For pharma investors to be worth their salt, they need to appreciate the trends that drive the industry. Change tends to be slow, and it's often necessary to hold pharma stocks for years before seeing a significant payoff -- but the winds of change are always blowing, so there's still no time to rest on your laurels.

In the next few years, I expect the major pharmaceutical businesses of tomorrow to look and act more or less like they do today, but I also expect that many of the leading players today will struggle to maintain their status relative to their peers. Let's take a look at some data which will help to clarify why that could be the case.

Image source: Getty Images.

1. Tomorrow's winners won't be the same as today's

Most of the major pharmaceutical companies compete in a slew of different areas. More successful businesses end up faring better, on average, thereby giving them a larger share of the global market for prescription medicines in general. And having more high-earning drugs on the market is a surefire way to grab a larger share.

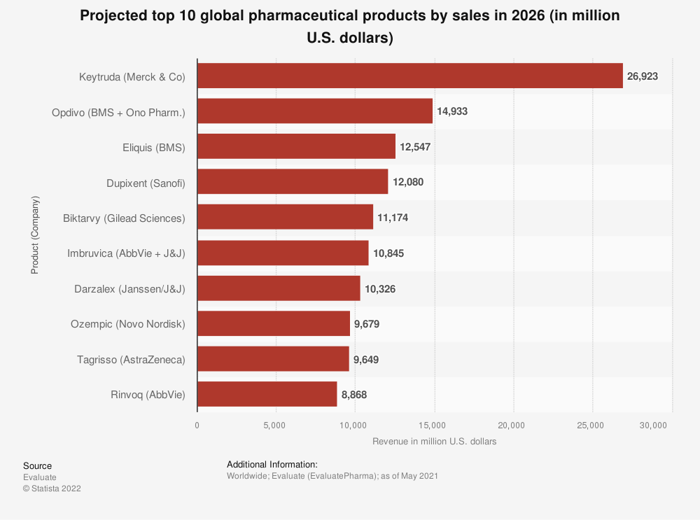

With that in mind, take a gander at this data:

Image source: Statista.

As you can see, today's high-profile pharma companies like Pfizer (PFE 0.23%) probably aren't going to be represented in the best-seller's list in 2026. That doesn't mean they're going to go out of business, but it does indicate that they might become comparatively less powerful than they are today, and perhaps only temporarily so.

In contrast, competitors like AbbVie (ABBV 0.98%) and AstraZeneca could see their market shares grow as a result of targeting more lucrative disease areas with their development efforts which are going on today. The point is that they'll likely see their businesses strengthen throughout the next few years, and that could be an important part of an investment thesis if you're wondering which competitors' shares to buy.

2. Acquisitions will continue to be a battleground

Pharma companies and their investors are loath to accept a diminished standing in the global market, especially if there's a chance to head it off with corrective action. But developing new medicines typically takes in the ballpark of seven years, and only 13.8% of medicines make it through the clinical trials process to reach commercialization.

So a common strategy is to push forward with as many ambitious pipeline projects as is feasible in the hopes that, eventually, a few will succeed. Beyond that, it's often convenient to buy up promising biotechs or merge with smaller, established drug developers that have a few promising drugs on the market to contribute.

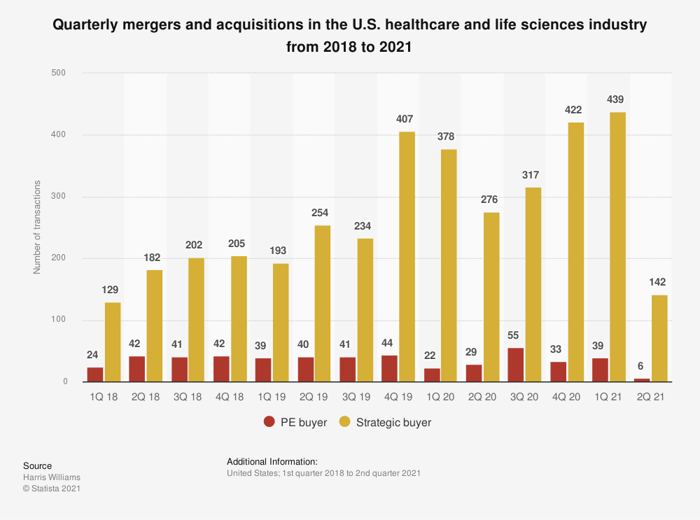

In my experience, most pharma investors understand the above, but the actual scale of merger and acquisition activity in the pharma industry and the wider healthcare sector isn't as clear. Consider the chart below:

That's right, there are hundreds of mergers and acquisitions going on in most quarters.

As there's no guarantee that any individual acquisition by a pharma company is going to yield a profitable drug down the line, it shouldn't be a surprise to hear that it's a numbers game. Thus, given the trends outlined in the first chart I showed, businesses with significant cash holdings to use for acquisitions are better-positioned to maintain their share of the global market for prescription drugs.

In more concrete terms, that means drug developers like Pfizer and Johnson & Johnson will have more than enough to gobble up promising, young competitors -- especially given Pfizer's hoard of $31 billion of cash and short-term investments and J&J's $31.6 billion.

With money like that, either of the two could even potentially outbid a poorer competitor like AbbVie, which only has $9.8 billion in liquid holdings.

Time will tell whether acquisitions continue to be as popular as they have been in recent years. Either way, investors moving forward should keep an eye on cash as it's sure to be a key factor in shaping the future of the pharma industry for years to come.