter in a long story for the German biotech. Obviously, the demand for Sars-CoV-2 vaccines has been immense. But now that the approach has been proven, its use is expected to grow in the post-COVID world.

Some of the assumed future revenue is certainly attributable to BioNTech's pipeline. The company is developing a vaccine for influenza -- its original partnership with Pfizer -- and currently lists 18 active development programs targeting cancer. Management expects its first randomized phase 2 data from oncology in the second half of this year. That drug candidate targets melanoma.

It's easy to make the argument for BioNTech over the next decade. After historic success with the COVID-19 vaccine, the company is plowing profits back into the business in an effort to create more breakthrough s in perhaps the most lucrative market available -- cancer. Right now, Wall Street is worried about the dropoff in Comirnaty sales. If clinical trial data is positive, it won't wait long before bidding shares back up.