As an owner of some Upstart (UPST 3.90%) shares, this last year has been one of the more fascinating rides I've ever taken with one of my investments.

Though the stock has been up by as much as 1,100% from its initial public offering price, it has faded over the last six months and is now "only" up by about 200%.

In terms of its business metrics, the fintech credit specialist's net income rose from $6 million in 2020 to $135 million in 2021, and revenue rose by 264% to $849 million.

Setting aside the market's volatile views on Upstart's value, this high profitability is fascinating to me for two reasons.

Image Source: Getty Images.

A rare pairing of top-line growth and profitability

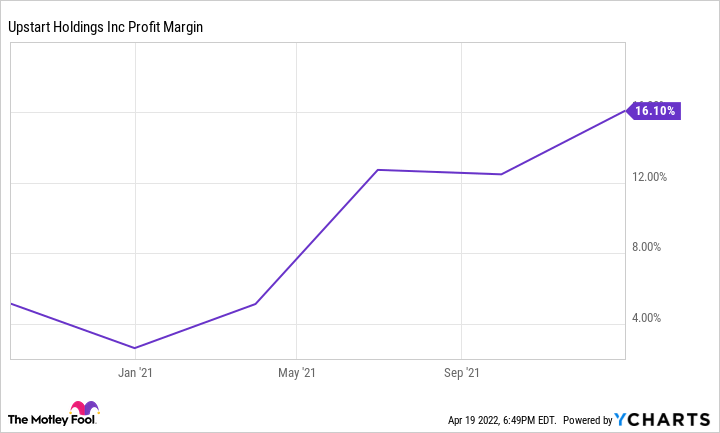

Upstart's combination of 264% revenue growth year over year and 16% profit margin doesn't make it a one-of-a-kind company, but it does place it in rarefied investing air.

Consider the following.

When I run a screener for tech stocks with profit margins of 15% or higher and sales growth rates above 100% for the trailing 12 months, it yields nine results -- one of which is Upstart.

However, when I remove the profit-margin filter, the figure balloons to 67. So while I'm impressed that 67 tech stocks doubled their sales in the last year, the contrast serves to highlight how rare it is to achieve Upstart's level of sales growth while also operating with meaningful profitability.

Touching on this exact matter during Upstart's fourth-quarter 2021 earnings call, chief executive officer and founder Dave Girouard stated:

To gain some perspective on what Upstart achieved in 2021, we looked for another company in the public markets with our combination of scale, growth and profits, but we were unable to find one. Our profits are neither marginal nor ephemeral. We generated more cash in 2021 than we burned in our entire eight-plus years as a private company. Profits matter for a reason.

The beauty of this profitability is twofold.

First, it enables reinvestment in the business, allowing it to continue expanding.

Second, it achieved that profit gain while expanding into new loan markets.

High profitability despite new loan verticals

Upstart operates a machine-learning platform that reviews large quantities of data about credit applicants to help banks make lending decisions. For many people, its platform provides a fairer and more accurate gauge of credit risk than the traditional FICO score.

In its first venture beyond its core business of offering this service for personal loans, it began building out its auto lending capabilities. It started to meaningfully scale that business in late 2021. Management expects that segment to generate $1.5 billion in transaction volume during 2022.

That Upstart has been able to increase its profitability while also scaling its auto unit is fascinating, as these new loans require an incubation period rather than being sold to the company's banking partners like normal. This short-term holding period means Upstart has $261 million in loans (primarily auto loans) on its books -- which theoretically should be a drag on its profitability.

Yet Upstart's profit margin has improved to 16%.

UPST Profit Margin data by YCharts

The company plans to enter small-dollar and small-business lending this year, and is looking ahead to entering the massive mortgage market in 2023. With all these irons in the fire, it is pretty promising that Upstart's profitability has shined so brightly already.

Best yet for investors, its core personal loan segment only has a total addressable market of $90 billion. In contrast, the small business, auto, and mortgage verticals have total addressable markets of $600 billion, $700 billion, and $4.6 trillion, respectively.

As Upstart expands its lending capabilities into these niches, scales up, and eventually matures, I can only wonder how far its profitability may improve.

UPST PE Ratio data by YCharts

Considering Upstart's massive top-line growth, its solid profitability, and its reasonable price-to-earnings ratio, I will be delighted to continue dollar-cost averaging my way into a larger lifelong holding in this robust business.